- May 5, 2020

- Posted by: Amit Pabari

- Category: Currency

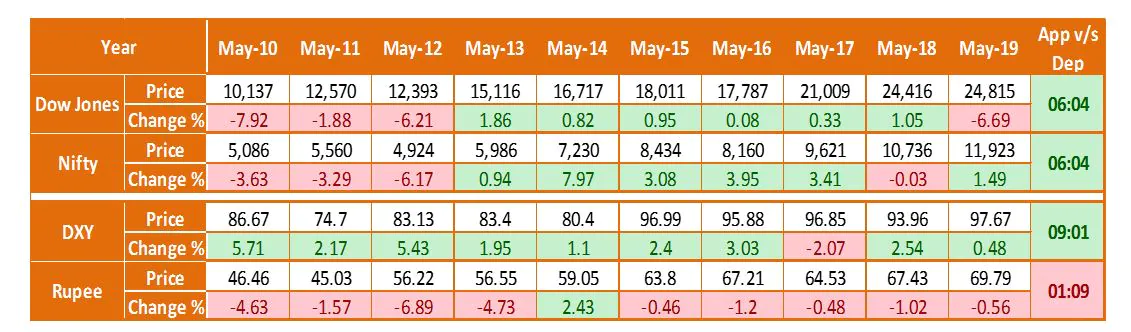

Sell in May and go away! It is one of the most well-known proverbs in the investing world. To substantiate, let’s have a look at the seasonality table for Dow Jones, Dollar Index (DXY), Nifty and Indian Rupee. As seen from the seasonality table below, Dow Jones and Nifty have performed mixed with a positive bias and have surged 6 out of 10 years. If observed, every time the fall in Dow Jones is significant as compared to the rise. On average, it has fallen by 5.68 percent and risen by 0.85 percent if combined together. Whereas, for Nifty it is nearly a neutral move. The index has fallen by an average of 3.28 percent and risen by 3.47 percent combined together.

For currencies, DXY has risen 9 of the 10 years with an average increase of 2.76 percent. Ironically, it holds inverse for the Indian rupee which has depreciated 9 out of 10 times on an average of 2.39 percent.

But will it necessarily hold true this time around, as investors face one of the most significant public-health crises in history.

To evaluate better, let us understand the factors based on the positive or negative impact they can have.

Positive factors in the short-to-medium term:

- The significant fall in the crude oil prices could save 35 to 40 billion dollars annually for the country despite given depreciation in rupee.

- Being Asia’s second-largest economy, India could attract FDI and FII inflows as the country still expect to grow positively as compared to other nations.

- According to IBEF, pharmaceutical export from India stood at $13.69 billion in 2019-20 (till January 2020). It is expected to grow by 30 percent to reach $20 billion by the year 2020.

- The only immediate positive impact would be an invention of a vaccine. This shall help soothe the sentiments of global investors and regain their faith in markets, thereby bringing inflows.

Negative Factors:

- Chances of a trade war between the US and China have escalated post the virus outbreak as Trump has alleged China and WTO for the pandemic. He has also instructed many US firms to divest their investments from China. The US also seeks to bill China at least $160 billion for COVID-19 reparations.

- Extension of Lockdown in India especially in the largest Economic Centres like Mumbai, Delhi, Chennai, Kolkata, Ahmedabad which continues to be in Red Zone. This will result in lower growth and higher fiscal deficit, thereby making the appreciation journey difficult.

- GST collection for March slipped to a record low of Rs 28,309 crore as on April 29, down from Rs 1.13 lakh crore recorded in the same month last year.

- RBI’s expansionary monetary policy might not have a significant impact on the economy in the near term due to a lack of demand and consumption amid the current lockdown.

Technical Aspect:

For Nifty:

As seen above, the Nifty has made an all-time high of 12,430 levels and the recent low was made near 7,510 levels. After a sharp plunge, Nifty has bounced towards 9,881 levels, which is exactly corresponding to the 50 percent retracement rally from 7,510. Therefore, technically in order to end the bear market, Nifty needs to trade above 9,800 to 10,100 levels for consecutively two weeks.

For Rupee:

A similar pattern has been observed in dollar-rupee. As seen above, after making a high of 76.90 levels, rupee rallied towards 74.93 levels. This is coinciding with 38.2 percent retracement of the overall move from 72.50-76.90 levels.

For the bear run in the rupee which started from 72.50 and halted at 76.90 levels, the 50 percent retracement level is at 74.50. For rupee to appreciate, it’s important for the rupee to break its previous crucial all-time high of 74.50 which was made in 2018. Until then, there is a 60-70 percent probability that rupee can cross the 76.90 and move towards 77.50 levels in the month of May.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.