2025 – The Year of Rising Metal Prices

Dec 16, 2024

Will the bull run continue in US Equity

Dec 02, 2024

Does US really need to cut rate?

Nov 18, 2024

Trump’s Victory- DXY Soaring and dip in Gold!

Nov 11, 2024

CR Forex Outlook on Global Currencies and Assets Classes for Samvat 2081

Nov 04, 2024

What is the Impact of the US Election on DXY?

Oct 21, 2024

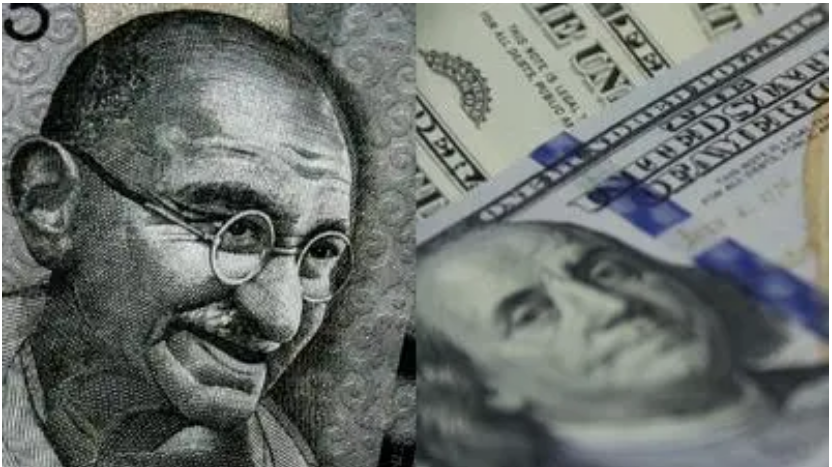

Rupee 84 and Beyond | Ft Amit Pabari (MD, CR Forex)

Oct 14, 2024

Understanding New Interest Rate Subvention Rule & Outlook on Rupee

Oct 08, 2024

Is the Indian Midcap Overvalued? | Nifty Midcap & Rupee Analysis

Sep 30, 2024

Sell Signals From Equity Market: What Investors need to know?

Sep 09, 2024

Rupee Opens Weaker Against Dollar Ahead Of Major Central Banks’ Rate Decisions

Dec 16, 2024

Shaktikanta Das-led MPC keeps repo rate unchanged at 6.5%, cuts CRR by 50 bps to 4%

Dec 06, 2024

Compass For Navigating Through Volatile Markets

Sep 30, 2022

Webinar: “Minimizing Banking & FX costs & Outlook for USD-INR”

Mar 10, 2022

Webinar: Currency Outlook and Cost Reducing Strategies

Mar 04, 2022

Minimizing Banking & Forex Costs for Exporters

Jan 20, 2022

CR Forex webinar with Mr V. Thiagrajan on Global Outlook 2021

Jan 20, 2022

CR Forex MD Mr. Amit Pabari’s webinar with BSE on – Rupee outlook and RBI hedging guidelines

Jan 20, 2022

Register Here For Regular Updates

-

Dec 09, 202411:12 AM

Dec 09, 202411:12 AMU.S. markets are witnessing one of the strongest rallies in decades, but is this momentum here to stay, or are there warning signs ahead?”

Read moreU.S. stock markets are soaring, with the S&P 500 breaching the 6,000 mark for the first time and the Dow Jones breaching 45000 level. The Nasdaq surged around 8.00% last week, while the Russell 2000 skyrocketed 12.5%. However, beneath the celebratory headlines lies a critical question: Are these markets dangerously overvalued? Let’s analyse through

-

Nov 23, 202411:11 AM

Nov 23, 202411:11 AMFed Rate Cuts Triumph Over Trump’s Economic Policies: A Defining Market Battle

Read moreAs the U.S. heads into a new political era following the 2024 presidential election, the financial markets are caught in a fierce tug-of-war between two monumental forces: the Federal Reserve’s ongoing rate cuts and Donald Trump’s potentially disruptive economic policies. Despite the uncertainties surrounding Trump’s plans, the Fed’s methodical rate cuts appear to be the

-

Oct 28, 202411:10 AM

Oct 28, 202411:10 AMHow the 2024 U.S. Elections Could Impact the DXY and Indian Markets

Read moreThe upcoming U.S. presidential election is poised to be a pivotal moment, not just for America, but for the global economy. The DXY is significantly influenced by the economic and fiscal policies proposed by the U.S. administration. With Donald Trump and Kamala Harris outlining distinct policy paths, the DXY could experience notable fluctuations, which in

-

Oct 14, 202406:10 AM

Oct 14, 202406:10 AM2025: The Year of Soaring Oil Prices?

Read moreAs we dive into October, the crude oil market finds itself riding waves of uncertainty, caught between rising geopolitical tensions and fluctuating supply dynamics. The stakes are high, and the world’s attention is firmly on the Middle East, where political conflicts threaten to turn into major supply disruptions. Add to that a hurricane hitting U.S.

-

Sep 19, 202411:09 AM

Sep 19, 202411:09 AMNavigating Market Peaks: Why bonds are your smartest move during this rate cut cycle?

Read more“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes As September month is under way, Keynes’ famous words resonate deeply within the financial community. With the Federal Reserve on the cusp of its first rate cut in years and global equity markets teetering at record highs, the financial landscape is

-

Aug 29, 202411:08 AM

Aug 29, 202411:08 AMThe Chinese Yuan’s Appreciation: Implications for the Indian Rupee

Read moreIn recent weeks, the Chinese yuan has recently staged a significant comeback, strengthening from 7.31 to 7.08 against the U.S. dollar. This resurgence, although modest, marks a noteworthy shift following months of weakness amid China’s dimming economic prospects. As the yuan navigates these choppy waters, one must ask: What’s driving this revival, and how will

-

Aug 05, 202407:08 AM

Aug 05, 202407:08 AMWill Trump’s return ignite a dollar debate as Fed prepares to cut rates and economic strain mounts?

Read moreWith the rapidly shifting dynamics and the election day fast approaching in the US, global attention is intensifying. The outcome of this election is poised to make waves worldwide, particularly influencing the dollar and other currencies significantly. To start, let’s examine who is leading the race for the US presidency: Current President Joe Biden recently

-

Jul 09, 202407:07 AM

Jul 09, 202407:07 AMUS Election Showdown 2024: Trump-Biden face-off and its effects on dollar and equities

Read moreFollowing the recent elections in India which took markets on a ride, the political spotlight has now shifted across the Atlantic, as the US braces for a high-stakes showdown between Donald Trump and Joe Biden on November 5. Let’s dive into the turbulent waters of the political landscape to explore what’s at stake, who is

-

Jun 12, 202408:06 AM

Jun 12, 202408:06 AMRupee at the mercy of politics? What’s the fate of the rupee?

Read moreThe recent spike in volatility in Indian markets and the rupee signifies a significant shift in the political landscape, indicating a potential triumph of politics over economics after a decade. Contrary to expectations of a comfortable victory, Modi’s BJP failed to secure a majority by itself, necessitating a coalition government. Is it the first instance

-

May 06, 202409:05 AM

May 06, 202409:05 AMNavigating economic horizons: RBI’s role in FY 2024-2025

Read moreIn the new financial year 2024-2025, all eyes are on the Reserve Bank of India and its actions that will shape the country’s economic landscape. With the first monetary policy committee meeting for FY25 being on the hawkish side, the market is eager to gauge how and when will the central bank’s stance change amidst