The Economic Times | Here comes the end of another rollercoaster year for the Indian Rupee, closing the Financial Year 2023 roughly by about 8% decline, the largest since COVID-induced FY 20. The local currency came under immense pressure after global commodities jumped multi-fold and gave a boost to already heated global inflation.

With no option left, central bankers had to intervene by raising the rates by 25, then 50, then 75, or in some cases 100 bps+ to curb the price pressure.

From another end, the rising USD and weakening local unit provoked a trade deficit to make another bigger hole.

Some rescued their currency by using USD from their FX reserves, like India, and confined the currency’s range between 80.50 to 83.25 for almost 4.5 months.

What lies ahead… how are things shaping for the new financial year 2024?

Negatives for the rupee:

US inflation, Fed rate hike, rising US yield, and stronger USD:

Well, Fed’s interest rate pivot narrative didn’t sustain much, as aggressive rate hike expectations emerged out of the thin air in February and will continue in the next FY as well.

In recent testimony, US Fed Chair Powell hinted at a hawkish stance and thus the market pushed the terminal rate to 5.50-5.75%. For the next FY, the more the job market remains on the tighter side and inflation remains sticky; the more the Fed will hike their rates to switch the real interest rate into positive territory.

Eventually, we will see further spikes in short & medium-term yield. As a result, the dominance of the USD could make a comeback and we could see US DXY jumping towards 107 to 109 levels.

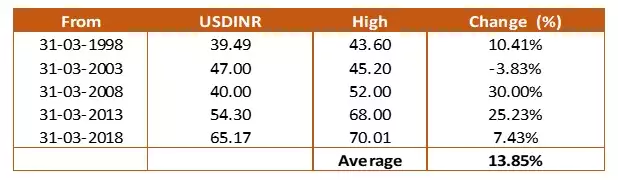

Anomaly of pre-election year depreciation

Be it seasonality or conspiracy theory, the Rupee’s sharp fall in the year preceding the general elections may come into the limelight as the Rupee has depreciated six out of seven occasions before elections since 1989.

The only time it had reversed or gained against USD was in 2004 when the BJP-led NDA coalition had switched power.

This depreciation theory before the election could persist amid the fear of existing policies getting reversed or the fear of huge fiscal money being spent on public welfare schemes. Hence the bias could likely be on the depreciating side.

Geopolitical tension: US-China / China Taiwan / Russia Ukraine

Yes, the war is still ON, and sanctions are on the radar from both ends. The winner could be one, but the loser could be the entire world as it will largely impact the commodity prices the way they did in 2022, and so the inflation and the growth.

If things intensify on the geopolitical front, inflation shall become a prolonged ailment for the world which eventually could lead to a sustained risk-off mood for global markets and Rupee too.

Positives for the rupee:

RBI’s two-way play: Buy lower, sell higher

Isn’t it interesting that despite the US DXY falling from 114.80 to 100.80 in a 3-month time span, the USDINR pair remained near 82 levels? Isn’t that interesting that the Yuan jumped from 7.32 to 6.70 and the Rupee remained near 82 levels?

Post that too, US DXY jumped to 105.50 and Yuan fell to almost 7, but that time too Rupee didn’t move much. The RBI remained a major reason behind the same and curbed the rate & volatility.

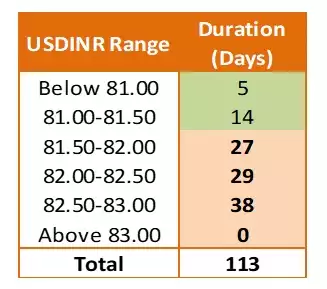

As per the observation, whenever the USDINR pair falls below 81.50, RBI starts their rescue operation and takes it back above 82 levels and as it goes above 82.70-80 levels, RBI takes contra position.

The above data suggests that out of 113 trading sessions since 1St Oct 2022, RBI kept the USDINR pair below 81.50 just for 19 days, that is 17% of the time.

Further, RBI didn’t allow it to have an 83+ closing level, not even for a single time on a closing basis.

Decoding the same further, we can observe that the RBI targeted to keep in a range of 81.50 to 82.50 for 56 trading sessions, which is almost 50% of the time.

Hence, in the upcoming FY, RBI may keep on churning through their $560 billion reserves or could use a forward book of $10 billion.

If the Rupee slides in no time for any major reason, then RBI may come up with Sell/Buy swaps, as they had done last year in March & April.

Rising FD flows and turning FPI flows

The FDI flows have been in limelight this calendar year as many corporates and banks raised via different options. As a result, we have seen almost $11 billion in inflows hitting the market in just two months and a further $4 to $4.5 billion worth of flows are expected to hit till April end.

On the hot money flow side, FPIs have turned their stance toward the ‘Deposit’. For March, they are net buyers with Rs 6,295 crore.

If India remains a hot spot for them and if things remain relatively better, then we could see the Rupee outperforming or at least will fall at a lesser pace than its peers.

Relatively more robust domestic fundamentals

All is well… says India’s fundamentals. The strong domestic demand, favorable business & credit condition, and RBI’s timely & supportive call for interest rate & growth; all seems going in favor of India and thus can attract yards of FDI flows.

If the domestic situation remains resilient, then it could favor the local currency and we could carry trade set up in Indian rupee.

Outlook:

Technically, the above weekly chart suggests that the USDINR pair is oscillating between 80.50 to 83.25. The given structure can be considered as a consolidation phase and that could be followed by a breakout on any uncertain event.

Summing up the story in short, we are expecting that the USDINR pair will trade in the range of 80.50 to 83.25 till the time we see risk-on sentiment dominating the market.

However, from April to June 2024 will not be a smooth road and the chances of a breakout above 83.25 could increase then as an implication of given negatives will create the risk-off sentiment and we could see the pair heading towards 84-84.50 levels.

–Amit Pabari is the Managing Director of CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/5n98tsbu