Keeping the Galwan and other border issues aside, the ‘Hindi – Chini Bhai-Bhai’ tagline appears to be justified, at least in economic terms.

The relationship between the two giants of Asia, and the world, has been progressing at a tremendous pace. While considering the trade relationship, one should also go through a likely outlook on currency and its impact on trade.

Yuan’s yard fell short in front of the USD…

After trading in a consolidation range of 6.82 to 6.93 for almost 2 months, the Chinese Yuan was seen losing its value beyond the psychological 7 mark to a six-month low of 7.11, down by 2.5% for May against average EM currency depreciation of 1.84%; tracking a broad firmer USD as economic resilience in the United States and shrinking business/investment activity in China.

The data released this month suggest that industrial output, retail sales, and fixed investment grew at slower paces than expected. On the other hand, it seems that China is again grappling with a new COVID XBB virus variant and could post 65 million cases weekly by late June.

From a monetary policy perspective, PBoC is expected to cut the Reserve Requirement Ratio (RRR) by 25 basis points by the end of the third quarter of 2023 for major banks and is expected to remain on the easing side.

Thus, pressure mounts on the Chinese Yuan to depreciate further towards 7.20-7.30 levels as IRD (Interest Rate Differential) will go in favor of the USD.

Rupee is rarely rumbling…

What does any country’s government or central banks want for their economy? Higher growth and stable inflation (within the central bank’s range). Despite multiple global headwinds and record-level tightening by major central bankers, the economic data from the domestic side has been truly remarkable.

Be it manufacturing or service, both the PMIs are in the expansionary mode. FPIs invested almost Rs. 43K crores in May, the highest monthly inflow since Aug-2022.

Apart from hot money, permanent flows, that is FDIs are also supportive of the Rupee. Approximately $600 bln Reserves are sufficient to cover almost 10.8 months of import (import-coverage ratio) and central banks have all the tools available to tame the Rupee’s unexpected move.

RBI’s eagle eye on the forex was the only reason behind the tight range of the Rupee over the last 7 months. The local currency has always been at the middle of the EM currency performance table. Over the short term, the Rupee is expected to remain in the range of 81.50 to 83.25.

India and China shake hands tightly for trade…

Despite India’s efforts to reduce its dependency on China through import substitution and free trade agreements (FTAs) with Asian countries or through “Atma Nirbhar Bharat”, China’s share in India’s imports has increased over the years.

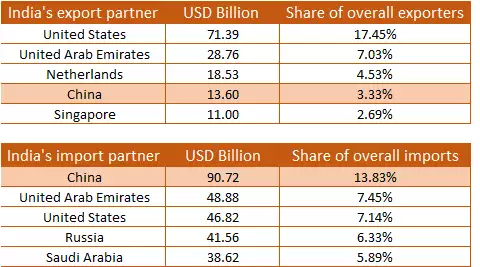

As can be seen in the given trading partner list, China remains at the top of the import partner list, and on the export side, China is the fourth largest partner.

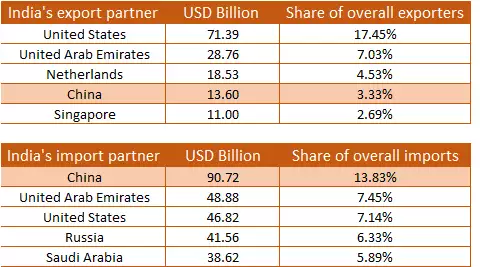

The given import and export figure signifies that our overall deficit with China is almost $87 billion or 11% of the total yearly deficit.

The weaker Yuan will surely benefit the Indian importers as they need to pay a lesser amount for the same commodity but at the same time erode the profit margin of the exporters as they will realize a lesser conversion rate.

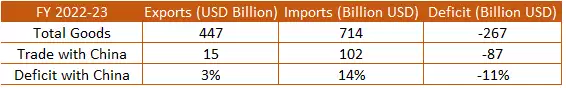

However, it has been observed in recent times that depreciation in the Yuan has fetched higher demand for Chinese products and higher import levels.

results in higher demand for the product).

As importers will get the benefit of weaker Yuan, they will be propelled to import more, and thus overall trade deficit could increase & make Rupee vulnerable to Yuan.

As India imports almost $100 billion worth of goods from China and exports just $15 billion, the deficit will be marginally lowered if the Chinese Yuan depreciates or Rupee appreciates, or in other terms, CNYINR falls.

But during this scenario, if imports in value term increase due to the fall in counterparty currency, then India’s trade deficit figure could remain above average.

Rupee. The global implication and competitiveness surely have their impact where Chinese products are tabled against Indian ones.

Technically speaking:

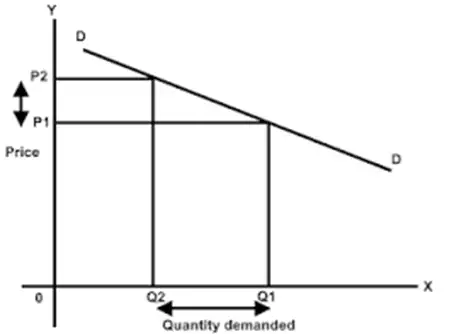

As can be seen in the above CNYINR technical chart, the pair is trading in a range of 11.20 to 12.20 over the last two years.

Currently, it is trading at the middle of the given range but will move southward towards 11.20 levels USDCNY is expected to test 7.20-7.30 levels. Whereas, USDINR is expected to remain in a tight range of 82.20 to 83.20 levels.

Outlook:

Noting key pointers from the article briefly, the trade figures between the two giants- India and China are Stronger.

Or we can say, India is more reliant on China than the other way round.

Therefore, Yuan is considered an immediate peer currency for the Rupee. The weaker Yuan or stronger Rupee (CNY/INR) pushes importers to purchase more and creates a higher dollar requirement, making the trade deficit higher and the Rupee weaker.

Overall, we expect the CNYINR pair to chase its support level of 11.20 in the upcoming weeks as Yuan is expected to depreciate towards 7.20-7.30 levels and the Rupee to remain in the range of 82.20 to 83.20.

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)