- July 19, 2023

- Posted by: Amit Pabari

- Category: Uncategorized

In 2022, we had seen multi-year high volatility due to rising geopolitical tension after the Russia-Ukraine war and central bankers’ tightening spree to get the upper hand in their battle against inflation.

As a result of the double whammy impact of geopolitical tension and higher borrowing cost, the USD being a global cycle currency traded at the highest level in 21 years.

At the same time, the Indian rupee was seen steadily depreciating from 74.50 to 83.25, a fall of more than 11%. As the year progressed towards the end, inflation started to revert towards its mean and thus the expectation of jumbo hikes was slashed, and the dollar gave up its strength.

But despite the weakness in USD, the rupee didn’t experience positivity and went for a lengthy consolidation.

The consolidation in the USD-INR pair, which started around October 2022 is still intact. It was seen bottoming near the 81-81.50 zone and topping near the 82.80-83.25 zone.

The major reason behind the sideways move or lower volatility is the RBI’s regular intervention on both sides.

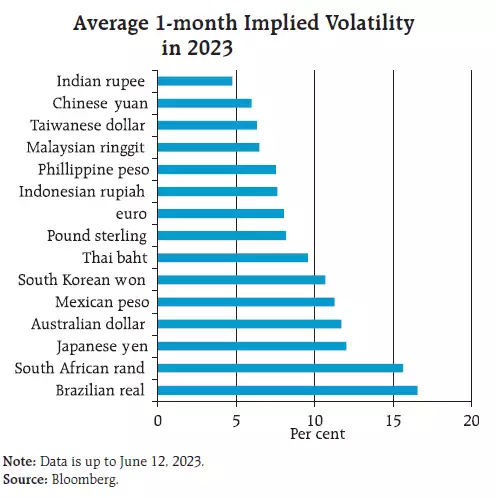

Recently, just before last week’s spikes in the pair, Rupee’s 1-month implied volatility was at below 5% and one-year implied volatility was at 5.20%, the lowest since 2007.

The given excerpt from RBI’s bulletin suggests that Rupee holds the lowest volatility among the list of foreign currencies.

Who had benefited through the lower volatility:

1. Importers: It was a complete turnaround period for the importers’ risk management strategy. The premium cost for the importers was around 4% – 4.5% in 2022 and volatility used to be medium to high. But now the cost has been reduced by more than half. Along with that, lower volatility due to a prolonged

consolidation is the double benefit for the importers.

2. Foreign investors: Surely, lower volatility in the country’s currency where they have invested their funds is a win-win situation for the FPIs as their cost of currency hedging gets reduced.

FPI investment when Nifty was at 17,000>>> USD-INR was at 82.30 >>> Sell USD/ Buy INR (82)>>> cost of hedging has been 1.50-75% for a year

Let’s assume that FPI takes out money

FPI outflow when Nifty is at 19,000 >>> USD-INR is still at 82.30(Same rate when they brought investment) >>> Buy USD/ Sell INR

So, the currency risk diminishes for the FPIs, who can easily grab the investment opportunity.

Moving forward…

Fundamentally Speaking:

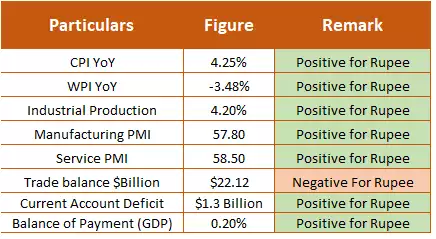

India’s economy is showing resilience on the back of a strong services sector and a relative outperformance of manufacturing. The banking sector performance has been closely watched and addressed by the central bank and suggests no scope for turbulence.

On the inflation side, headline inflation will continue to remain within the 4% +/- 2 percentage point target range through the rest of 2023 as energy price base effects feed through. However, unfavorable weather conditions could be a chal .

challenge for food prices. And therefore, RBI to leave the policy rate at 6.5% through the rest of 2023.

However, the headwinds from weak external demand, volatility in global financial markets, protracted geopolitical tensions and the intensity of El Nino impact pose risks to the outlook.

Despite this, real GDP growth for 2023-24 is projected at 6.5% – one of the fastest growing in the world. The only caveat to the same is a trade deficit, which widened by $22.12 bln in May 2023, the highest level since December 2022.

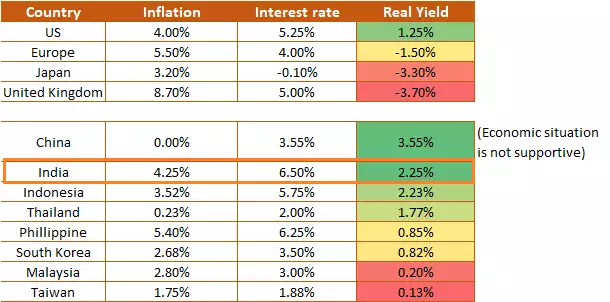

On the flows side, FPIs have been extremely bullish as they have poured $13.80 bln in 2023, out of that $6.8 bln in June alone. As India is having a higher real yield (go through the table) among major DM and EM, equities and debt attracted huge inflows over the last few months.

China is not attracting FPI or FDI flows as their economy is facing multiple economic crises and their central bank is infusing money/ cutting rates to support the same.

Optimistic business outlook, resilient demand outlook & fundamentals on the domestic front along with anchored inflation. Apart from this hot or temporary money, there have been notable inflows on the FDI front, which have helped the equity market test all-time-high.

India’s FX reserves stand at $595 billion, a jump of almost $33 billion in the calendar Year 2023 – covering more than 10 months of imports.

The reason behind the spike in FX reserves is attributed to the RBI’s absorbing FPI flows and restricting Rupee’s appreciation between 81 to 81.50.

Technically Speaking:

Technically, the rising base is called a ‘Higher Lows’ and the falling peak is called a ‘Lower Highs’. The USD-INR pair can be seen following the same and makes a symmetrical triangle.

Currently, the pair is standing right at the cliff edge, and from here on the chances of further lower side momentum seem higher. However, the final confirmation will be on the breakdown below 81.80 and 81.65.

As long as these levels hold, one can expect a further squeeze down of momentum and the pair could consolidate into a range of 81.80 to 82.80.

Outlook:

Volatility- a contrary indicator, just spiked from the multi-year bottom, although the pair can be seen trading within the central bank’s produced boundary- 81.80 to 82.80.

Ideally, the pair could have breached 81.50 and managed to test the 80-mark given the subdued movement in the US DXY and FPI/FDI inflows over the last 4-5 months. However, RBI and importer’s buying near 81.50-81.80 didn’t allow the same.

Further, weakness in the Yuan/Yen and other currencies raised the question regarding competitiveness and put pressure to depreciate.

If risk-on sentiment continues globally, and if the US Fed can make a soft-landing of the economy while pausing a rate hike, then USD could weaken further and help EM currencies to appreciate.

Overall, the momentum or volatility could deepen further and ‘higher lows’ & ‘lower highs’ could get closure. And thereafter, there are higher chances that the pair could give a breakout on the downside. If the USD-INR pair manages to break 81.80 and 81.65, it could move further lower towards 80.90 – 80.50 levels.

Though, RBI may not allow the pair to trade for a longer period over there & may intervene to pile up more FX reserves. Thus, the appreciating rally in Rupee could be short-lived.

–Amit Pabari is the Managing Director of CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://rb.gy/we44y