- April 20, 2021

- Posted by: Amit Pabari

- Category: Market

This is the story of the Indian equity market where till March-end, all investors & traders were cheering and applauding for the equity market performance on easing COVID fear, India’s dominance in the vaccine market, stable political scenario and higher carry trade. But things quickly turnaround like in a fraction of a second as the domestic COVID situation is pouring fuel into the fire. India’s financial market dynamics are very much correlated to the COVID and ignoring global fundamentals such as the strong US and European equities, weaker US dollar, easy liquidity due to DM’s ultra-loose monetary policy. The investors and traders need to tighten their seat belts before a roller-coaster rally as domestic signals are pulling the rope down and international factors are pulling the rope higher. In the given environment, Nifty’s view remains gloomy with the expectation of further fall and hence it is advisable to apply sector rotation strategy by investing in Pharma, IT and a bit into FMCG sector.

The below factors will surely help you to pick the best call on the Indian market for investment or trading.

Economic data could drag the market lower

The Financial Year 2022 has been kicked off with economic data. The inflation and industrial activity fell short of expectation and remained sluggish. The recent jump in the global commodity prices; may be due to higher expectations of future demand or due to supply disruption could be a headwind for the Emerging markets central banks to raise the rates. This could have a negative impact on the local equities if the policy rate diverges from the market expectation. The strong recovery in the stock market over the last one-year was just based on “expectation” and not factual. If we check the ground reality then many market players and small industries are still facing business issues. If this discounts into the growth, then definitely in a lagging effect slowdown will be observed.

FII flows and other corporate borrowings could dry up

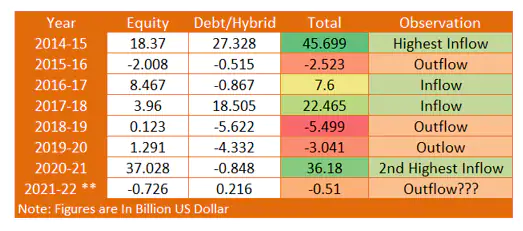

With the second-highest FII inflows ever worth $36.18 billion and FDI flows of $72.12 billion (in the first 10 months) into FY 2020-2021, India’s story was looking interesting. The nifty doubled from a March-2020 bottom of 7500 to an all-time high of 15400 in Feb-2021. The Sensex managed to touch half the century-50000 mark. The flood of liquidity, the printing of money, higher government’s fiscal expenditure started to help to revive the economic growth engine. The Indian corporate borrowed Rs 31,000 through IPOs in FY 21. After heavy borrowings and excess investments, definitely expectations rise for a return. And if that doesn’t meet or doubts increase, then the market reacts negatively. The history suggests that after heavy investment inflows are followed by an outflow. So question raises for an outflow this FY-22. Please go through the below table for ready reference.

Corona Crisis is becoming Cruel day-by-day

You need to understand the Chronology…. Firstly, cases started falling and things had started running on track till mid-February, 2021. The easing lockdown, restoration activity along with slower vaccination program didn’t help to stop turning cases back to higher. And then the Corona variant comes into the picture. Currently, India is short of hospital beds, oxygen and key medicines & vaccines as infections pass the 15 million mark, just next to the United States. The financial center, Mumbai which contributes almost 13 percent to India’s GDP had already announced Janta-Curfew last week. And now, many other states including capital-Delhi and other states like Tamil Nadu (8.59 percent of GDP), Uttar Pradesh (8.35 percent of GDP) and Gujarat (7.92 percent of GDP) have announced strict restrictions. Apart from lives & livelihood, businesses & industrial activity will get affected unimaginably if not controlled. The stock market could experience higher volatility and sudden a “zero fear” effect in adverse case.

Leads and lags on major economic turn

Against recent fall of 7.5 percent in Nifty from an all-time high, the Bank nifty has corrected by more than 19 percent. If volatility continues in the stock market, then banking stocks are likely to underperform more than other stocks as deposit, loan and collection activity slows down. Additionally, realty, media, metal and power sectors underperformed due to lower demand and fall in spending habits due to lower cash in hand. The investment strategy could shift their base towards more promising sectors like as demand for vaccines & medicine during pandemic rises and the IT sector because work from home increases demand for technology systems. Further, food, beverages, household and personal products like consumer staples are likely to outperform.

Technical chart of Nifty and Bank Nifty

The above are weekly charts of the Nifty and Bank Nifty. On one side, nifty has given a signal of reversal by breaking the uptrend line, other side Bank nifty had already given the breakdown earlier and now moving towards a 38.2 percent retracement level of 29,450 and then 50 percent of 26,900. The Nifty is likely to follow the bank nifty and it is expected to test 23.6 percent of 13590 and then 12,430 over the medium term. On the contrary side, any move beyond 15,000 in Nifty and 34,000 in bank nifty will be a reversal point. Overall, short term to medium-term trend remains bearish for both the indices.

-Amit Pabari is the managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.