- March 15, 2024

- Posted by: Amit Pabari

- Category: Uncategorized

n 2022, chatters buzzed intensely over which central bank would be the first to raise interest rates. The following year, 2023, saw a shift in discourse, with speculation centering on which Central bank might be the first to hit the pause button. However, transiting to 2024, the talk of the town is who will cut…

By Amit Pabari

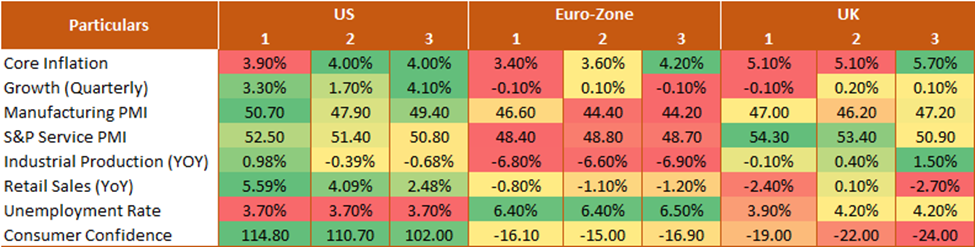

As various economies grapple with distinct challenges and opportunities, central banks in the United States (US), European Union (EU), United Kingdom (UK), and India navigate changing landscapes, each with its unique set of economic indicators, policy priorities, and market expectations.

Let’s delve into a comparative analysis of the monetary policy outlook for these key regions, examining recent economic data, central bank stances, and market sentiments to find out trends and anticipate potential future moves for currencies.

Federal Reserve (Fed)

Recent US economic data has shown strength, exceeding expectations. Federal Reserve Chair Jerome Powell emphasized a patient approach to rate adjustments, hinting at only three cuts this year. This boosted the dollar index to a two-month high at 104.60, and US 10-year bond yields surged to 4.17%. Market expectations for rate cuts have eased, with Fed funds futures pricing in 115 basis points of easing for the year, down from 150 basis points. The likelihood of a March rate cut now sits at 14.5%.

However, the recent quarterly Household Debt and Credit Report for Q4 2023 reveals concerning signs of financial strain, particularly among younger and lower-income households. Total debt surged by $212B to $17.5T, with mortgage balances rising to $ 12.3 T. Credit card and auto loan delinquencies continue to surpass pre-pandemic levels, with 1.42% of total debt in serious delinquency (delinquent by 90 days or more), compared to 1.03% in Q4 2022. In a nutshell, delinquency transition rates increased across all debt types except student loans. This highlights a worrying trend, indicating growing financial stress among consumers. Therefore, once the euphoria surrounding stronger economic performance fades and reality sinks, the DXY would start correcting on the downside.

European Central Bank (ECB)

As seen, the Eurozone economic data reveals a gloomy picture. Recently, the IMF downgraded its forecast for eurozone economic growth in 2024 to 0.9%, citing weak consumer sentiment, high energy prices, and subdued manufacturing and business investment. Eurostat data confirms near-stagnation, with 0.1% year-on-year growth in Q4 2023. Well, high interest rates are hindering recovery, increasing borrowing and production costs, and reducing investment and consumption. The bank also showed that demand for loans in the eurozone weakened further in Q4 2023, with companies’ demand for loans and household demand for real estate and consumption both falling.

Despite prevailing market expectations for rate cuts, the ECB is showing resistance to rate reductions. Its stance remains cautious signaling a move towards a more neutral stance on future monetary policy. This shift implies a careful balancing act between stimulating economic growth and guarding against inflationary pressures.

Bank of England (BoE)

The UK economy has faced challenges since Q1 23, with growth of 0.3%, stagnation in Q2, and a 0.1% contraction in Q3. Q4 23 GDP, due Feb 15, may show another small contraction, with near-stagnant conditions possibly persisting through H1 24. Well, measured inflation is expected to sharply decline due to the base effect. Though inflation, which rose at an annualized rate of nearly 11.5% from Feb-May 2023, may have fallen to 4%, potential tax cuts planned in the upcoming budget could spur another inflationary wave especially as the labor market still holds tighter than expected. The unemployment rate fell again to 3.9%, thereby putting more upward pressure on wages and prices. Hence, the central bank’s focus appears to prioritize managing inflationary risks, over immediate recessionary fears.

The swaps market suggests the Bank of England may begin easing after the Fed and ECB, with fewer cuts expected this year. The first cut isn’t fully discounted until June, with 105 bp of easing expected this year, compared to over 170 bp at the end of last year. This could keep the GBP supported with upside biases.

Amid the recent robust economic data, the Reserve Bank of India (RBI) is currently navigating a landscape influenced by recent economic data, liquidity concerns, and market expectations. Despite strong economic indicators from the United States impacting market sentiment, the RBI is expected to uphold its current policy stance. With average core inflation having eased to 5% in 2023, there’s a cautious optimism surrounding the RBI’s approach.

The potential for a rate cut to materialize from June 2024 onward, emphasizing a gradual withdrawal of accommodation measures. However, the RBI’s monetary policy decisions will ultimately hinge upon the trajectory of inflation and broader economic indicators and most likely would be the last in the queue to cut rates v/s the other major central banks. Furthermore, the inclusion of Indian bonds in the JP Morgan Bonds and Bloomberg EM index is anticipated to bring inflows in the range of $30-$35 billion. Also, the projected IPO flows for 2024 are likely to reach approximately $12 billion. Hence, the overall biases of the rupee shall remain on the appreciating side.

Momentum of Currencies in the Changing Dynamics-

As seen in the table, the DXY had a swing momentum from Nov till date when the Fiat moved from above 107 levels to nearly 100.50 and back to near 104.50. Well, between Nov to Dec 2023, the currency weakened by about 6% and in the same period, the EUR and GBP appreciated by about 4.5%, whereas the rupee strengthened by 0.25%.

However, between Dec 2023 and Feb 2024, the DXY appreciated again by nearly 4%, and in the same period, the EUR and GBP weakened merely by around 3% and 1.5% respectively, whereas the rupee still strengthened by another 0.11%.

However, between Dec 2023 and Feb 2024, the DXY appreciated again by nearly 4%, and in the same period, the EUR and GBP weakened merely by around 3% and 1.5% respectively, whereas the rupee still strengthened by another 0.11%.

This story suggests that the weakness in DXY translates well in EUR and GBP appreciation while the strength in the dollar doesn’t result in a significant loss in EUR and GBP. And on the other hand, Rupee outperforms with flying colors in both scenarios.

Potential Currency Trends:

In conclusion, the comparative analysis of monetary policy outlooks for key regions suggests a bearish outlook for the US Dollar Index (DXY) and a bullish outlook for the Euro (EUR), Pound (GBP), and Indian Rupee (INR).

In conclusion, the comparative analysis of monetary policy outlooks for key regions suggests a bearish outlook for the US Dollar Index (DXY) and a bullish outlook for the Euro (EUR), Pound (GBP), and Indian Rupee (INR).

The signs of financial strain among U.S. consumers could compel the Fed for more cuts and are likely to weigh on the DXY, with a target range of 102 to 102.50. On the other hand, the ECB’s resistance to rate reductions amidst guarding against inflationary pressures in the Eurozone implies a supportive environment for the Euro, with a potential target of 1.0900. Similarly, the Bank of England’s focus on managing inflationary risks over immediate recessionary fears suggests a bullish outlook for the British Pound, with a target of 1.2700.

Meanwhile, the Reserve Bank of India’s gradual withdrawal of accommodation measures amidst robust economic data and anticipated inflows from bond inclusion and IPOs is expected to bolster the Indian Rupee, with a target range of 82.80 to 82.50 levels.

Amit Pabari is a managing director ar CR Forex Pvt Ltd. The views expressed in this article are his personal views.

Source: https://shorturl.at/mLWZ6