- September 11, 2022

- Posted by: Amit Pabari

- Category: Uncategorized

[vc_row][vc_column][vc_column_text]

Financial Express Link – https://bit.ly/3GlBnYK

The Jackson Hole last month delivered a fatal blow to the markets and proved to be a complete turnaround for fiat. Powell seemed quite “focused” on taking “firm measures” (vigorous hikes) to bring the inflation to Fed’s 2% target as the economy’s health with a strong labor market and robust growth supported the same. In addition, on the QT front, the Fed has been moving slowly and well behind schedule, where between June to Aug, $147.5 billion of balance sheet reduction was expected, but only $31.5 billion was achieved in the first two months. Plus, as the Fed is doubling the size of QT to $95 billion from this month, it will have to ramp up its balance sheet reduction program to meet the shortfall of previous months if they intend to hit the monthly caps. This will create a natural dollar shortage in the system inflating the dollar further.

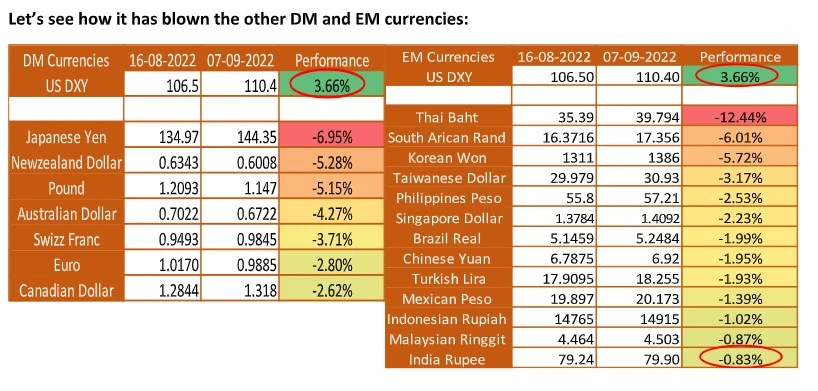

As seen in the above tables, in the past 3 weeks, the DXY has risen by 3.66% whereas, amongst the Developed market currencies, the Japanese Yen is the worst hit with a nearly 7% fall followed by the New Zealand dollar, Pound with over a 5% fall each. The second largest traded currency EUR is also hit by a 2.8%

In the case of the Japanese Yen, higher inflation and lower real wages weighed on spending signaling a slowdown. As the BOJ is running behind the yield curve control it is crushing the long-held role of the yen as the safe haven of choice. In contrast, that money is flowing into US dollars amid the policy divergence between the Fed and the BoJ, hitting the Yen to lows not seen in nearly 24 years. With the current pace and in the absence of BoJ’s intervention, the Yen is likely to fall near 148-150 levels.

Also read: Gold Price Today, 8 Sep 2022: MCX gold may trade at Rs 50100-50750; all eyes on ECB monetary policy

For GBP, with the kingdom surrounded with majorly all sorts of crises, good news for those struggling with soaring energy costs comes with the latest GBP 130 billion relief announced by new PM Liz Truss. Well, the markets are reading this as another stimulus boost for the economy at a time of already strong inflation. The more cash the PM promises in terms of tax cuts or any fiscal support, the greater pressure it’ll create on the Bank of England to hike the rates larger and faster. As the economy goes into recession this year and the BoE is faced with the trade-off between high inflation and very low economic activity, the window for hiking rates seems to be getting closed more quickly than expected. Hence, creating more room for the pound to fall past 1.1450 toward 1.1000 and 1.0500, the levels last seen in the 1980s.

Whereas for EUR, while the data remains not so ugly as expected, new troubles are unveiled with every passing day challenging the stability of the currency. The pair have been struggling post-Russia completely shut its gas supply to Germany from the Nord stream. The pressure is growing on the EU as soaring energy prices are going to be a major problem for Europe, not just this year but in the years to come as well as nearly $2 trillion Surge in Europe’s energy bills is expected by 2023. That apart, energy trading exchanges in Europe are stressed by the requirement of $1.5 trillion margin calls to secure trades, sucking up capital and putting pressure on governments to provide more liquidity buffers. Rising prices have led to fear of defaults and hence the energy crisis deepens creating massive problems for the EU. Finland has warned of a “Lehman Brothers” type situation, with power companies facing sudden cash shortages. All in all, clouds remain darker with currently no light on the horizon keeping the EUR vulnerable with dives close to 0.9500 to 0.9200 levels remaining on cards.

Impact on USDINR amid the domestic and global fundamentals

As seen in the table above, the rupee has remained the best performer vs other developed market and Emerging market currencies against the dollar, with the currency weakening merely by 0.83%, the lowest amongst the rest.

Well, the credit for this goes to strong RBI’s foot into currency intervention, quite evidently seen from the reserves falling from over $600 billion in June to $561 billion now, though a major part of the fall in reserves comes due to currency devaluation in the basket of foreign currency assets of RBI. Moreover, the inflows for the month of August remained robust at over $7 billion which further helped in preventing the fall. Well, not to overlook the economic fundamentals back home which are quite decent with the growth of over 13%, and the economy holds up in expansion on the service and manufacturing side, which has helped build up positive investors sentiments towards India. That apart talks about India’s inclusion in JP Morgan’s global bond index would open up prospects for further inflows into the Indian Bond market, keeping the bar up on the positive side.

However, how long these domestic factors will help to overshadow the global glooms in the face of falling Asian and western currencies is questionable. As, if the rupee is kept overvalued compared to the Chinese Yuan and other EM’s by using reserves and interventions, it will lead us to lose competitive advantage and make the exports less appealing.

Considering all the aspects globally and domestically, the pressure on the USDINR pair seems bound on the upside. The moment RBI would get lenient in its intervention, USDINR shall break 80.10 and march towards 80.50 to 81.00 levels. On the flip side, 79.40 to 79.20 shall act as a near-term base for the pair.

-Amit Pabari, MD, CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/mrxscu4m

[/vc_column_text][/vc_column][/vc_row]