- October 28, 2024

- Posted by: Amit Pabari

- Category: Uncategorized

The upcoming U.S. presidential election is poised to be a pivotal moment, not just for America, but for the global economy. The DXY is significantly influenced by the economic and fiscal policies proposed by the U.S. administration. With Donald Trump and Kamala Harris outlining distinct policy paths, the DXY could experience notable fluctuations, which in turn would directly affect the Indian rupee and stock markets.

A Bearish Outlook for the DXY?

Histrorical view –

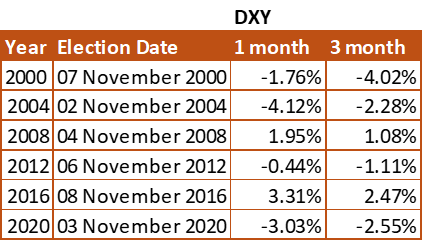

Historically, the dollar index tends to depreciate following U.S. elections, as shown in the table. This depreciation typically occurs over one-month and three-month periods post-election. However, during times of crisis—such as the Lehman Brothers collapse and Brexit—the dollar index has shown strength, moving positively amidst the uncertainty.

US elections –

Policy Impacts on the Dollar

1. Kamala Harris’s Policies:

- Capital Gains Tax Increase: Harris’s proposal to raise the capital gains tax aims to ensure that wealthy taxpayers pay a minimum rate of 25% on unrealized gains. This move could dampen investment in U.S. assets, leading to decreased demand for the dollar as foreign investors may be less inclined to pour money into U.S. markets.

- Wealth Tax: The introduction of a wealth tax might encourage wealthy individuals and corporations to relocate their capital offshore. This capital flight could further weaken the dollar as domestic asset holdings decrease, prompting a shift towards foreign currencies.

- Energy Regulation: Harris’s increased regulation on oil and gas could drive energy prices higher, accelerating inflation and reducing the purchasing power of the dollar. A rise in energy costs might also increase the risk of economic stagnation, further eroding the dollar’s value.

- Ukraine-Russia Conflict: Continued U.S. military spending linked to the Ukraine-Russia conflict could balloon the fiscal deficit. A growing deficit may shake investor confidence in U.S. Treasury securities, exerting additional downward pressure on the dollar.

2. Donald Trump’s Policies:

- Tax Cuts without Spending Cuts: Trump’s proposal for tax cuts, lacking corresponding spending reductions, would likely inflate the federal deficit. Rising debt levels might compel investors to demand higher interest rates, which could initially bolster the dollar due to increased returns on dollar-denominated assets. However, the long-term implications of a growing debt burden could undermine confidence in the currency.

- Tariffs on Imports: Trump’s tariffs, particularly on Chinese goods, could lead to increased consumer prices and potential retaliatory trade measures. This may disrupt global supply chains and diminish U.S. exports, thereby reducing foreign demand for dollars. If perceived as destabilizing, such tariffs could prompt countries to diversify away from the dollar, accelerating the shift toward alternative reserve currencies.

- Impact on Global Trade: Trump’s tariff-centric approach may weaken the dollar’s standing in global trade. Nations looking to lessen their reliance on the dollar for international transactions could reduce demand for the currency, leading to depreciation.

Overall Impact on the U.S. Dollar

Both candidates’ policy frameworks pose risks to the U.S. dollar. Harris’s taxation and energy policies may suppress investment in U.S. assets and elevate inflationary pressures, while Trump’s tariffs and deficit-expanding tax cuts could weaken global demand for the dollar and diminish its role in international trade. In either scenario, the dollar may face downward pressure if these policies come to reality, leading to rising government debt.

The Impact of U.S. Economic Policies on India

The outcome of the 2024 U.S. Presidential Election could significantly shape India’s economic landscape, with each candidate presenting unique challenges and opportunities. If Trump wins, Indian exports might encounter higher tariffs, making goods less competitive in the U.S. market. However, his assertive stance on China could strengthen bilateral relations between India and the U.S. Trump’s focus on U.S.-first innovation may also limit technology transfer, restricting collaboration in tech sectors.

Conversely, a victory for Kamala Harris could enhance trade relations, facilitating smoother exports for India. Harris is likely to bolster the U.S.-India partnership, reinforcing cooperation in defence and economic ties. Additionally, she may foster innovation and growth through technology collaboration between the two nations. Ultimately, U.S. economic policies will dictate India’s access to global markets and investment flows, shaping its economic future.

Impact on the Indian Rupee

The 2024 U.S. Presidential Election could significantly influence the trajectory of the Indian rupee. The dollar’s strength is closely tied to global economic policies, and both Trump’s and Harris’s proposed policies could lead to a weaker dollar over time leading to appreciating rupee. Still, the Reserve Bank of India (RBI) will remain vigilant. Despite global headwinds, the USD/INR pair has shown resilience thanks to strong RBI interventions. This reflects the RBI’s commitment to curbing further rupee depreciation and maintaining its position below the 84.10 mark.

Conclusion

Looking ahead, with the Fed likely to cut rates by another 100 basis points in 2025, coupled with the impact of the U.S. elections, and both the DXY and U.S. 10-year yields appearing to have peaked, the dollar’s strength is expected to fade in the medium term. We anticipate the Dollar Index to ease back to the 100-102 range. As the dollar weakens, we anticipate EUR/USD and GBP/USD to advance towards 1.0950 and 1.3100, with the potential to reach 1.1075 and 1.3200, respectively. On the domestic front, we can anticipate the USD/INR pair moving towards 83.80 and possibly reaching 83.50 levels in mid-term.

Amit Pabari is a managing director ar CR Forex Pvt Ltd. The views expressed in this article are his personal views.

Source: http://surl.li/gvrqpn