- May 26, 2021

- Posted by: Amit Pabari

- Category: Uncategorized

The crude oil is widely known as Black gold- because being a rare resource on the earth, having commercial value and especially after purification, it turns from black to golden color. The history of the oil should be written in golden letters as it has many remarkable events. One of those is last year’s deep contango (when spot price trade lowers than future prices) as spot fell to negative $40 on account of global lockdown. However, since then the prices have recovered strongly on steady return of the oil demand and restoration of industrial activity over last 1 year. But over the last 3 months, oil prices are trading in a sideways mode. The future of crude oil prices will remain linked to crucial developments. Let’s discuss those factors one by one.

Major Breakthrough in US-Iran deal

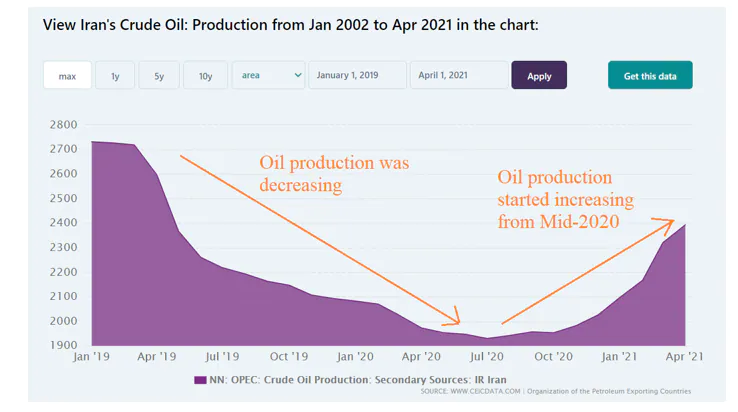

In 2018, former President Donald Trump had withdrawn the United States from the deal and re-imposed sanctions on Iran. Since then Iran has enriched more uranium to substantial levels through more sophisticated technologies which comply with the agreement. This led the US administration to join diplomats from Europe, China, and Russia to restore the 2015 agreement. Last week, oil prices fell by more than 3 percent after Iran’s President Hassan Rouhani said the United States is ready to lift sanctions. If we look at the top oil producer’s list then Iran stands at 3rd highest in OPEC and overall 7th in the world. Iran has already increased their production since mid of 2020 as given in the chart. And if Iran makes a comeback on breakthrough then it is expected to ramp up to 4 million bpd within three months and hence, we could see a correction in crude oil prices by 7-10 percent over the short term.

Higher Inventory glut and Rig count

The US Energy Information Administration (EIA) reported that US crude oil inventories jumped by 1.3 million barrels for the week ended May 14. The supply side has been steady from the US to counter production cut decision by the OPEC over last month. The refineries are operating with 86% of their capacity, extracting an average of 15.1 million bpd of crude- which is good on the supply side. If we look at Rig count, the number of rigs extracting crude oil in the US increased by 8 to a total of 352- the highest since April 2020 for a third week in a row. All in all, this suggests the supply from the US is likely to remain constant or maybe increasing to pre-pandemic levels and resilient demand from lockdown countries like India, Singapore, Japan and Brazil could cut demand factors and hence oil prices could correct back to sub $50 levels.

Demand from third-largest oil consumer- India for Iran oil

The rise in crude oil prices over the last few months; especially following the OPEC+ decision to cut production- made India diversify their oil dependency from OPEC to non-OPEC countries especially the USA, Qatar, and Mexico. In fact, the share of OPEC in India´s oil imports slipped in March to a two-decade low. But now Indian refiners are planning to make space for resumption of imports from Iran if the sanction is lifted. India was the second-biggest oil client for Iran after China with an import of 480,000 bpd in FY-2019. From India- BPCL, HPCL, IOCL and Indian oil are expected to buy in the spot to gain from cheaper barrels available in a surplus market. The only headwind in front of this lies in the lockdown scenario in many parts of India as the demand could be sluggish for May, June month.

Technical on the WTI Crude oil prices

The below weekly chart of the WTI crude oil prices suggests that it could face stiff resistance, firstly in the range of $67-68 and further at $69.50, where the upper Bollinger band is located. In the near term, if it reverses its move on the downside then it will open the door towards $60.85 and $57.10 over the short term and further at $50.50 over the medium term. The probability of odds for the bearish move is higher from a technical perspective.

Conclusion:

After strong global recovery from the pandemic in developed countries and weakness in the US dollar on Fed’s dovish tone has helped crude oil prices to jump higher. But the future lies in the upcoming event that is US-Iran nuclear deal and demand scenario from the Asian countries where lockdown has been extended. Overall, rising crude oil supplies from the US and expected wild card entry from Iran could change the given case towards bearish oil prices. Hence, we expect WTI prices should find a hurdle near the $67-69.50 zone and correct down towards $60.85 to $57.10 over the short term and further lower towards $50 over the medium term.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.