- February 2, 2021

- Posted by: Amit Pabari

- Category: Currency

All this while when markets were waiting dollar-rupee to react on the budget day, the momentum of the pair remained trapped in a narrow range despite a cheerful rally seen in the equities. Not only the markets unfettered a six-day losing streak but overturned the biggest single-day rally in more than 9 months. Sensex ended 5 percent higher at 48,600 while the Nifty 50 gained 4.7 percent to end at 14,281, giving their best budget-day gain since the Union Budget of 1997.

In FY22 the government aims to gather Rs 1.75 lakh crore through divestments in 2021-22. The central government will further incentivise states to divest assets as the non-core assets will not serve the purpose of Atmanirbhar Bharat. Some of the big-ticket divestments include the stake sale in Life Insurance Corp. of India, boosting FDI limit to 74 percent for insurance companies, etc., helping the government raise resources.

Well, instead of showing sharp gains deriving out of the rally seen in the equities, the dollar-rupee stayed depressed where the pair, though marginally but sustained well above 73.00 levels during and after the Budget announcements.

Glooms at the horizon

Widening Deficits: Despite a slew of measures announced by the FM that could bring in inflows in the country, the dollar-rupee couldn’t possess any sharp gains as the country’s fiscal deficit settled at 9.5 percent in 2020-21 vs 3.5 percent pegged last year and will be targeted at 6.8 percent in 2021-22. The pandemic imposed double pressures on the government’s balance sheet with a contraction in nominal GDP hampering the tax revenues, and a need for increased spending to support the economy. FM Nirmala Sitharaman stated a gross borrowing plan of Rs 12 lakh crore. The government also plans to raise an additional Rs 80000 crore by the end of the current fiscal year in March, in addition to its record Rs 13.1 lakh crore projection.

Sell off in the Bonds: The strain on the deficit front followed a significant sell-off in Indian sovereign bonds as the debt levels increased than expected. This led to the increase in the Indian 10-year bond yield by 16 basis points to close at 6.06 percent, its biggest jump in 8 months. The spike in the yields has put the RBI’s plan of action into focus who had so far kept the yields anchored by regular OMO bond purchases despite a heavy sell-off in the debt seen last year. This led to an increase in the spread between Indian 10-year bond yields and RBI’s repo rate to 2.06 percent. With the increase in the spread, it will be challenging for the RBI to get further accommodative and rather it might seek to take a hawkish stance. Hence, the focus will now shift on the RBI policy meet due on 5th Feb to watch if Shaktikanta Das reiterates his on-going support for the debt market to keep long-end yields lower to facilitate government borrowing while absorbing excess liquidity.

Well certainly, sell-off in the bond market didn’t allow the rupee to get stronger past 72.80 levels despite a rally in the equities. Also, RBI’s objective of building reserves, prolonged stress in the debt segments coupled with rising deficit estimates with reduced tax revenue, all together could cap any unprecedented strength in the rupee.

Strategy:

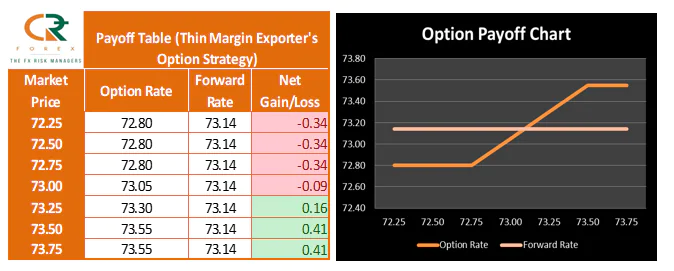

Strategy for Exporters: For thin margin exporters like chemical exporters and agri exporters

Spot rate: 72.97, Forward Rate: 73.14

Option strategy for Date: 24th Feb, 2021

Strategy: Sell 73.50 Call at 0.19; Buy 72.75 Put at 0.14

CR Forex view: We are expecting that there is a limited downside for the dollar-rupee pair and we could see an upside reversal in making. Further, RBI doesn’t seem to allow the pair to fall below 72.80-72.50 levels and is likely to intervene in the market. Hence, this strategy is useful for those thin margin exporters who want participation on the upside and at the same time want to remain hedged on the downside.

Scenario:

1. If the dollar-rupee expires above 73.25 levels, then the exporter’s payoff will be better than the forwarding rate. Above 73.75 their remittances will be locked at 73.80.

2. In an adverse case, if the dollar-rupee expires below 72.75 then exports will be locked at 72.80 levels. Here, the downside will be protected and risk will be locked.

For the exporters whose costing are at or below 72.80 and need upside participation, this strategy is best suitable as it protects the costing and gives upside participation while paying no option cost.

Strategy for Importers: Importers can maintain a one-month hedge policy and cover their exposure till End-Feb around 72.80-72.90 levels. They can also buy at the money call option to keep the downside open.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.