- July 11, 2022

- Posted by: Amit Pabari

- Category: Uncategorized

A tranquil business of currency trading has now been jumbled to high volatility due to war, soaring inflation, central banks tightening at vastly different speeds, and recessionary fears. A flight to safety has pushed the US dollar up and driven the currencies around the world to their lowest levels in years, as economic prospects in Europe, UK, and elsewhere are darkening amid soaring energy prices.

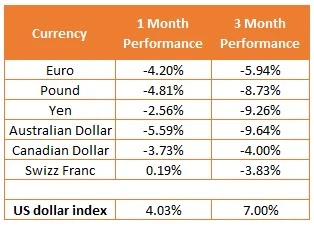

The DXY surged to its highest level in nearly two decades bringing its year-to-date gain to nearly 11% out of which a 7% rise is attributed to the last 3 months, boosted by safe-haven flows. As the recessionary fears take a front foot, the 2-10 year US Treasury bond yield curve inverted, suggesting markets are positioning themselves ahead of an anticipated recession. Forming a foundation for the dollar’s strength is the US Fed seems to be more determined to raise interest rates to soak out inflation than other central banks. The country doubtlessly has better long-term growth prospects than peers, cushioned with strong employment and high savings to withstand a global downturn. Unable to cope up with the US Fed policy has hammered the DM’s and EM’s substantially.

What is denting the Euro?

The Energy Crises

The euro plunged to a 20-year low falling almost 1.5% after natural gas and electricity prices surged to record levels in the continent, boosted by a possible Russian supply cut and labor strike in Norway. High energy prices have hit the heart of Europe’s manufacturing powerhouses in Germany and Italy, bringing the latter into deficit for the first time since 1991.

The Gentle ECB vs Brutal Inflation

The supply shortages have sparked fears that they might not just surge inflation higher but also cause job cuts, hitting consumer spending and economic growth. Building fears have reinforced expectations for the ECB to increase interest rates more gently and gradually than other major central banks including the Fed. An interest rate hike by 0.25% this month is expected this month and possibly by a larger amount in September.

The War Impact

European economies are having a bigger impact compared to the US as Germany and eastern Europe had more economic ties with both Russia and Ukraine. The sanctions on Russia and the collapse of the Ukrainian economy is having a more significant impact on disrupting the European economy.

The GBP Pain

Political & Geopolitical Crises

The UK political jitters are holding back investors from placing bullish bets on the GBP. Key parliamentary members including FM Sunak resigned arguing that PM Johnson has lost his ability to run the government properly and competently. However, PM Boris Johnson is in no plans to step down.

On the Brexit front, the UK parliament is considering a new law that would unilaterally change customs arrangements between Britain and Northern Ireland that were initially agreed upon as part of its EU exit deal. The political and geopolitical drama in the UK is likely to continue to weigh on the GBP which has already hurt by nearly 9% in the past 3 months.

Recessionary Fears

The ongoing strike at Norway threatens further cuts to UK’s gas imports. The pound had already been under heavy pressure as a big jump in natural gas prices is building a base to push inflation even higher to 11% later this year. The average household bills are likely to expand to £2,800. The UK’s economy relies heavily on energy imports and with the ongoing turmoil, it becomes more likely for the economy to tip into recession before the end of the year, causing the pound to hit hard.

Gradual BoE

Denting the currency further, the BoE, unlike Fed, would adopt a gradual approach toward raising interest rates amid the worsening economic outlook. Some market players expect a bigger rate hike of 50 basis points at the Aug. 4 meeting. The BoE warned that the economic outlook for Britain and the world had darkened and told banks to ramp up capital buffers to withhold the storm. The banks are told to increase the amount of money they set aside to absorb shocks to 2% of their assets as a buffer, as opposed to the normal 1%.

Outlook for the majors

Euro: With the given headwinds, Euro remains vulnerable and as the EURUSD pair has broken a crucial 1.0350 support, heading its way towards parity (1.000). If the pair breaks further below parity, then we need to evaluate how much further it could fall. On the upside, 1.0350 and 1.06 shall remain crucial resistance. In terms of EURINR, if 80.50 is broken, levels close to 79.50 could be expected.

GBP: GBP seems to mark its move close to 1.18 after breaking crucial support of 1.2150 levels. Further, if the pair take out 1.18, levels close to 1.15 could be seen in the short run. Important resistance could be seen close to 1.2150 and 1.2250 levels. In GBPINR terms, the pair is likely to move close to 93.00 levels in the short term.

-Amit Pabari is managing director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/yuta4ff3