RBI Strategy for Rupee and Reserves explained..

Jun 30, 2025

Decoding the Impact of US-Iran Direct Conflict on Markets!

Jun 23, 2025

Oil Spikes, Rupee Slides? Weekly FX Strategy on Crude, BOJ, & Fed Moves

Jun 16, 2025

Outlook on Silver, Crude and USDINR

Jun 09, 2025

India’s Growth vs Global Headwinds | Will RBI Cut Rates Again?

Jun 02, 2025

Yields Up, Dollar Down, What does it mean for Global Markets?

May 26, 2025

Journey from trade wars to trade deals. Where is US Dollar heading?

May 12, 2025

Will the rupee bounce back towards 85 levels?

May 05, 2025

Is Rupee ready for Move towards 86?

Apr 28, 2025

Trump wants Rate Cuts! But will Powell blink?

Apr 21, 2025

Israel Strikes Iran: Oil spike to hit OMCs, airline, tyres, lubricant shares; 24,250 key support for Nifty

Jun 13, 2025

INR vs USD: Rupee strengthens against US dollar amid Fed rate cut bets, US-China trade deal. Where’s rupee headed now?

Jun 12, 2025

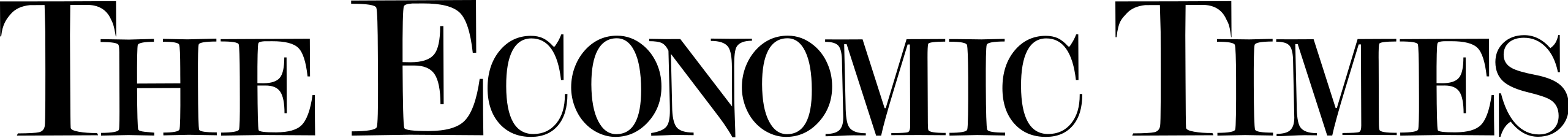

Compass For Navigating Through Volatile Markets

Sep 30, 2022

Webinar: “Minimizing Banking & FX costs & Outlook for USD-INR”

Mar 10, 2022

Webinar: Currency Outlook and Cost Reducing Strategies

Mar 04, 2022

Minimizing Banking & Forex Costs for Exporters

Jan 20, 2022

CR Forex webinar with Mr V. Thiagrajan on Global Outlook 2021

Jan 20, 2022

CR Forex MD Mr. Amit Pabari’s webinar with BSE on – Rupee outlook and RBI hedging guidelines

Jan 20, 2022

Register Here For Regular Updates

-

Jun 28, 202510:06 AM

Is the US heading into a recession?

Read moreFrom households to Wall Street and factories to foreign capitals, uncertainty is gripping every corner of the economy. President Trump’s sweeping new reciprocal tariffs, introduced in early April, have triggered financial market chaos, spooked consumers, and forced companies to put their spending and investment plans on hold. While policymakers assert that the economy remains fundamentally

-

Mar 19, 202507:03 AM

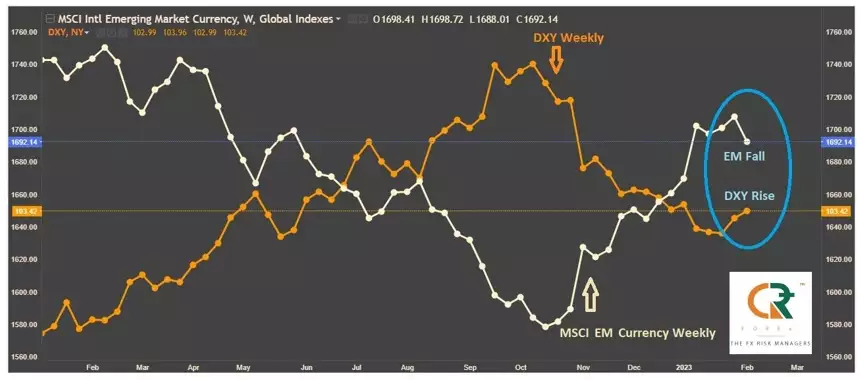

Mar 19, 202507:03 AMU.S. Equity Market Faces Turbulence Amid Economic Warning Signals

Read moreThe U.S. stock market is walking a tightrope, balancing on the edge of uncertainty. While indices remain elevated, warning signals are flashing red across the board. Overvaluation concerns, slowing earnings, inflationary pressures, and escalating trade tensions are brewing a perfect storm. Will this turbulence lead to a mere market correction, or are we staring at

-

Feb 19, 202509:02 AM

Feb 19, 202509:02 AMJob Market Tumult: Is the U.S. Economy Staring Into an Unemployment Abyss?

Read moreThe U.S. labour market has long been a pillar of economic strength, but cracks are starting to appear beneath the surface despite seemingly positive numbers. With the Initial jobless claims declining by 7,000 to 213,000, slightly below expectations signalling a slowdown in layoffs. While the unemployment rate dipped to 4.0% in January 2025, its lowest

-

Jan 29, 202510:01 AM

Jan 29, 202510:01 AMRate Cuts Incoming or Just a Mirage? What the Fed, ECB, and RBI Have in Store for 2025!

Read moreGlobally, as inflation edges higher and economic data reveals fading signs of strength, central banks are focusing on pivotal data to decide whether to proceed with their rate-cut cycle or shift to a more cautious stance. With several major central bank meetings scheduled this month, the markets are closely watching for any signals regarding future

-

Dec 25, 202410:12 AM

Dec 25, 202410:12 AMSilver: Ready to Sparkle in 2025?

Read moreOften in the shadow of gold, silver is gearing up to take centre stage in 2025. A perfect storm of surging industrial demand, supply deficits, geopolitical uncertainties, and undervaluation relative to gold sets the stage for this versatile metal to dazzle. Here’s why silver might just be your shining investment in the coming year. 1.

-

Dec 09, 202411:12 AM

Dec 09, 202411:12 AMU.S. markets are witnessing one of the strongest rallies in decades, but is this momentum here to stay, or are there warning signs ahead?”

Read moreU.S. stock markets are soaring, with the S&P 500 breaching the 6,000 mark for the first time and the Dow Jones breaching 45000 level. The Nasdaq surged around 8.00% last week, while the Russell 2000 skyrocketed 12.5%. However, beneath the celebratory headlines lies a critical question: Are these markets dangerously overvalued? Let’s analyse through

-

Nov 23, 202411:11 AM

Nov 23, 202411:11 AMFed Rate Cuts Triumph Over Trump’s Economic Policies: A Defining Market Battle

Read moreAs the U.S. heads into a new political era following the 2024 presidential election, the financial markets are caught in a fierce tug-of-war between two monumental forces: the Federal Reserve’s ongoing rate cuts and Donald Trump’s potentially disruptive economic policies. Despite the uncertainties surrounding Trump’s plans, the Fed’s methodical rate cuts appear to be the

-

Oct 28, 202411:10 AM

Oct 28, 202411:10 AMHow the 2024 U.S. Elections Could Impact the DXY and Indian Markets

Read moreThe upcoming U.S. presidential election is poised to be a pivotal moment, not just for America, but for the global economy. The DXY is significantly influenced by the economic and fiscal policies proposed by the U.S. administration. With Donald Trump and Kamala Harris outlining distinct policy paths, the DXY could experience notable fluctuations, which in

-

Oct 14, 202406:10 AM

Oct 14, 202406:10 AM2025: The Year of Soaring Oil Prices?

Read moreAs we dive into October, the crude oil market finds itself riding waves of uncertainty, caught between rising geopolitical tensions and fluctuating supply dynamics. The stakes are high, and the world’s attention is firmly on the Middle East, where political conflicts threaten to turn into major supply disruptions. Add to that a hurricane hitting U.S.

-

Sep 19, 202411:09 AM

Sep 19, 202411:09 AMNavigating Market Peaks: Why bonds are your smartest move during this rate cut cycle?

Read more“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes As September month is under way, Keynes’ famous words resonate deeply within the financial community. With the Federal Reserve on the cusp of its first rate cut in years and global equity markets teetering at record highs, the financial landscape is