- June 10, 2020

- Posted by: Amit Pabari

- Category: Currency

The price action in the dollar-rupee pair suggests that the currency is trading sideways despite series of positive-negative events and news on Indo-global front. It has been the seventh consecutive week wherein the pair is trading in its narrow range of 75.00-76.20 levels.

It has been time and again witnessed that the reins of the Forex market are in the hands of RBI and ultimately ‘RBI is the king’. During deserted times like these, when drizzle of rains was awaited (in the form of inflows), June finally embraced the shower of foreign inflows to soothe the market from the soaking heat (of outflows) that began in March. A significant amount of $2.47 billion FII inflow in the past 5 trading sessions along with a series of corporate inflows played a major role to keep rupee well insulated from the global heat. These inflows began when the government announced relaxations on the lockdown and stage-wise reopening of the economy.

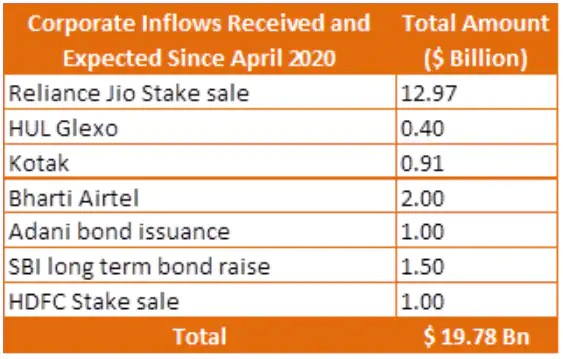

A heavy chunk of corporate inflows have been realized and expected as the companies have begun selling stakes and raising bonds to support their financials. Let’s first glance through the number of inflows coming from these corporates:

The above given received and expected pipeline of corporate inflows coupled with the FII inflows of $2.47 billion received so far, takes the sum total to around $22.25 billion. Even if 50 percent of the huge chunk of inflow is considered to be realized so far, the domestic currency should have been trading below 75-mark as of today. On the contrary, the pair has not been able to sustain below 75 levels in the last two months and has remained on the relatively weaker side of the range 75.00-76.20.

How did the effect of inflows get nullified?

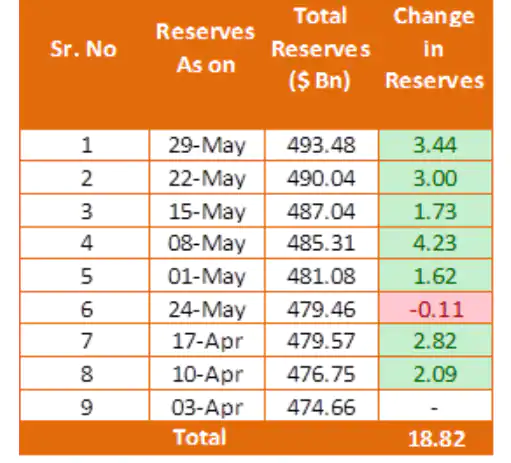

Here comes the role of the king RBI, who has remained on the buying spree since last two months as seen from the table below:

In the past two months, RBI has bought a total to $18.82 billion worth Forex reserves to mark a new life-time high of $493.48 billion. This rigorous buying of RBI has mobbed off the effect of inflows on the rupee, taking the currency back to pavilion. The central bank is curtailing a sharp rise in the rupee beyond 75.00 for the last 2 months through its dollar-buying interventions in significant quantum. The present behaviour of RBI clearly indicated that the central bank is comfortable with the current levels of the rupee and doesn’t want the pair to appreciate sharply. An aggressive buy-side dollar intervention from the central bank can be to achieve the twin objectives:

- Raising the forex reserves well beyond the $500 billion-mark in-order to cushion it from the upcoming unknowing challenges.

- To support the sagging export sector that is badly affected by the long lockdown.

- Due to ratings getting downgraded, there is a threat of bonds falling into junk category which can lead outflows which can lead to currency depreciation.

On the economic front, the gloomy economic outlook with negative GDP growth along with fears of a recession is disallowing the rupee to breach the 75-mark. However, a shift in sentiments is quite visible in the market which is likely to bode well for the Indian rupee in the near term. Risk appetite has returned to the markets and there is a lot of optimism as businesses reopen across major economies. As global, as well as domestic equities, are on the rising march, the rupee is likely to stay well supported.

All in all, considering the present facts and figures, the pair is likely to remain congested in its near term range of 75.00-76.20 levels until any major trigger leads to a breakout in the range. The longer the pair remains range-bound; the sharper will be the breakout.

Strategy:

Exporters: Exporters can target to sell on upticks between 75.80-76.10 levels as the opportunity arises for their near term exposures. They can maintain a 50-70 percent hedge ratio of the total orders. For the balance, a stop-loss of 75.20 or cost whichever is higher should be followed in order to safeguard from any erratic move in the pair.

Importers: Importers can look to buy their near term payments on dips close to 74.90-75.20 levels and can have import cover up to 1 month. The ones keeping their positions open can maintain a stop-loss of 76.00 or cost whichever is lower.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.