- January 5, 2024

- Posted by: Amit Pabari

- Category: Uncategorized

After a steadfast three-month span with a narrow range of approximately 40 paise, the Rupee last month surpassed the 83 level, a level last touched in August. Despite an inability to sustain near 82.90, the Rupee experienced heightened volatility, a result of the RBI deliberately permitting a deviation from the established range.

As there was a dollar and Rupee liquidity mismatch in the system, the local currency failed to track the fundamentals and the weaker dollar index.

As per the recent figure of December 25, the surge in banking liquidity deficit reached 2.67 trillion rupees, representing the highest since April 1, 2016. The given constraints stem from outflows related to advanced tax payments and GST are expected to persist through the month-end.

Consequently, there is a prevailing expectation that the RBI may refrain from aggressive intervention at higher levels due to the Rupee liquidity tightness within the banking system.

If RBI Sells USD >>> It Buys Rupee >>> Further Crunch of Rupee Liquidity into the Banking System.

Let’s now look at the measures implemented by the RBI to address the Liquidity Deficit

• Buy Dollar and Sell Rupee

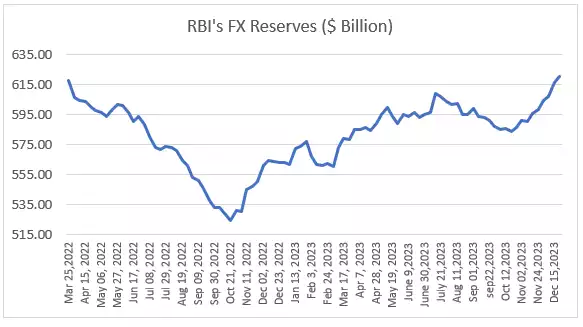

As observed, the liquidity deficit hovered around 1.5 lakh crore in November, a figure that has escalated to approximately 2.67 lakh crore rupees by 25th December. The RBI’s strategic approach to mitigate this deficit involves purchasing dollars in exchange for Rupees. Consequently, when inflows materialize, the RBI absorbs these funds from the banks and reciprocates by providing Rupees. This dynamic is underscored by the recent couple of months’ FX reserves ..

• RBI’s infusion through VRR

When the central bank seeks to infuse liquidity into the market, it orchestrates a variable-rate repo auction, extending repos at interest rates lower than the prevailing market rates.

This strategic move incentivizes banks and financial institutions to secure funds from the central bank, utilizing securities as collateral. This action effectively ‘injects’ liquidity into the financial system, increasing the pool of available funds for lending and investment.

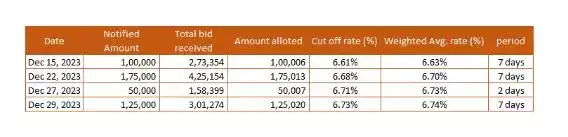

The RBI has administered the Variable Rate Repo (VRR) almost 4 times over less than 20 days. The details are as below.

This proactive measure aims to assist banks in addressing liquidity deficits.

What’s next? Will the liquidity issue persist or will be resolved?

At the close of each quarter, there’s typically increased pressure on liquidity within the banking system. However, as we enter a new year, liquidity concerns are expected to diminish.

Furthermore, Indian banks have been addressing short-term funding needs amidst liquidity constraints by turning to certificates of deposit (CDs).

Amid a liquidity squeeze, banks raised approximately Rs 66,000 crore through Certificate of Deposits (CDs) in the fortnight ending December 15, marking the highest amount raised in a fortnight over the past seven years.

Additionally, in December, several mid-sized banks increased deposit rates, aiming to attract customers to deposit their surplus funds, thereby tackling liquidity shortages.

On December 28, the state-owned Bank of Baroda announced a rise in interest rates on Domestic Retail Term Deposits, including NRO Term Deposits, ranging from 10 to 125 basis points across different maturity periods, effective from December 29, 2023.

Additionally, in December, several mid-sized banks increased deposit rates, aiming to attract customers to deposit their surplus funds, thereby tackling liquidity shortages.

On December 28, the state-owned Bank of Baroda announced a rise in interest rates on Domestic Retail Term Deposits, including NRO Term Deposits, ranging from 10 to 125 basis points across different maturity periods, effective from December 29, 2023.

Additionally, on Wednesday, SBI elevated fixed deposit interest rates by up to 50 basis points across different tenors.

In general, the increased borrowing via CDs and the elevation of deposit rates may aid banks in addressing their deficit concerns. Given that we’re nearing the start of the quarter, it’s possible that the RBI might not need to pursue VRR aggressively.

Outlook on the Rupee:

Presently, USDINR is experiencing fluctuations mainly between 83.00 and 83.40, struggling to maintain levels below 83. Robust inflows noted in November and December, along with resilient fundamentals backing the Rupee, suggest a potential adjustment leading it back towards the 83 level.

Breaching this support could prompt a 50-paise shift, guiding the Rupee towards 82.50 in terms of appreciation. Once liquidity deficit concerns stabilize, RBI intervention by selling Dollars may prevent the Rupee from reaching an all-time low.

RBI is anticipated to adopt a more flexible approach in the foreign exchange market, allowing for a wider range of 20-25 paise compared to the previous range of 5 to 10 paise.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article are his personal views.

Source:https://shorturl.at/hmzO1