- August 18, 2020

- Posted by: Amit Pabari

- Category: Currency

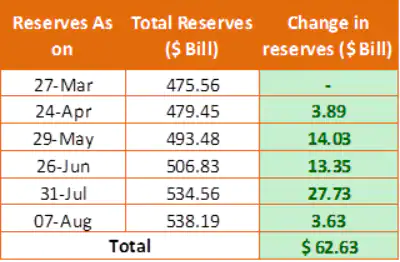

Yet another week, the Forex reserves were seen rising and RBI remained persistent in its approach. Today, RBI stands tall with the reserves amounting to nearly $538.19 billion.

As seen in the table above, RBI has accumulated nearly $62.63 billion of Forex reserves so far since March 2020. The central bank not just bought dollars but also played a great role in controlling the volatility in the pair. Despite Dollar Index falling from 103 to 93 levels, FDI inflows worth $22 billion and nearly $8 billion FII inflows in the Indian capital market, RBI has not allowed the rupee to appreciate below 74.50 in last 3 months with continuous dollar buying.

RBI can have multiple objectives in building the FX Reserves as given under:

· Increase rupee liquidity: One of the objectives is to increase rupee liquidity into the system in order to fulfill the consolidated borrowing needs of the centre and state governments and support the economy. However, with excess rupee liquidity in the short-run, CPI Inflation going up and prevailing supply disruptions, it will be watchful to see how long RBI will buy dollars.

· Boost Exports and cover for Imports: An increase in the dollar value shall boost the exporters and incentivize them in a way with the higher yields on the overseas sales; thereby boosting the overall exports of the country. On the other side, higher reserves keep the country warranted against any unprecedented weakness in the rupee as well as it helps to create the country’s import cover for a longer period.

· Curb Volatility: Off late, the volatility in the pair has drastically come down. Implied Volatility for dollar-rupee pair which was trading at 9.50 percent annually on 31st March has come down to 4.58 percent today. RBI has played a significant role in compressing the volatility in the pair that could have occurred arising out of inflows in the market.

Well, the question is how long will RBI be able to keep buying dollars?

The spike in the recent CPI prints to 6.93 percent can cause strain to the bond market as the real yields remain in the negative territory. With CPI inflation threatening to remain well above the upper mandate of RBI for consecutively the last few months, there is little scope for RBI to lower interest rates. At the same time, to finance the fiscal needs of the country at these times, the government might have to increase its supply of government bonds which might take yields above the psychological 6-mark. This blend of negative real yields, the little scope of a further rate cut and higher supply of government securities can steepen the yield curve significantly.

Hence, there is a possibility that RBI may step and will have to conduct operation twists, OMO’s or swap auctions. At this point, when RBI does operation twist and if it continues to buy dollars, it pumps rupee liquidity into the system which shall nullify RBI’s motive of flattening the yield curve. Therefore, RBI shall take a pause in buying dollars as it did in June first week. Therefore, the rupee will get another chance to shift its trajectory on a stronger side.

If seen from the other side, the US and Indian bond yields have jumped by 20 and 12 bps respectively in the last 10-12 trading sessions. However, the impact of an increase in the Indian bond yields on rupee has remained merely zero so far. If the Indian 10-year yields keep rising and RBI chooses to stay away from OMO’s or Operation twists, yet rupee might not see any major depreciation as US yields have been rising on a faster pace, thereby keeping the spread intact above 5 percent.

Outlook:

Hence, it is possible that RBI shall do more OMO’s and OT’s considering the need to cool off the rising yields and fulfill the government’s borrowing needs. With that RBI might have to halt dollar purchase temporarily, and there is a 65-70 percent possibility that the currency shall strengthen past 74.50 levels and shift its trajectory on the stronger side to move towards 73.00-73.50 levels within the next 2 to 3 months’ time frame. Therefore, every uptick above 75.20-75.50 levels arising out of any adverse and sudden negative developments, shall remain selling opportunity.

Technical Outlook:

The primary trend for the rupee is on a stronger side as the pair is continuously making lower highs right from the month of April. In the absence of volumes, the volatility in the pair is likely to remain muted as rupee trapped between FII inflows and dollar buying by RBI, thereby keeping the near term range intact within 74.50-75.50. If the pair breaks the support of 74.50 given by RBI pausing dollar purchase, then it shall move towards 73.50-74.00 levels.

Strategy:

Strategy for Export: Exporters are suggested not to get complacent and sell their near term exposures in tranches on upticks above 75.15-75.30 levels. It is advisable to maintain an overall hedge ratio of 70-80 percent.

Strategy for Imports: Importers can buy their 15 days to one-month payments close to 74.60-74.70 levels. To hedge more than a month, they can buy at the money call option in order to keep the downside open.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.