-

Where is the Indian rupee headed? Find out here

- December 31, 2019

- Posted by: Amit Pabari

- Category: Economy

No Comments

Globally, emerging market currencies have been on a rollercoaster rise driven by the US-Sino drama. As we glance through 2019, most of the Asian currencies had depreciated against the dollar.

-

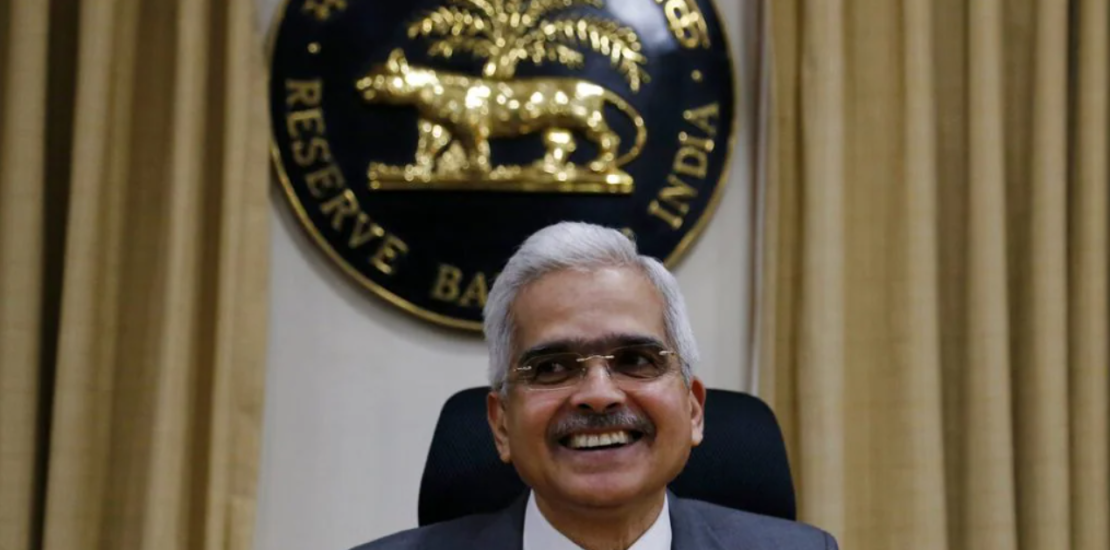

RBI’s Operation Twist: What will be its impact on rupee and retail loans?

- December 27, 2019

- Posted by: Amit Pabari

- Category: Finance

From forex swaps instead of its traditional bond purchases to embracing an ‘Operation Twist’, the RBI is pushing the boundaries of conventional central bank policy to improve rate transmission, spur credit to the economy and keeping rupee stable.

-

US-China deal and Brexit are over, so what’s next for currencies?

- December 23, 2019

- Posted by: Amit Pabari

- Category: Market

The markets are now in a relaxed mode, done and dusted by the most awaited completion of ‘phase one’ of US-China trade deal and completion of dollar inflows from Arcelor Mittal takeover deal. For 15 days, the rupee has been trading in a thin range of 70.50-71.30 levels.

-

Will bears take over bulls for the rupee or is it going to be a tug of war?

- December 19, 2019

- Posted by: Amit Pabari

- Category: Economics

Globally, the rise in uncertainty around the world in the past two years has been increasing demand for safe havens such as the US dollar, US Treasury bonds, and Gold.

-

Indian rupee will see selling pressures between 71.10 and 71.30 per dollar

- December 16, 2019

- Posted by: Amit Pabari

- Category: Market

After a cheerful weekend following the Asian peers, the Indian rupee retreated back in its comfort zone near 70.80 levels from the recent highs. As the markets are nearing much awaited Christmas holidays, volatility shall dry up as traders shall be closing their trading books and heading to party.

-

US Fed and ECB meetings will decide how the rupee acts and RBI reacts

- December 11, 2019

- Posted by: Amit Pabari

- Category: Market

Markets are in a pause mode, waiting for the storm to hit once again. Approaching year end, liquidity tends to dry up as market participation by traders drops. Because of this fall in trading volumes, there could be more than usual volatility if any of the scheduled events affect prices in a negative way.

({{currency.regularMarketChangePercent.toFixed(2)}}%)