[vc_row][vc_column][vc_column_text]

The Indian Rupee experienced a significant weakening and came under pressure in the month of May, with a sharp decline of over 1.00%. Interestingly, this decline occurred despite the staggering inflows of $5 billion. This raises the question of whether the current weakness in Asian currencies could impact the INR. To gain a better understanding, let’s explore the factors that contributed to this situation.

Asian Currencies Performance

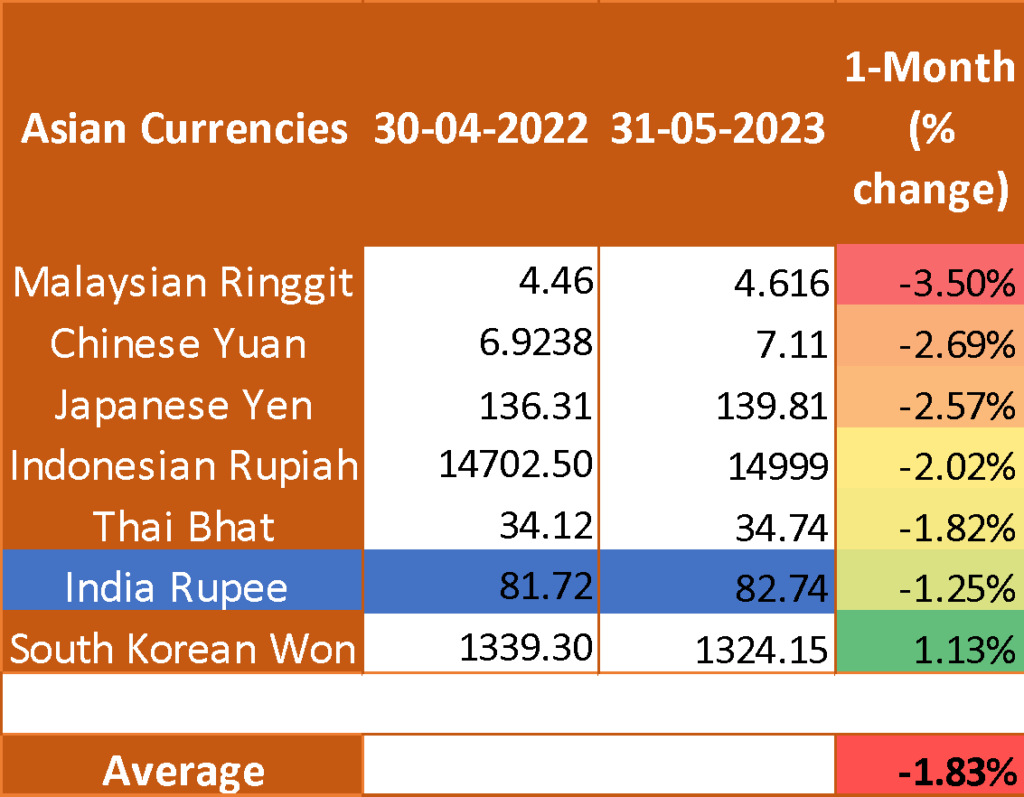

If we go through the table, the Asian currencies have sharply depreciated against the US Dollar. On Average, it has weakened by over 1.83% on the back of global risk aversion. Narrowing interest rate differential lost the carry trade appeal as the US Fed remained hawkish vs the Asian central banks. Other Currencies like the Malaysian ringgit and Thai Bhat too depreciated, tracking Yuan’s weakness as investors doubt the recovery of growth in China. Hence, this attracted significant FII investments of over $5 billion to India last month. However, damage to the India Rupee was limited due to FII flows shifting from China to India on the back of potential growth prospects.

Some facts about weakening CNY

The Chinese currency started to come under pressure, and it fell from 6.92 to 7.11 levels. Despite China’s reopening initially being seen as a spur for equity gains in early 2023, money markets facing challenges, including China, have been wrong-footed. Factors such as patchy economic data, rising geopolitical tensions, a resurgence in COVID-19 cases, and regulatory risks have dampened the optimism surrounding China’s reopening. Recent data reflects a gloomy macroeconomic outlook, with a drop in the manufacturing and services sectors, rising youth unemployment, disappointing retail sales and industrial production, and weaker external and internal demand.

Additionally, the divergence in monetary policy stances between the US and China has negatively impacted sentiment. While the People’s Bank of China (PBoC) leans towards easing, the Federal Reserve is moving towards tightening, resulting in negative carry and outflows from China.

Furthermore, recently investors started withdrawing money from exchange-traded funds that buy emerging market stocks and bonds for four straight weeks. China’s high equity risk premium of around 9% indicates that investments in Chinese equities are not as lucrative and could be overvalued compared to other countries like India, where the equity risk premium is around -1%.

Additionally, the weaker yuan hampers foreign investors’ profits, further contributing to outflows from China.However, India’s growing importance as an alternative to China is attracting investor attention. Stable geopolitics, robust domestic fundamentals, well-managed currency, and a diminishing India risk premium have made India a lucrative destination for foreign capital inflows. Investors are increasingly focusing on India’s opportunities, given its favorable conditions compared to China.

However, India’s growing importance as an alternative to China is attracting investor attention. Stable geopolitics, robust domestic fundamentals, well-managed currency, and a diminishing India risk premium have made India a lucrative destination for foreign capital inflows. Investors are increasingly focusing on India’s opportunities, given its favorable conditions compared to China.

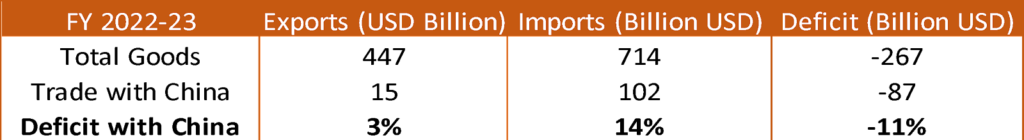

However, there is another dimension to it as a weaker Chinese currency which comes with a caveat. The weakening Yuan and stable INR lead to a cheaper CNYINR level that would push higher imports from China leading to a rising trade deficit in the medium term. As seen in the below table, India’s trade deficit with China stood at $11% in 2022-23, having the highest deficit compared to any other country. Therefore, a higher trade deficit could mount pressure on the domestic unit.

Outlook on USDINR

The Rupee is caged between the mix of negative global fundamentals and a positive domestic outlook coupled with RBI managing the unit. It is likely to face some pressure due to the weakening Asian currency in the near term. If the Chinese currency weakens, the rupee too will come under pressure to remain competitive on the export pricing front. Even if the currency remains stable, a declining CNYINR rate could make the imports from China more lucrative eventually leading to straining deficits. However, the pace of deprecation would be slower as the FII and FDI flows are expected to remain higher in the coming days. The RBI intervention around 82.80-83.00 levels too will protect one-way direction.

Overall, there is an 80% probability that the Rupee to trade in the range of 82.20-80 levels in the short term. The broad range seems to be capped between 81.50-83.25 in the medium term. However, a breakout above 83.25 levels, could further trigger a move towards 83.50-84.00 levels.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://rb.gy/1ix17

[/vc_column_text][/vc_column][/vc_row]