- January 15, 2023

- Posted by: Amit Pabari

- Category: Uncategorized

Financial Express | The inflation in the US began to rise from the beginning of 2021 from 2% to peak at around 9.1% in June whereas the Fed began to rise rates in March 2022 from 0.25% to 4.5% up-till December 2022. Since the inflation began to fall sustainably from July 2022 and markets got convenience about the same in Nov-22 as the core and headline CPI fell sharply, the Dollar reversed. The mighty dollar’s bull run came to a climactic end late in Q3 22 and early Q4 after a winning streak of nearly 18 months. The end of the bull run started with the sequence of events from late Sep 2022 as given in the below-timeline:

As seen above, firstly after UK PM’s resignation the capital strike against Truss’s unfunded fiscal stimulus was called off which spurred a dramatic short-covering rally in GBP and got it lifted by more than 10% in less than two weeks. Secondly, market confidence grew that the US inflation has peaked and that the terminal rate of Fed funds would be around 5% after the release of November’s inflation prints. Thirdly, the ECB turned progressively hawkish after a delayed start of the tightening cycle. Now, its tightening cycle is expected to extend beyond the and an increased expectation of more hikes than the Fed kept the Euro dominant. Finally, the US economy saw a sharp decline trailing from previous months on retail sales, industrial production, and manufacturing and service PMIs. All this made the DXY test below 103 levels.

How majors could perform in H1 2023!

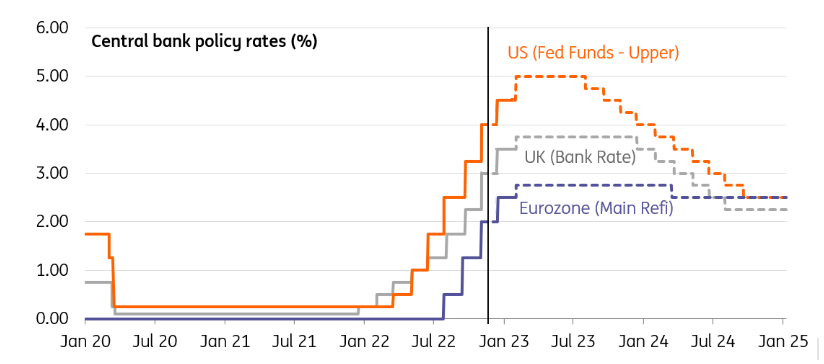

Kicking into 2023, most of the central banks may complete their rate hike cycles around the middle of the year while the unwinding of the bank’s balance sheets may continue longer as seen above. Well, a tussle between the currencies would be on as the markets would juggle between the two critical questions, “who will pause hikes sooner?” and “which economy will slow down quicker?”

The DXY

The resilience of the US labor market and the consumer are expected to carry into the first part of 2023, with the risks of a recession increasing later in the year. In the four FOMC meetings in H1 23, the market looks for two 25 bps hikes, with a terminal rate reaching 5.0%. If there is a risk, it is a critical divergence between the Fed and the markets. Despite the pushback from officials, the market continues to price in a 25bps cut in the last quarter of 2023.

Overall, a softer CPI is expected, with the headline rate falling below 7% for the first time since November 2021 and the core rate may slip below 5.9%. With a persistently slowing inflation and economy, the Fed may acknowledge that it’s time for Pivot before H1 2023. Broadly, when the Fed pivots, as it will at a certain point when inflation slows down considerably, the dollar will be dumped heavily. Overall, it seems like the dollar’s cyclical rally has ended and that it will weaken over the course of H1 2023 where levels around 101.50 and 98 could be on cards.

EUR-USD

The EURUSD started the trading year with more upside momentum. The trading range for the 2022 year was about 2000 pips considering the extreme of the high to the low (1.15 to 0.95). In the recent past, the prospect of a more aggressive ECB helped lift the euro to new six-month highs near $1.0750 in mid-December before a consolidative phase emerged.

ECB President Lagarde clearly signalled to lift key rates by another 50 bp at the February meeting, and the hawkish rhetoric has encouraged the market to price in another half-point move at the March meeting as well. Well, starting in March, initiating a formal quantitative tightening process, ECB will not fully re-invest the maturing bonds in its portfolio. As inflation appears to have peaked at 10.7% in October and with falling natural gas prices amid warm winters, the ECB projects it to fall to 6.3% by the end of 2023. However, subsidies that are dampening inflation now expire and could see price pressures rise again during spring. Well, an economic contraction may have already begun, but the ECB’s forecasts suggest it may still be short and shallow. If at all the contraction goes another way round, a break of the $1.0550 would signal a correction close to $1.02. Overall, as the divergence of monetary policy begins working in Europe’s favour, the euro is to rise to 1.09 to 1.11 by H1 2023 and we anticipate a normal range of about 1400-1600 pips for the year.

GBP-USD

After a rhetoric rally of nearly 2000 pips and peaking around the 1.2450 area in the last quarter of 2022, Cable gave a sharp correction. With the 0.3% contraction in Q3, the UK’s recession, which may last up to 2024, has already begun. Still, with double-digit inflation above 10%, the Bank of England’s tightening is not over. There probably is scope for another 50 bp hike at the next February meeting and at least a couple of quarter-point hikes later.

Given the historic cost-of-living squeeze in the UK, it is difficult to visualize the fortunes of much improvement in the near-to-medium term. With that, being overbought with a 2000 pips rally, a break of the $1.1950 levels if at all could further signal 200 pips decline towards 1.1750 levels, but the same could be seen as corrective in nature and not the end of the Pound’s recovery. Going further, the cable could rise back towards its 1.25-1.27 region by H1 2023 more likely due to broadly weaker dollar than positive developments in the UK.

–Amit Pabari is the MD, CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://tinyurl.com/mumbdsea