- October 25, 2022

- Posted by: Amit Pabari

- Category: Uncategorized

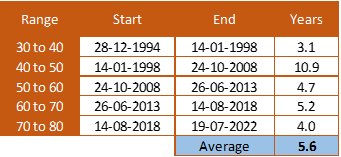

The Indian Rupee has been vulnerable to both domestic as well as global factors. On one side Current Account Deficit (CAD) and Balance of payment (BOP) are in bad shape and on the other, increasing marginal utility for USD has kept the local currency under pressure. Thus, sharp depreciation resulted in a quick change in the 10/- range, as can be seen in the given table.

Against the average of 5.6 years to change a range, this time it took only 4 years, which is more comparable to the 1994-1998 period when it had taken just 3 years to shift a range and the global market had suffered the Asian Crisis.

Amid heightened volatility traders, importers and exporters must be anticipating the future of the USDINR pair

Here’s a look at the unfavourable factors for the Rupee

Only king in the market- USD

“In the kingdom of the blind, the one-eyed man is king”- Against the gloomy global outlook, (kingdom of blind), USD (one-eyed man) is likely to be a king. Surely, the world has caught a cold as the Fed has sneezed by raising interest rates to curtail inflation.

However, raising rates by 3 percent from the bottom failed to shake the inflation as US CPI is still above 8 percent and the core CPI is at 6.6 percent. Analysis suggests that Fed won’t stop raising rates until they equal to inflation rates, or real rates turn positive. Nutshell, the US Dollar index has further room to move towards 117 to 121 levels.

After inflation, energy shock doesn’t seem transitory:

Globally, inflation jumped due to higher energy prices. The major reason was the recovery in demand post-pandemic and supply concerns. The Russia-Ukraine war further added fuel to the fire.

Europe was more impacted by the war as it imports 45 percent of its gas from Russia or 40 percent of its consumption whereas the UK’s import of commodities from Russia accounts for 24 percent. The situation worsened over the months and impacted the fiscal and monetary situation of the UK and EZ. The crises could lead to a contagion risk in the global financial market and could support a safe-haven bid for the USD.

Warning from global regulators:

Global finance regulators– World Bank and International Monetary Fund (IMF) – said that over a third of the global economy is heading for contraction either this year or the next. Further, they have sharply cut global growth forecasts, including that of India.

Kristalina Georgieva, managing director of the IMF, said “things are more likely to get worse before it gets better” and that the Russian invasion of Ukraine, which began in February, has dramatically changed the IMF’s outlook on the economy.

Further on the US, she said that the labour market could lose momentum because the impact of higher borrowing costs is “starting to bite,”.

World Bank President David Malpass, on the other hand, said that there’s a “real danger” of a worldwide contraction next year.

Rising pressure on Emerging market currencies

The biggest emerging market- China returned with a spike in COVID cases after the weeklong holidays. Further, dwindling China’s falling growth due to multiple crises like real estate, and draught/heat/power pressurized on Yuan to trade at the lowest level since Global Financial Crisis 2007-08, near 7.20 levels.

We expect the Yuan to further depreciate towards 7.40-7.50 levels over the next two to three months. Just like China, other emerging market economies (EMEs) are confronted with challenges of slowing global growth, elevated food and energy prices, spillovers from advanced economy policy normalisation, especially Fed, and debt distress, which may hamper growth and thus local currency.

Against given backdrops, the below points could be rays of hope for the Rupee. However, the probability of occurrence and impact on the Rupee would be subjective.

Will global central bankers shake hands to weaken USD?

Recently, there has been growing speculation of FX intervention from central bankers. Maybe, coordinated FX intervention could take centre stage. There was such an intervention in 1985 (Plaza accord) where France, West Germany, Japan, the United Kingdom, and the United States agreed to depreciate USD.

Against the positive 25 percent whopping positive performance of the US dollar index since the bottom of Nov 2021, there have been multi-year or decade-low levels in DM and EM currencies, and that too despite the central bank’s efforts to rescue the fall. But if all major central banks join hands and come up with a solution in consultation with Fed, then the depreciating move could halt. However, dynamics since the 1985 agreement have changed a lot, and chances of this remain very limited.

2013-like options left with RBI

In 2013, when Rupee had depreciated sharply from 55 to 68, RBI had come up with an option of a dollar swap window for oil companies and a 3-year FCNR deposit at a special concessional rate. To control the current situation, RBI could do the same and guide gold imports, limit proprietary trading, minimum daily CRR, or adjust LAF/MSF rates.

Outlook

When worlds collide and days are darker, the only option left is to have USD in hand and that too in cash. After COVID, inflation is at a decade high, growth is under big question as uncertainty over business models persists, supply chain mess, lower demand, chopped margin and rate hikes by the central banks, and not to forget elevated energy prices pouring over other sectors have made the standard of living costly- making the currency weaker against USD.

The situation is likely to worsen further amid given challenges. Overall, we are expecting US DXY to head higher towards 117 in the near term and 121 over the medium term. This means EURUSD is likely to fall towards 0.93 and 0.90 levels and GBPUSD to fall towards 1.05-1.03 levels.

Finally, on the question- ‘Is the Rupee unfolding unchartered territory?’ The answer is YES, it is expected to steadily depreciate towards 83.50 to 84 over the short term and 85 over the medium term.

–-Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/nhdsfens