- April 15, 2020

- Posted by: Amit Pabari

- Category: Market

Global economies are continuing to deliver a robust fiscal response to tackle the coronavirus outbreak, facing the current economic swirl. Nations across the world have come up with various tax incentives, loan guarantees, and wage subsidies in order to shield their citizens as well as their businesses from the devastating effects of the pandemic.

Here’s is a list of measures taken by some major governments to tackle its impact on the global economy:

USA

The slew of measures that have been taken by the US government includes, a spending bill of $8.3 billion to fight the pandemic. Later, the government allowed the Fed to distribute up to $50 billion in financial aid to states, cities, and territories. On March 17, it further proposed a stimulus package of $1 trillion in order to fight the coronavirus-driven economic slowdown.

On the part of the Fed, all the programs combine, could provide more than $6 trillion of liquidity to the financial and business system.

Europe

EU finance ministers have approved €500 billion in stimulus measures designed to cushion their economies from the coronavirus pandemic. The stimulus package includes up to €100 billion ($110 billion) in wage subsidies to prevent mass layoffs, loans to businesses and credit for EU governments.

EU limits on budget deficits have been relaxed to allow member countries to borrow more. The finance ministers also pledged to work on a recovery fund that will help the region bounce back from the current crisis.

UK

The UK has sanctioned 330 billion pounds ($424 billion) to fight the coronavirus pandemic. The amount includes 12 billion pounds to help national health services. The government has also announced loan guarantee to businesses threatened by the coronavirus pandemic.

In addition to this, it has announced 20 billion pounds of tax cuts, a three-month mortgage payment lapse for borrowers affected by COVID-19. The government has also waived off tax on non-domestic properties for this financial year and simultaneously, the BoE said that it would set up a new lending facility for affected businesses.

Japan

Japan has passed three rescue packages-one $4.6 billion package in February and a $15 billion package in March. Post that a spending bill also includes $4 billion for a number of programs including boosting mask production and stopping the virus from spreading to nursing homes.

Recently, Prime Minister Shinzo announced a third stimulus package worth $989 billion, Japan’s largest ever. The package, equivalent to about 20 percent of the nation’s economic output, will include cash hand-outs worth 6 trillion yen for households and small businesses hit by the virus and offers businesses deferrals on tax and social service costs worth 26 trillion yen.

China

Initially, the PBoC expanded reverse repo operations by $174 billion. It added another $71 billion on February 4. On March 5, the Chinese authorities allocated $15.93 billion for coronavirus-related funding and later it launched a $79 billion stimulus.

Also, the PBOC cut reserve requirements for banks that will free up to $78.8 billion in funds that will aid the firms affected by the COVID-19 outbreak. China’s State Council has authorised new bonds to fund infrastructure, additional subsidies and tax breaks for the car industry, and cheap loans for small businesses.

India

Till date, India injected a $22.6-billion economic stimulus plan providing direct cash transfers and food security measures to give relief to millions of poor hit by an on-going 21-day nationwide lockdown.

A second stimulus package worth $13 billion is expected to be announced soon and it’s focussed on help for small and medium businesses. Apart from that RBI has taken several steps to infuse liquidity in the market for helping households and businesses to combat the crises. It has been active on the monetary policy front by cutting rates, boosting liquidity and allowing a three-month moratorium on most loans.

Impact of the stimulus package

Increasing the money supply by dramatic amounts in an economy where output is constrained by law is likely to be inflationary. At times like this, stimulus’ cannot increase real output in an economy as the problem now is on both, demand and supply side. People tend to remain conservative in their investment decisions despite receiving excess money in form of incentives given by the government. As such times the flow of money doesn’t move towards riskier assets class like equities, commodities, high-yield bonds, real estate, and currencies.

So the question is where will the money find its way?

29.24%

$1,420.25

2011

8.93%

$1,531 (All time high marked at $ 1910)

2012

8.26%

$1,664

As these are exceptional times surrounded by ample uncertainties and risk of great recessions hovering, such stimuluses’ can either lead to more savings or investments into safe heaven asset class. As central banks across the world begin the largest money printing program ever in history, this excess of liquidity could lay the groundwork for gold to revisit the all-time high of $1,910 reached in 2011.

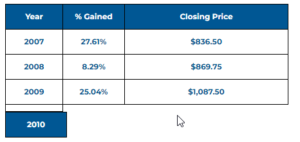

The price action across gold continues to resemble the trend last seen during the Global Finance Crisis. During 2008, it became apparent that the global economic system was under incredible strain.

As the stock market turbulence persisted, valuations of safe-haven assets across the board spiked, led by gains in gold and U.S. Treasuries. As like the current times, with real estate, equities, and commodities markets under bearish pressure, billions of dollars began a mass migration into safe-haven assets between 2007 to 2012 and the most consistent winner was gold.

It is said that history repeats itself and the same trend shall rule out for gold this time too.

In our previous report, we had mentioned that the trend for gold is on the upside and it shall march towards $ 1720 levels. The same was accomplished in the last week; gold will pave its way towards all-time highs of $ 1910 levels in the coming months.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.