- June 15, 2021

- Posted by: Amit Pabari

- Category: Market

If someone asks who is heading the US right now? Then the answer would be “J” factor. Firstly, the US administration is headed by ‘Joe Biden, who is pushing the US economy through his trillions of fiscal plan. From the central bank- ‘J’arome Powell had pushed QE last year during a pandemic, is now expected to announce ‘June monetary policy on Wednesday. The chances of going hawkish in this meet are lesser but they will likely be forced into debating moderate overshooting of the inflation target. If not in June then August ‘Jackson Hole or in September meet they will surely turn their page.

Will these ‘J’ factors along with other factors help the US dollar index to recover the ground and jump towards 93.50? The answer lies in the below points.

Fed is on course to take off the Airplane

It’s been noisy everywhere about the June Fed meeting and expectations are building strongly about the change of the outlook on inflation as they have resisted the temptation to try and quantify what moderate overshooting means. But will have to get a bit more concrete on when enough is enough. Are recently released 5 percent headline CPI and a 3.8 percent core CPI a moderate overshoot of the target? This time Fed could not keep it the same verdict and explain as a temporary bottleneck. Further, the recent massive build-up of dollars in the funding market is also forcing Fed to conduct a record reverse repo program (ON RRP- $547 bln as of last Friday), raising a concern in the money market that short-term rates could fall below zero. The market has started pricing in an early rate hike in 2023, and now the official dot plot will be watchful. If we get any clue on the tapering, even the smallest clue will also spook the market and the dollar index could jump immediately above 91.50 levels.

US is doing good in absolute and relative terms

In absolute terms, US economic data has been dollar-supportive. The June month started with beating ISM services and manufacturing PMI. Then, the unemployment rate fell to 5.8 percent and the economy added 559K jobs in May. Post that, last week’s inflation came in at record levels and consumer sentiment improved further up to 86.4. These figures are far better than Europe or Japan or Asia’s economic data. Further, vaccination drive has been remarkable in the US, although the UK is leading the race. But new variant- Delta in the UK has delayed easing of the lockdown by another 4 weeks to 19th July. All-in-all it seems that the US economy is better placed and hence the probability of hawks for the central banks is increasing day by day.

EU-UK Brexit woes looms over recovery

Another hot topic in recent days after the ‘Fed meeting’ is ‘Brexit’. The G7 meet turned into a Brexit meeting when the EU offered a last chance to the UK to reset the relations amid a Brexit divorce deal. In return, UK Prime Minister Boris Johnson accused the EU of not taking a sensible approach to post-Brexit arrangements and threatened to use an emergency clause to suspend if the deal is not compromised. The US president urged the UK to ensure the Northern Ireland peace process. Summing this issue in short, the pandemic recovery in both EU and UK could be hurt by rising Brexit concerns and thus this could be negative for both Euro and Pound. If this weakens then on a relative basis, Dollar could become stronger.

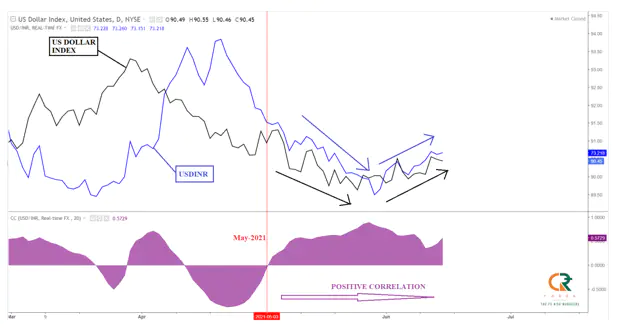

Technical correlation between US Dollar Index (US DXY) and dollar-rupee (USDINR):

The recent uptick in the US dollar index seems promising and it is expected to jump further higher towards 91.50 over the short term and 93-93.50 over the medium term. The correlation between US DXY and USDINR which was seen misplaced before May-2021 is again converging as both are moving in the same direction. So, if US DXY moves higher towards 93-93.50 then one can easily see the USDINR pair also moving higher above 74-74.50 levels.

Outlook:

CR Forex in-house research suggests that there is a high probability that the Fed could start unwinding their bond-buying program in either of these 3 key events- the ‘June meeting, ‘Jackson hole or the September meeting. In this June meeting, Fed has to come up with a higher revision of the inflation and growth forecast for the remaining quarter. If they ‘start thinking about tapering’ then participants should remain very much cautious and ‘start thinking about risk management. Apart from the US fed, Europe and UK fundamentals crisis and Brexit issues are suggesting further upside in the US dollar index up to 91.50 in the near term and broadly 93-93.50 levels over the medium term. If that is the case then USDINR is likely to bounce strongly towards 74.50-75.00 over 1-3 months. Last but not the least; the dollar index is likely to play like D ‘J’okovic’s French Open final winning game.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.