- January 6, 2024

- Posted by: Amit Pabari

- Category: Uncategorized

By Amit Pabari

Reflecting on the year 2023, global equity markets experienced significant success, demonstrating impressive performance. Similarly, commodities, including gold and various others, also witnessed robust returns. As we anticipate 2024, characterized by potential challenges for equity returns, gold and bond is foreseen to continue its ascent, maintaining its upward trajectory in the coming year.

By Amit Pabari

By Amit Pabari

Looking at the factors why Equities will underperform-

Higher interest rates, rising US debt levels, credit rating downgrade, weaker consumption levels, rising expectation of credit card delinquencies, and weaker corporate earnings may result into a correction in equities and market may see hard lending in H2 of 2024.

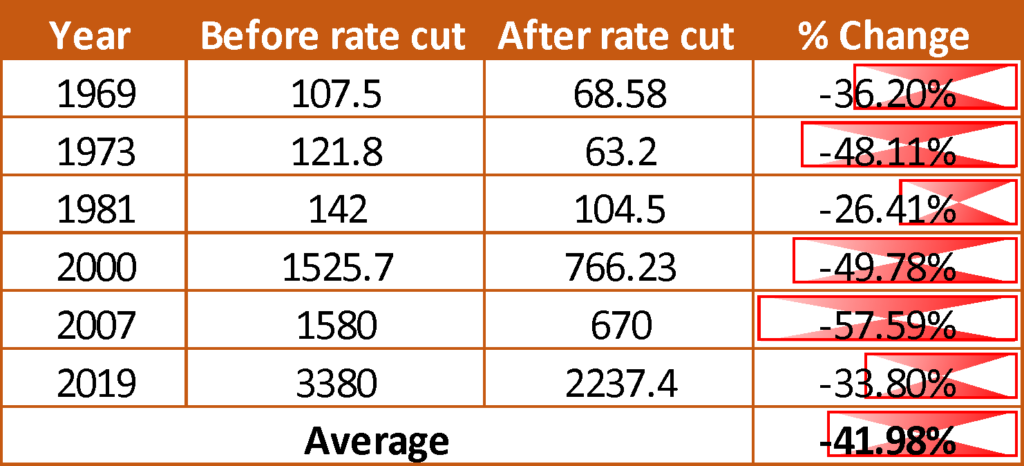

In the history of 50 year , an observable trend emerges, revealing a correlation between equity market downturns and instances of rate cuts by the Federal Reserve (FED).. This is how S&P 500 has reacted everytime the FED cuts the interest rate with an average fall of 41%. As the US equity market faces a downturn, it amplifies the likelihood of underperformance in other emerging and Asian markets. Projections indicate an anticipated rate cut during the upcoming March-April meetings, suggesting the possibility of negative returns in the latter half of the year for equities.

ALSO READ

Jefferies’ Wood bets on CIL, SBI in latest Greed & Fear report

Looking at the recent US data releases which have come on the negative side, the rate expectation continued to rise leading to overall pressure on the DXY. Further the overall U.S. treasury, the national debt surpassed the $34 trillion mark on December 31, 2023, marking a historic milestone. This occurred as a result of substantial borrowing during both the tenure of former President Donald Trump and the current administration under President Joe Biden. The purpose was to stabilize the economy and facilitate recovery. However, this recovery was accompanied by a rise in inflation, leading to increased interest rates and a higher cost for the government to manage its debts. The long-term concern lies in the potential risks associated with continually escalating debt levels. A sustained increase in debt could contribute to upward inflationary pressures and result in prolonged elevated interest rates, consequently amplifying the challenge of repaying the national debt.

However, Indian Equities can outperform the global one as the January to May period before the election has been positive for the equities. In the past two General Elections (2014 and 2019), noteworthy inflows of $15.53 billion and $11.98 billion respectively were observed from January to May. Recent state election outcomes, indicating victories for the BJP in three major states, have raised expectations for the ruling government’s potential third consecutive win in the general election. Such an outcome might attract flows, mitigating policy shift risks and potentially bolstering the Rupee.

As Equities face the prospect of underperformance, what lies ahead for the future of Gold?

Gold is poised for outperformance, particularly when central banks signal rate cuts, as such indications often reflect concerns about economic growth. In response to these signals, investors, wary of a potential recession, typically reevaluate their portfolios and make adjustments to manage their risk exposure.

ALSO READ

Winter of content: New demat accounts scale new highs in Dec

The reasons for Gold to appreciate are-

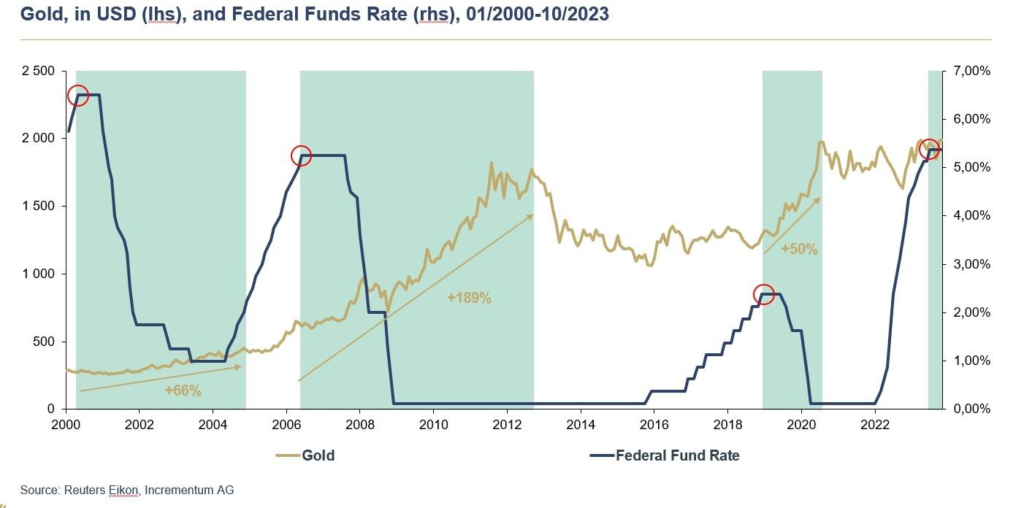

Analyzing the presented chart, it becomes apparent that a consistent trend in the market is observed: whenever the Fed (FED) opts for a rate cut, there is a concurrent appreciation in the price of Gold by at least 50%. Anticipating a forthcoming rate cut by the FED in the second quarter of 2024, it is plausible to expect a corresponding increase in the Gold price.

Another contributing factor to the potential appreciation of gold is the strategic actions of central banks. A survey conducted by the World Gold Council reveals that a substantial 70% of the surveyed central banks express intentions to increase their gold reserves within the next twelve months. This trend of central banks actively acquiring gold is anticipated to persist over the coming years.

ALSO READ

MobiKwik refiles IPO DRHP, issue size cut to Rs 700 cr

Thus anticipated course for gold in the global market is poised for an upward shift, with projections reaching between $2300 and $2600 per ounce. In the Indian context, this ascent translates to an expected movement towards the range of 72000rs to 75000rs per gram.

As impending rate cuts loom, the anticipation for bonds is to outperform in tandem with gold-

The narrative on interest rates took a U-turn in November when the US, Eurozone, and UK experienced a stiff or multi-month low in the inflation rate. This immediately reflected in the expected interest rates for 2024. Interest rates and bond prices share an inverse relationship. In light of discussions regarding a rate cut in the final quarter of 2023, bonds have already begun yielding positive returns. With over 50 banks poised for rate cuts, a favorable outlook suggests that bonds are poised to deliver robust returns in 2024. The details of the market’s expectation of a rate cut are as follows.

Rate Cuts >>> Money Supply Increase >>> Cheaper Borrowing >>> Investments in Bonds >>> Bond Price Rise >>> Bond Yields Falls

Considering the likelihood of higher returns from bonds, it is advisable to explore investment options in Debt Funds, Balance Funds, or directly in AAA-rated corporate Bonds.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article are his personal views.

Source:http://surl.li/pqpyj