- October 28, 2020

- Posted by: Amit Pabari

- Category: World

As we are just 7 days away from the U.S. election, mood shifts are gripping the financial markets as investors are growing anxious and the same is reflected in FX and Equities. In our previous report, we had mentioned the amount of Stimulus given by the U.S. and how equities are impacted by the outcome of the US election.

In this report, let us study how what is the typical reaction of the dollar to stimulus historically and going further, what US elections have on cards for the world’s dominant currency.

Let us take the case study of the 2008 financial crises to understand how the dollar reacted to the excess money supply.

The global recession of 2008-2009 led to unprecedented stimulus packages being unveiled by governments around the world. In the US, a $787 billion stimulus package known as the American Recovery and Reinvestment Act (ARRA) of 2009 contained a huge line up of tax breaks and spending projects aimed at vigorous job creation and a swift revival of the US economy. The initial cost projections of the stimulus package consisted of $212 billion in tax rebates, $296 billion extra for Medicaid, unemployment benefits and other mandatory programs, and an additional $279 billion in discretionary spending to keep the economy afloat. During these times, excess dollar liquidity caused by money printing via QE led to a decline in the DXY that had begun in 2009 up-till 2014. The dollar had fallen from 90 to 74 levels by 2011. However, in 2014, when the Fed announced the ending of QE, the dollar index regained its strength and reached nearly 100 levels by 2015.

Following the historical trend, this year too despite all the major economy announcing stimulus, the dollar has remained on a broader downtrend as the stimulus provided by the US is way higher than the rest of the other economies, thereby increasing the excessive supply of dollars. The dollar has fallen by nearly 9.5 percent from 103 in March when the US had announced its first stimulus package to nearly 93.00 levels in October. If the US comes up with an additional stimulus that is under negotiation, the currency might weaken further.

As we are gearing up for the US election, let you understand what shall be its impact on the Dollar index

The above graphical presentation shows what would be the possibility of the outcome of the US election and its impact on the dollar.

Will Trump win drive the dollar up or Biden would?

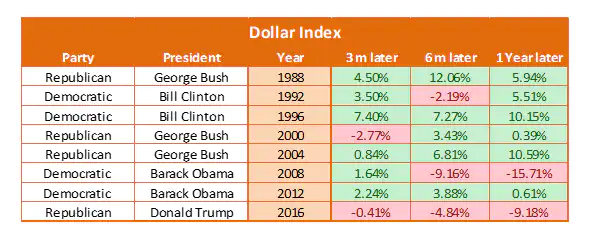

Well, in our observation, over the past 3 decades, US elections have been conducted 8 times and surprisingly, the dollar index has the majority of the time appreciated irrespective of whichever party or president comes in power.

As seen above, Dollar has been on the uptrend most of the year’s post the elections except the years of recession or political strains. Like in 2009, the Fed had announced QE which led to excessive money printing and a decline in the dollar and in 2017, as geopolitical tensions were rising between the US and North Korea which led to a dollar fall.

As USD is the world’s reserve and dominant currency it has the authority to print unlimited money to support the economy while crises. The US dollar being a Fiat currency, which is a government-issued currency and doesn’t need to be backed by commodities such as gold, the supply of fiat currencies can be unlimited. Hence, the US Fed has the power to print an unlimited amount of money.

Also this time, Trump is promising a bigger stimulus package than Biden. His latest proposal offered is worth $1.8 trillion and Appeals to Congress to pass targeted relief aid for struggling airlines and small businesses as well as another round of $1,200 stimulus cheques for individuals offering.

On the other end, Biden’s campaign calls the $1,200 stimulus checks (plus an additional $500 per child) that millions of Americans received under the CARES Act and extending unemployment benefits $600 a week. Also, offers a weaver of a minimum of $10,000 in federal student loans for each borrower and increasing Social Security checks by $200 a month including 64 million retired workers. In all, Biden has published a subsequent stimulus package that could cost another $3 trillion.

Therefore, irrespective of the candidate that wins, they will come up with a huge stimulus. Hence, for dollar, as both the leader has promised to add more and more money in the economy, downward pressure can sustain in the medium to the long run and more money printing will take place.

Outlook for Indian Rupee in given circumstances

Considering the broader weakness in the US Dollar and domestic measures taken by the government and RBI to improve the liquidity and revive demand, more and more investments are likely to turn towards India. As inflows could remain favorable, the medium-term biasness of the rupee shall remain on the appreciation side. However, a few volatile sessions can play their part to take the rupee on the weaker side of the range of its broad range of 72.50-74.50 levels. Until the pair breaks 74.50 levels, every uptick on the dollar-rupee pair can be taken as a selling opportunity.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.