- December 9, 2024

- Posted by: Amit Pabari

- Category: Uncategorized

U.S. stock markets are soaring, with the S&P 500 breaching the 6,000 mark for the first time and the Dow Jones breaching 45000 level. The Nasdaq surged around 8.00% last week, while the Russell 2000 skyrocketed 12.5%. However, beneath the celebratory headlines lies a critical question:

Are these markets dangerously overvalued?

Let’s analyse through some of the commonly used indicators-

The above table highlights the Warren Buffett Indicator for the S&P 500, which compares the total market capitalization of U.S. stocks to GDP. Here’s what it suggests:

- Current Ratio: The ratio is 209.2%, far exceeding the threshold for being “Significantly Overvalued” (above 156%).

- Implication: This indicates that U.S. equity markets are trading at extremely high valuations relative to the size of the economy. Historically, such elevated levels have often been followed by market corrections or periods of lower returns, suggesting caution for investors.

- While this indicator provides a broad valuation measure, a warning is that factors like interest rates, earnings growth, and global economic conditions can also influence market dynamics.

Moving on to CAPE Ratio / Shiller PE Analysis: –

The chart shows the Shiller CAPE Ratio (Cyclically Adjusted Price-to-Earnings Ratio) for the S&P 500, a widely used measure of market valuation. Here’s what it suggests:

- Historical Peaks: The CAPE ratio spiked during the Dot-Com Bubble (2000), indicating extreme overvaluation, followed by a major market crash. A similar rise occurred during the Covid recovery phase, reflecting elevated valuations as markets surged despite economic uncertainties.

- Current Levels: The ratio is around 38.85, which is significantly higher than its long-term historical average (~16-17). Such elevated levels suggest that the market is overvalued, increasing the risk of a potential correction or lower future returns.

- Takeaway: While a high CAPE ratio does not predict the exact timing of a downturn, it serves as a cautionary signal that current valuations may not be sustainable in the long run.

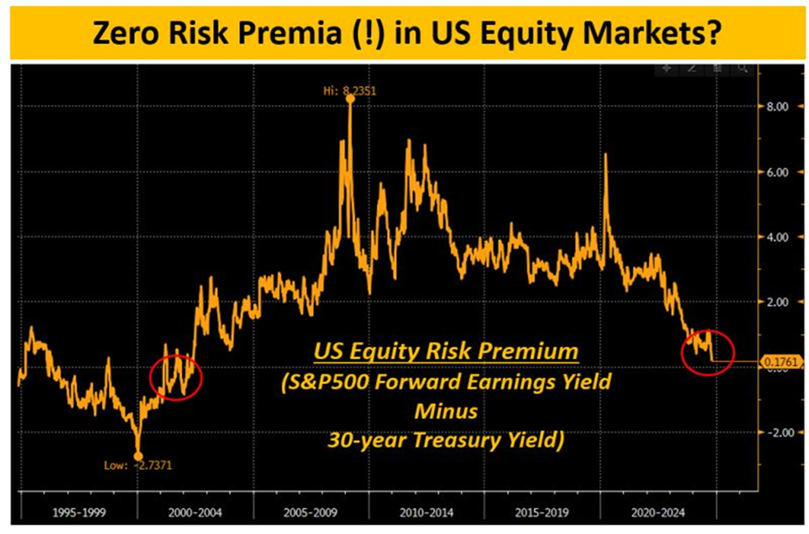

Lastly looking at the US Equity Risk Premium: –

Are US stocks still an attractive investment at such a low ERP? Let’s examine the chart to uncover the insights it reveals.

The chart shows that the U.S. Equity Risk Premium (ERP)—the gap between the S&P 500 forward earnings yield and the 30-year Treasury yield—has dropped to near-zero, signaling minimal compensation for equity risk. This suggests equities may be overvalued, with investors accepting lower returns amid rising Treasury yields, possibly due to optimism or speculative behavior. Historically, such low ERP levels have often preceded market corrections or economic downturns, highlighting a potential imbalance in the current risk-reward dynamic.

Disclaimer – While these indicators highlight that the S&P 500 appears significantly overvalued, it’s important to remember that they rely on specific factors and don’t capture the full spectrum of market dynamics. However, they do provide a clear signal of overvaluation in the current market.

Looking at the monthly Chart of the S&P 500 below-

Technically 6200 to 6500 will act as a strong resistance for S& P 500. Close below 5800, will be the first sign of reversal. A correction could unfold, with the first target near 5,425 and an extended decline potentially reaching 5200.

Amit Pabari is a managing director ar CR Forex Pvt Ltd. The views expressed in this article are his personal views.

Source: https://shorturl.at/GAsS8