- April 22, 2021

- Posted by: Amit Pabari

- Category: Market

The yellow metal gold is on the verge of breaking out from an eight-month bearish zone and likely to outperform other asset classes owing to fall in real yield, sustained inflationary pressure and strong recovery in demand from top gold consumer country like China and India.

After topping out near $2070/ounce in last August, the prices were continuously trading on a bearish mode and formed a double bottom just above long-term trendline of $1675. Since then, $100 recovery has been seen but below fundamental suggests “show must go on”.

Inflationary pressure is shaping the Gold future

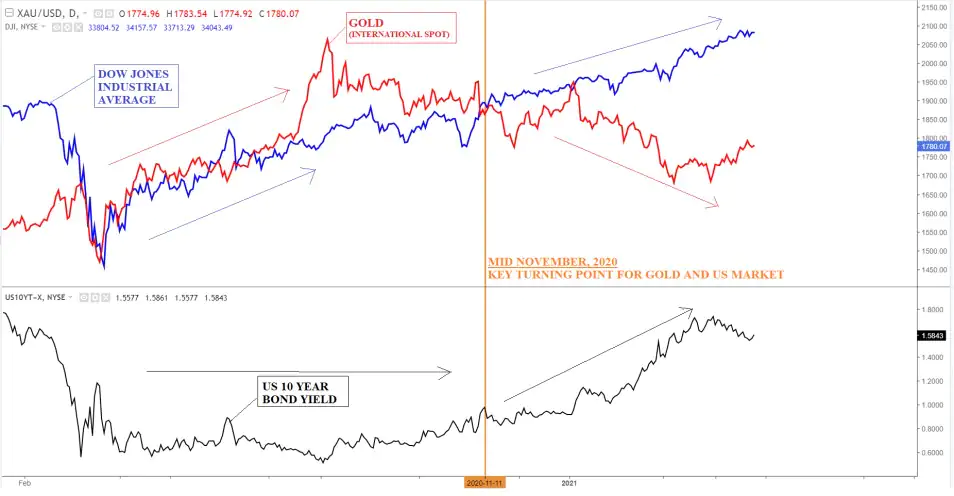

The US 10 year bond yield can be considered as “barometer” for the Gold as rise in the nominal yield (Interest rate that bond purchaser receives from bond issuer) since Nov, 2020 due to risk-on or reflationary trade slashed demand for the safe-haven. However, inflationary pressure was much higher and hence real yield (nominal yield minus inflation) didn’t recover much along with nominal yield.

It can be observed easily through the chart that reflationary trade was supporting the economic activity and so equity was experiencing risk-on move. Along with that, Gold was also seen rising till August and then went sideways before breaking down on a jump in the 10-year US bond yield above 1 percent in November, 2020. But as long as real yields are negative on higher inflation, we expect gold to outperform equity markets.

Dovish Fed is hawkish for the gold

After the last monetary policy meet, the Fed governor and member have been seen downplaying the rate hike chances by reiterating that the economic recovery and growth needs ultra-loose monetary policy. The fed and other developed central bank had been seen supporting the ZIRP (Zero Interest Rate Policy) and wanted to confirm twice just before making a U-turn on their policy rate.

This underpins the appeal for gold which we had seen last year when all central bank came up with rate cut and stimulus. The only condition is there has to be a halt in the further upside in benchmark bond yield. In the upcoming monetary policy which is due on 28th April, participants will be closely watching Fed’s tone on growth, inflation, yield curve and other economic data. Any lagging tone from fed and mixed economic data from the US could help Gold to recover the ground to test $1850 levels.

Fundamentals doesn’t support overvalued equities

Till when fed will further infuse liquidity in the market by keeping the ultra-loose monetary policy? The Biden’s 1.9 trillion Covid 19 relief package and then announcement of $2 trillion infrastructure plan is setting the path for the strong US growth. Along with that, controlled daily cases and higher vaccination program will have quickly re opening of the business activity. But this all was already discounted in the equity and that’s why US equities are trading at all-time high. The fed’s monetary stimulus could attract reflationary trade in equity but now government’s fiscal plan has to be backed by higher tax revenue planning- “Tax hike”. This would be the only reason why Biden is coming up with tax hikes to the wealthier group. The higher taxes on capital gain will attract some flows back to the traditional investment gold which doesn’t pay you interest like bond but just higher return. From valuation point of view, the equity market return has to be in sync with the country’s GDP (adjusted for the inflation) and this doesn’t allow equity to remain at top for more time. Any correction in the equity will pull flows towards inflation hedge investment –Gold.

Strong demand from ‘Hindi-Chini’

In total, India and China accounts for more than 50 percent of gold jewellery consumption globally. And after reopening of the economic, definitely demand for the gold has been seen back to the track. In the month of March, India’s gold imports from Switzerland touched highest in almost eight years as buyers wanted to take advantage of bottom fishing prices. However, due to lower footfall on stricter norms across many states in India hurt demands, but still India imported 160 tonnes of gold last month. From China, the government has given banks permission to import large amounts of gold into the country and it is expected that about 150 tonnes of gold worth $8.5 billion at current prices is likely to be shipped to China in April and May. Summing up, higher demand from Asian market could help yellow metal to shine again.

Technical outlook:

The weekly technical chart of international gold prices suggests that it was a parabolic move till Aug, 2020. But post that, prices corrected by almost 19% in corrective zig-zag form. However, it has taken support near immediate rising trendline support of $1675 and bounced back by almost $125 to test $1798 levels. The prices are likely to move further higher towards $1828 (38.2% retracement) and $1850 (down trendline resistance) before breaking out of the bearish trend. If both this levels are taken out then it will open the door towards $1920-$1950 levels. On the flip side, immediate support lies at $1720 and $1675 levels below which our bullish view will step down.

Conclusion:

Briefly, bullish view on the international gold prices are likely to be backed by fall in the real yield, alternative investment post Biden’s tax hike, mean reverting move in equities and persistent demand from major consumer such as India and China. Further, fed’s dovish tone will cool off the tapering and hike expectation- which could support precious metals. Overall, Commodity market’s super cycle is likely to remain intact on rising global growth story. The only headwind in front of gold could be triple digit dollar index and hitting another variant of COVID across world. The domestic gold prices are likely to outperform international gold on weakness in the Rupee.

Strategy for gold traders

In US dollar per ounce: We suggest gold traders to buy on dip towards $1730-50 zone for a target of $1830-$1850.

In MCX: We suggest buying on Gold future on dip close to 46,700-46,800 zone for a target of Rs. 48,800-50,000/10 grm levels with a stoploss of Rs. 45,800.

-Amit Pabari is the managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.