- August 16, 2023

- Posted by: Amit Pabari

- Category: Uncategorized

Experience suggests that things go wrong when it is least expected. Remember Murphy’s Law.

It was least expected that the US Dollar index would give a breakdown on the chart below strong support of 100.50.

And onto it, it was again least expected that the breakdown will be a false one. As the pair bottomed out near 99.50 and jumped sharply above 102.80 levels, the traders are into curious contemplation on the outlook. First, let’s check the reasons behind the recent jump and then analyze the outlook.

Unravelling the surprising recovery from 99.50 to 102.80?

Two primary factors contributed to this recovery: Robust US economic data and a Risk-off sentiment triggered by a credit rating downgrade.

Robust US Economic Data:

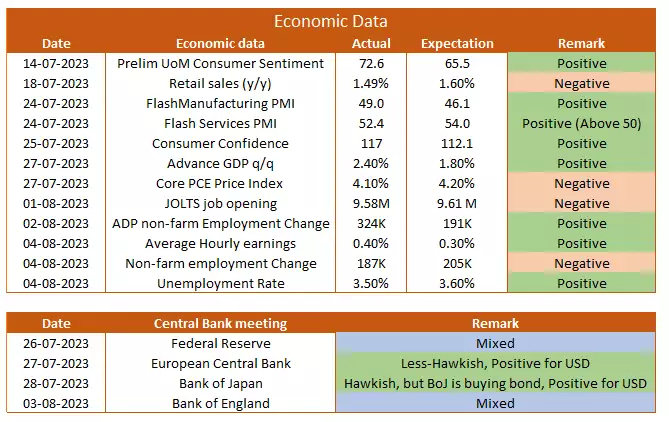

The given table identifies the positives for the US dollar. With 8 to 4, positives vs negatives, the sentiment turned positive for the US dollar. It seems that there has been further momentum left in the economy despite a 5.25% rate hike in 1.5 years and as the Fed wanted, a Soft landing can be easily achieved.

Risk-off sentiment triggered by downgrade:

On August 1, credit rating agency Fitch downgraded the United States from its highest triple AAA rating to AA+. Two of the three leading ratings agencies now rate the US at their second highest tier – Standard and Poor’s previously downgraded the US to AA+ in 2011, leaving only Moody’s with the US at the highest rating.

This downgrade raised concerns about potential fiscal deterioration over the next three years and the

recurring debt ceiling negotiations in the United States.

Following this, the US dollar index reached its highest level in four weeks, and benchmark 10-year Treasury yields surged to 4.20%, their highest point since November last Wednesday. However, some correction towards 4% has been observed over the last few days but the developed market and emerging market currencies felt tremors.

Central bank’s stance & check how much steam is left for the rate hike?

We usually track two kinds of performances. The first is ‘Absolute based’ and the second is ‘Relative based’. On the absolute front, US economic surprises have been good since the start of the rate hike cycle, outweighing the market’s expectations.

Except for some hiccups in the banking sector in Mar 2023 and Fitch’s downgrade in the first week of August 2023,

we didn’t see any major impact on any sector or the job market. That apart, growth has been steady, and fairly avoided the technical recession. Furthermore, inflation is just away by 100 bps from the target level.

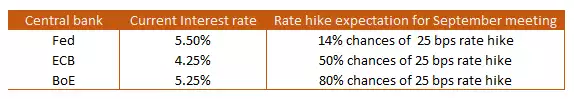

Well on a relative basis, real rates (Interest rate – inflation) are positive in the US, which is not the case with Europe and the UK. Though their inflation is easing, hikes are still needed to converge the prices. Based on the rate hike expectation sentiments, the EUR and GBP

Though their inflation is easing, hikes are still needed to converge the prices. Based on the rate hike expectation sentiments, the EUR and GBP were trading at 1.12 and 1.3140 in mid-July.

Indeed, a gravitational pull towards the fundamental aspects of the narrative seems to be unfolding and both (EUR and GBP) are corrected by almost 3%. Moving ahead, the trajectory of economic data is bound to significantly influence the momentum.

The US Fed is almost done with their rate hike but ECB & BoE are yet to wind up as they haven’t achieved their goal to take the rate higher, at least to match the inflation. The economic data from Europe and the UK has been off the peddle but fortunately remained away from a recessionary tagline.

And thus, both ECB and BoE will continue their job of a rate hike in September, and thus yield or interest rate differential will Favor EUR and GBP.

Overall, the narrative surrounding interest rate differentials, and the likelihood of ‘Hikes’ or ‘No-hike’ decisions will play a pivotal role in guiding the currency pair’s direction. With no major central bank meeting (On the global front) due this month, committee members’ speeches, economic data, and sentiment will be in focus.

Thus, we believe that Euro and Pound will make their base near the current levels and start heading higher again. And thus, it seems the steam in the US dollar index has evaporated near the 102.50-103 zone and is likely to resume its downward journey towards 100.50-100.00 levels.

Technical chart & outlook

It took 6 trading sessions for the US Dollar index to fall from 103.50 to 99.50, and it took 15 trading sessions for the index to recover 78.6%, which is near 102.80 levels. As can be seen in the below US dollar index, the breakout below 100.80 was a false one as it retreated above the neckline and jumped above 102.80 levels.

Now, it is standing at the ‘Apex point’(a point where both downward and upward line coincides). Usually in technical analysis, this point is considered as a reversal point. And thus, we expect that the US dollar index should take resistance in 102.50-103.00 levels and retrace back towards 100.50-100.00 levels.

Outlook:

The factors which were favoring a weaker US dollar index below 99.50 didn’t work well and we saw a sharp recovery as global sentiment started falling in sync with the fundamentals. But from here on, central bank rate hike-based sentiment will again take centre stage and start singing a song for EUR and GBP.

Though, we cannot expect a one-sided rally in both

the currency as economic data and activity don’t support it. On the technical front, the US Dollar index is expected to resist near the 102.50-103.00 zone and retrace back towards 100.50 levels.

And hence, we expect EUR-USD should find a bottom near 1.09-1.0950 and move towards 1.11-1.1150 levels. Whereas, GBP-USD is expected to make a base near the 1.2600-1.2600 zone and head higher towards 1.2900-1.2900 levels.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article is his personal views.

Source: https://rb.gy/mq4fg