[vc_row][vc_column][vc_column_text]

In the stock market, we have heard many times – “Bhav Bhagwan Che!”. In economics also, the ‘Bhav (price)’ of anything matters a lot. Who had thought that after COVID-19, the inflation rate will matter so much to everyone?

Be it producers or consumers or the central bankers, all have faced multi-decade high inflation. The latter one — central bankers had tried to fix the problems of the other two by raising the interest rates.

2021

Inflation started rising, but everyone thought it is transitory

2022

Inflation tested a multi-decade high, especially in developed markets and central bankers reversed QE, hiked interest rates to multi-year highs, and started QT.

2023 so far

Inflation started reversing in the US, and up to some extent in Europe, but growth was affected significantly as interest rates were shooting higher.

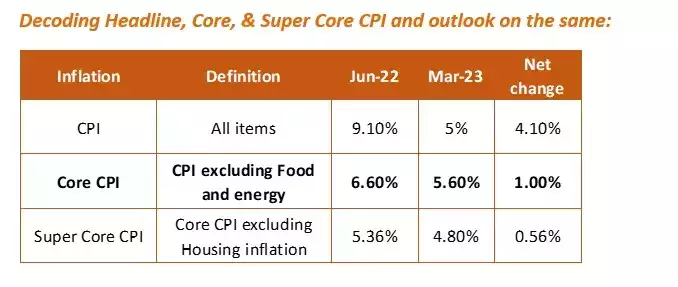

Headline CPI

Major triggering point in the headline CPI was energy and food. As crude oil and other energy prices corrected sharply on easing supply concerns and downcast demand, the headline CPI in the US fell sharply from 9.10% in June 2022 to 5.0% in March 2023.

Further, a broad decline in food and energy prices in the fourth quarter of 2022— although prices are still high — has brought some relief to consumers and commodity importers, contributing to the fall in headline inflation.

However, on the outlook front, oil and natural gas prices are likely to bottom out as Russia’s war in Ukraine has entered its second year. This could trigger a renewed energy crisis in Europe and exacerbate food insecurity in low-income countries.

A failure to extend the Black Sea Grain initiative, and trade restrictions on food and fertilizers run the risk of pushing a large share of the global population into food insecurity and at the same time prices inch higher.

Finally, the US might look to start piling up depleted oil reserves, which had recently hit the lowest level since 1983, and thus support WTI prices to remain above the $60-70/brl zone.

Core CPI

The core CPI, which excludes food and energy inflation, fell by just 1.00%. The shelter prices are having 30% weightage of normal inflation. It jumped 8.2% over the last year, the highest since 1982; accounting for over 60% of the total increase in all items less food and energy. It has a lag impact of 6 months, and hence it will take time to return.

Super core CPI

Falling further into the deep, super core CPI, which excludes housing inflation from core CPI, corrected just by 0.56% from June 2022 to March 2023. Super core inflation, “may be the most important category for understanding the future evolution of core inflation,” Fed Chair Jerome Powell said in November.

It reflects the prices of services, such as those provided by lawyers, plumbers, gardeners, and hairdressers, that remain stubbornly high. One should consider wage or labour-cost inflation as a kind of ‘super core’ measure of inflation.

The tight labour market forces companies to pay higher wages and at the same time passes the higher labour cost on to consumers; fuelling inflation and further wage hikes in a phenomenon known as a “wage-price spiral.”

The low unemployment rates are complicating a larger issue in the labour market today. The ongoing strength in employment data has almost entirely been driven by unskilled jobs.

Even though we have nearly 2 job openings for each unemployed person, most of those jobs available are not high-paying. So overall, the sticky job market is likely to create a magnetic force in favour of higher inflation.

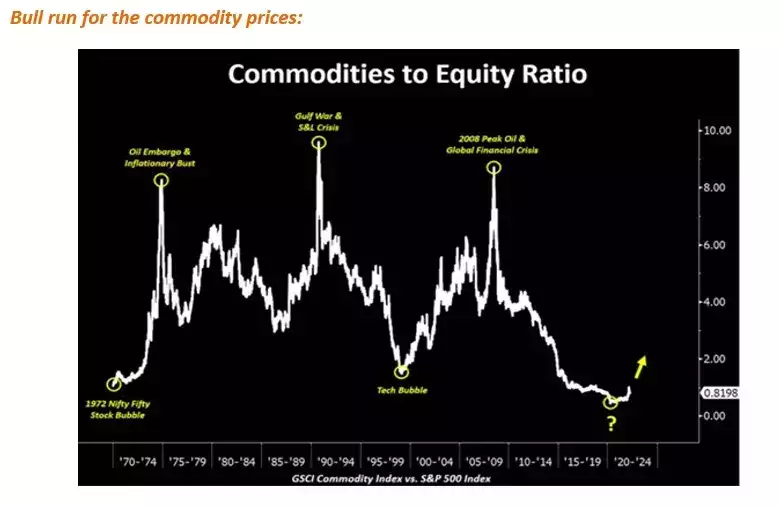

As it has been observed, the commodity-to-equity ratio is expected to rise, which means commodity prices will increase and thus inflation could remain sticky.

Overall, it would be a problematic situation for the central banks, whether to go with a hike to control inflation or to go with a cut to save growth.

Further going deep into the commodity prices, especially agriculture commodities, the interesting facts have been coming out:

• Cattle futures hit an all-time high• US orange crop falls to 86-year low, prices hit a new record

• Sugar prices tested 11-Year highs as global supplies shrink

• Rice prices are at a 5-year high, the shortage is set to be the biggest in 20 years

• London Robusta coffee future is up by 30% for the year

• US Sugar future soared by 25% since the start of this year

So, AGFLATION, which typically means rising food prices caused by increased demand for agricultural commodities will soon be a topic of discussion on the street. A fall in wheat prices to a pre-pandemic level may not help other commodity prices to cool off.

That apart, in the metal pack, without any doubt, gold and silver both are having their bull run time. International prices are expected to jump from $2000 to $2300 & $2600 and silver prices from $25.50 to $30 & $32.50 levels.

So overall, Inflation is in a transitory downtrend but a reversal in the prices with a fresh wave could be on the cards very soon.

Impact of the reversal of the central banker’s call on the interest rate and FX outlook:

US

The market is deeply discounting a cut by the end of this year; however, Fed is still expecting a year-end rate to be around 5.10%, probably they are having the foresight of stickier core & super core inflation. This will force market sentiment to reverse their expectation of a sharp cut to at least towards a long pause and that will help short and medium-term yield to rise and US DXY to jump towards 103.50 and 105 levels. On the downside, the index has formed double bottom near 100.50 levels.

EURUSD

From 0.95 to 1.10 in just 7 months time span was majorly due to a fall in the US DXY and rising expectations of more rate hikes from the ECB. In the upcoming time, inflation in Europe could also be resilient and ECB could fall into a dilemma whether to curb inflation or support growth. Overall, dwindling business & manufacturing activity and long stretched Russia-Ukraine war may not allow it to remain outperformed. Overall, the pair is very much near its resistance of the 1.1050-1.1075 zone. With an 80% probability of a reversal from the current level, one can expect a correction toward 1.08-1.0750 levels.

GBPUSD

Had anyone thought the pound could turn its table and make a strong comeback? It jumped from 1.0380 to 1.2585, a rise of 21% from the bottom on easing political pressure, receding impact of higher yields on the pension funds, and steadier expectation of BoE’s monetary policy call. However, double-digit inflation and recessionary fear in the UK economy could restrict BoE to go for a pause and thus would not allow GBPUSD to extend its rally. Thus, 1.2550-1.2600 seems strongly resisted in the near term and a pullback towards 1.2200 and 1.2100 levels cannot be ruled out.

USDINR

Despite a fall in US DXY from 114 to 100.50, the Rupee didn’t appreciate much and traded in a tight range of 81 to 83.50 over the last few months. Despite a bundle of FDI flows in January, the Rupee didn’t sustain below 81.50 and was seen weakening back to 82.50-83.00 levels as RBI was seen absorbing the flows. The inflation in India is very much contained as RBI has taken a timely call on their interest rate. Thus, domestic inflation would not matter much, or in fact, US inflation will. Overall, May is seasonally a depreciating month (8 out of 10 years), and the reversal in the US dollar index from the current level will lead to a jump in the USDINR pair towards 82.50-83.00 levels. On the contrary, 81.50 to 81.00 will be strongly supported, where we could see RBI and Importer’s rushing to cover USDs.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://rb.gy/1ix17

[/vc_column_text][/vc_column][/vc_row]