If you google “why communication is important”, then it answers that – By delivering messages clearly, there is no room for misunderstanding or alteration of messages, which decreases the potential for conflict.

Well! Last week was the perfect example of a central banker’s communication to the market, where ‘Fed’s hawkish pause with ambiguity’ and ‘ECB’s confident hike’ resulted in a weaker USD and stronger EUR, GBP & other EM currencies.

A peer one- BoE, fortunately, has been clear on their hawkish path and the same they are conveying to the market too. Let’s rewind last week’s cassette and check the central banker’s communication to the market.

Federal Reserve:

After 15 months & 10 hikes, all 18 Fed members voted to pause the rate hike at 5.00% -5.25% in the June meeting. The dot plots revised upward, pushing the median expectation to a funds rate of 5.6% by the end of 2023. On the economic projection side, the Fed revised real GDP, unemployment rate, and PCE inflation favorably and kept core PCE inflation a bit higher.

Powell was reluctant to describe the decision to hold rates steady as a “skip” and regarding July he said that “We didn’t decide” and rates will be data dependent. Ideally, being a global central bank or one of the biggest banks, the Fed should not ask the market to switch to data-dependent.

Along with higher & optimistic economic data on both an absolute and relative basis, the US Fed governor and members should communicate the same to the market. The implication of the economic data should have a perfect & positive

correlation with the interest rates decision.

Now, the debt ceiling has been resolved, at least for up to the end of 2024. So, there will be no question about spending or default. The banking crisis seems to be behind us. At the same time, the Fed is on course to mitigate its target level in quantitative tightening. Even if they go with Pause, they can tighten the situation through their balance sheet reduction program.

Fed’s one or two rate hike with clear communication to the market + stronger economic data+ US real interest rate at 24-year high + quantitative tightening + treasury general account’s plan to replenish the account with $600 bln (draining out liquidity from the financial system) = Stronger US DXY towards 105-105.50.

If any point from the above scenario falls apart, then we could see US DXY moving towards its support of 100.80-100.00.

European Central Bank (ECB):

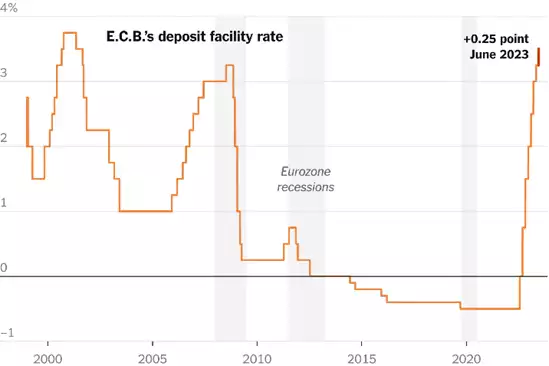

ECB raised interest rates by 25 bps to 4%, the highest level since the 2008 financial crisis, and the rate on the deposit facility to a 22-year high of 3.5%. They further warned that this rate-hike saga may continue through the summer. The market was seen completely ignoring the ECB’s forecast- an upward revision in inflation and a downward in growth.

On the tightening front, they took a hard call by announcing the discontinuation of reinvestments under the Asset Purchase Programme (APP) as of July 2023.

ECB President Lagarde emphasized that the central bank has more ground to cover and a rate hike in July is “very likely”. Although, she didn’t give her view beyond the July meeting. She communicated a plain, simple, and clear message on the policy.

At last, the market didn’t BUY Fed’s hawkish pause with 2 more hike kind of message and hence they joined Euro’s bullish party. Despite the eurozone technically falling into a recession, along with Germany being one of the biggest contributors to Europe’s growth also shrank by 0.3% in the first quarter of 2023; the ECB’s tone remained calm and composed.

It was very convincing and favourable for the market. However, the market will keep on increasing its expectations from the ECB. If it doesn’t fulfill then it will reflect over the Euro-Dollar pair. The market will start analyzing whether confidence in the ECB is reflected in the economic data or not.

Higher inflation + Stronger Job market + ECB rate hike + withdrawal of reinvestment of APP= stronger Euro (This is what the market has already discounted based on central bank policy sentiment)

But….

Technical recession in eurozone + weaker growth + upward revision in inflation + higher borrowing & mortgage cost + dwindling household’s standard of living = Weaker Euro (This is what the market will eventually understand when policy-based sentiment will fade away).

Bank of England:

BoE was one of the earliest central banks to accept higher inflation and go for a rate hike. Since December 2021, they have raised interest rates for a record-breaking 12 successive times to 4.5%. The story doesn’t finish over here. After the unwelcoming inflation and job report, the market is expecting another six 25 bps hikes from here.

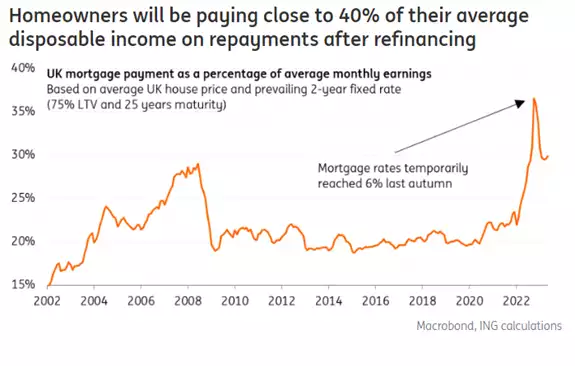

Currently, UK 2-year gilt rose above 5%- the highest since the 2008 financial crisis, surpassing the peak in Sept-22 under Britain’s shortest-serving Prime Minister Liz Truss following her largely unfunded mini-budget.

Unlike the US, which has a high percentage of mortgages outstanding that are fixed on long duration, the UK has a much higher percentage of mortgages outstanding on variable rates or short-term fixed rates.

There is a large refinancing wave from June to September, where fixed mortgages will be refinanced at much higher rates. As per the survey by the resolution foundation, an ‘average’ household could see their monthly mortgage payments increase by £2,900 in 2024.

Higher inflation + higher rate hike expectation + Higher UK’s interest rate differential with US + narrowly escaping recession= Stronger GBP

But…

Higher interest rates + Higher bond yields + higher mortgages rate + more pain for households + mess for BoE & government + political uncertainty = Weaker GBP.

Economic Comparison:

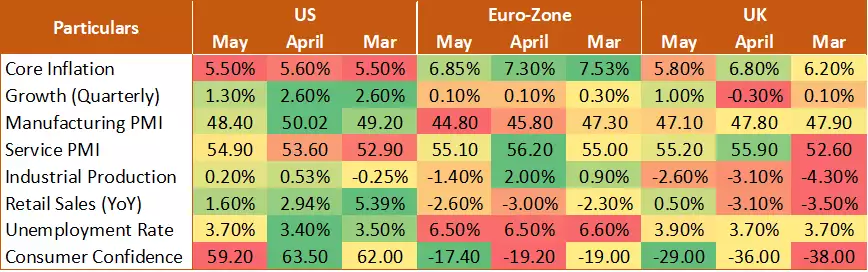

The above table clearly depicts that the US can afford higher interest rates to control inflation as their fundamentals are strong. Sluggish growth, higher inflation, and negativity in industrial production and retail sales may weigh over EUR and GBP.

Outlook:

Putting it in a nutshell, sentiment is like ebb and flow, it changes from time to time. So, currently, market sentiment is favoring trades based on more central bank policy and outlook, rather than its future

impact on the economy.

The market will soon realize that higher inflation will not fetch any positive results and the lagging part of the economy- the job market & GDP will start breaking down, especially in Europe and the UK.

On the outlook front, once the Fed starts showing more conviction in their policy and stays on course of tightening then US DXY could jump towards 105-105.50 levels. At the other end, the ECB, despite having more conviction in their policy call will not be able to justify on economic grounds and will have to step back from their tone.

Thus, we expect the EUR-USD to take resistance near the 1.10-1.1050 zone & fall towards 1.0750-1.0620 levels. At the same time, the market has discounted every possible positive thing for the Pound. It is just a matter of time for traders to realize the actual impact of the higher borrowing costs.

Overall, the GBP-USD pair is also expected to resist near the 1.2850-1.2900 zone and correct towards 1.2520 and 1.2425 levels. Thus, the chances of the USD jumping off the cliff are lower and hence may build a new wing. The only caveat to this view is that sentiment-based momentum continues beyond given levels and the market goes further away from its fair value.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: