- April 28, 2020

- Posted by: Amit Pabari

- Category: Finance

A lot of exporters and traders are under the impression that the Reserve Bank of India (RBI) is selling heavily in order to prevent the rupee from depreciating sharply. In the latest policy statement, RBI Governor Shaktikanta Das said that the country had sufficient forex reserves which are adequate to meet the import payments for the next 11 months. With high on forex reserves, markets were under the impression that RBI will sell dollars and not let the rupee depreciate to the extent of 77 and above.

The RBI and markets may feel they did their bit, to protect the rupee. However, as we dig deeper the efforts look unimpressive and questions arise: Has the RBI really sold dollars?

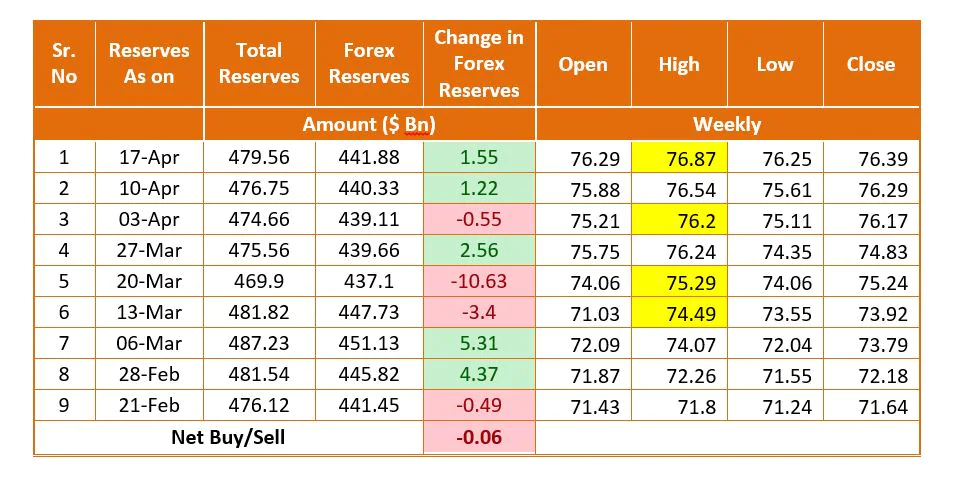

As seen from the net figure, RBI has merely sold $ 0.06 billion in the entire two months journey of rupee depreciation.

Rupee began to depreciate to touch a weekly high of 71.80 in the third week of February that ended on February 21. Here, we saw RBI started selling dollars after almost 6 to 8 months of a buying pattern. It sold around $0.49 billion to keep rupee between its one year range of 70.50-72.50 levels.

To the markets’ surprise, however, in the next two consecutive weeks which ended on February 28 and March 6, RBI bought a total of $9.68 billion. This implies RBI was way more comfortable buying even when the rupee was trading above 72.00 levels. It had anticipated that the pair has begun its journey to touch fresh highs amid the global panic led by the virus outbreak.

Going forward, when the pair broke its all-time high and moved beyond 75.20 in the week ended March 13 and 20, RBI sold around $14 billion to bring the rupee back below 74.50 levels. This was mainly done due to financial year-end.

In the consecutive week, it was again seen that RBI has bought $2.56 billion. Here, RBI must have participated to buy on the dips below 74.80 levels. Thereafter, when rupee breached 76.20 mark, RBI again sold $0.55 billion to normalise the pair and get it below 75.50 levels. The recent data suggests that making the best out of buying opportunity, RBI has again bought $ 2.77 billion to take its forex reserves back above $441.45 billion levels, from where the selling journey had begun. Hence, on a net basis, it is quite clear that RBI has sold merely $0.06 billion so far in the journey of depreciation, thereby not affecting its foreign currency reserves of the country.

In the current scenario, the question arises: was selling of dollars merely an illusion? Why is RBI buying dollars even when the rupee is depreciating?

One of the reasons could be that, as oil prices are at record lows and India is planning to buy oil as part of its strategic reserves, it would want to hoard dollars to finance it in the absence of capital flows.

The second reason for not intervening heavily could be that the RBI might be comfortable with current levels of rupee as long as other emerging market currencies are depreciating.

So far, the Indian Rupee has depreciated nearly by 7.30 percent, whereas peers have depreciated heavily like; Mexican Peso (-26.26 percent), South African Rand (-24.34 percent), Brazil Real (-19.48 percent), Turkish Lira (-13.19 percent) and Indonesian Rupiah (-11.42 percent).

Well, the intention doesn’t seem to be clear, but one thing certainly comes out is that, RBI is comfortable with the current levels of the rupee.

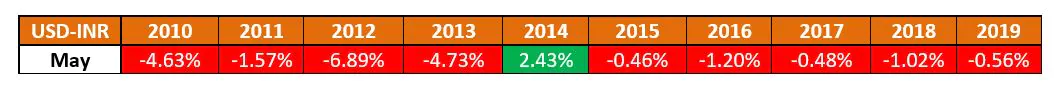

Going forward, as we head into May, seasonality effects will likely play its role this time too as seen under:

As seen, the pair has depreciated 9 out of 10 times in the month of May. The only exceptional time the pair appreciated in 2014 was due to the General Elections in India, which were conducted last May and the ruling Bharatiya Janata Party (BJP) returned to power with a strong majority. Otherwise, the pair has depreciated with a patent pattern every year.

As seen, the pair has depreciated 9 out of 10 times in the month of May. The only exceptional time the pair appreciated in 2014 was due to the General Elections in India, which were conducted last May and the ruling Bharatiya Janata Party (BJP) returned to power with a strong majority. Otherwise, the pair has depreciated with a patent pattern every year.

Hence, if the trend continues, the sustenance of rupee at lows close to 75.50-75.80 will be short-lived and the pair will seek fresh highs above 77.50-78.50 levels in the days to come. However, the view shall be void if the pair closes below 75.50 along with positive change in the fundamentals occur. This majorly includes the invention of a vaccine against COVID-19, containment in further spread of the virus and foreign inflows in Indian capital markets.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.