- February 22, 2023

- Posted by: Amit Pabari

- Category: Uncategorized

The Economic Times | Major central banks across developed economies concluded the year in December 2022 by chasing inflation by raising interest rates.

However, this year, all three banks i.e US Fed, ECB, and BOE acknowledged that inflation was on the right path of decline, “disinflation”, which raised questions about further tightening.

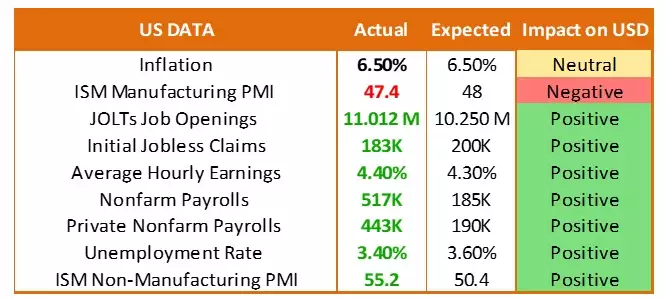

Well, the honeymoon period that began in January for risk assets kept twirling between red and green and the dollar rebounded with a bang at the post-mammoth US jobs growth report and a sharp rebound in the service ISM.

The DXY (US Dollar Index) had a blockbuster comeback post-NFP data which took DXY from 100.70 to 103.60 levels and there are enough reasons to validate the same.

“A” for Apple and “B” for Ball, “C” for Cat, and “D” for Dove… No wait, it’s a Hawk… That’s how the markets are narrating the Fed’s less hawkish stance!

Clearly, the market stands positioned for a more hawkish US Fed than at the start of the year and a few days ago post the FOMC when it was predicting a more dovish one.

Now the markets see higher terminal rates since the beginning of the year and even higher than the FOMC meeting.

“Strangely, when the Fed was hawkish, the markets heard dovish and when the Fed sounded less hawkish, markets placed hawkish bets. A wired inverse correlation between the markets and the Fed…”.

It’s evident that markets were too early to discount a pivot while the Fed was cautious of the unexpected surprises as seen last week and maintained its pace while markets rushed for cuts.

Does this unfold a suspected overdue correction in DXY or an indication of something that markets didn’t expect?

One strong data >> more hikes needed (market expectation) >> DXY could rise close to 105.

Data-dependent Fed (more validation) >> not very hawkish >> DXY could fall back close to 100.

Looking at the current perplexed relationship between the Fed and the Markets, the DXY largely seems to consolidate and tugged between a range of 100-105 until the next FOMC meeting due in March.

How would the EM currencies be impacted?

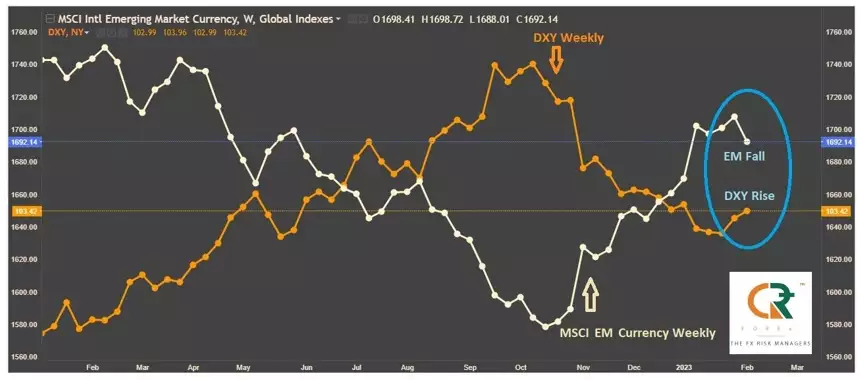

The popularly marked inverse relationship between the dollar and the price of EM currencies doesn’t go out of the way.

A strong dollar increases emerging-market interest costs and generally leads to EM underperformance and that’s exactly what we saw in the whole of 2022.

As evident in the below graph, the MSCI index of emerging market currencies appeared finally to be in an upswing against the dollar when the year started.

But, the reaction to the latest US data has brought it right back downwards. This is a big test of the emerging market currencies that had just begun to rally.

While we talk about the dollar’s inverse relationship with the EM currencies, the story changed as the DXY diverged from the USDINR off-late.

As seen above, the USD-INR had a perfect positive correlation with the DXY until mid-Nov wherein, when the DXY made a high of 114, USDINR too made a high of 83.20.

However, post that, the track got split and recently even while DXY traded near 103.50 levels and EM currencies were strengthening, USDINR still remained around 83 levels

This apparently is due to domestic factors that weighed on the rupee such as FII outflows and later Adani fiasco.

Well, going further there seems to have mixed factors that can play out for the rupee.

On the positive side, inflows pertaining to SBI green bonds, and sale of Sovereign green bonds summing up to nearly Rs. 24000 crores could prove an immediate respite for the rupee, and the pair would likely move towards 81.80-81.50 levels in the upcoming sessions.

However, in the medium term, since RBI doesn’t seem tolerant of a stronger rupee and heavy buying from the importer’s side, the rupee is less likely to move past 80.50 levels.

Plus, the squeezing interest rate differential between the US and India is further weighing on the FII flows thereby limiting the strength.

Overall, the pair is likely to remain well intact between the range of 80.50 on the lower side and 83.20 on the higher side until March.

Hence, the opportunity would be on both sides, so buying on dips and selling on uptick would work as an ideal strategy until then.

–Amit Pabari is the Managing Director of CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/586v3jj4