- December 7, 2023

- Posted by: Amit Pabari

- Category: Uncategorized

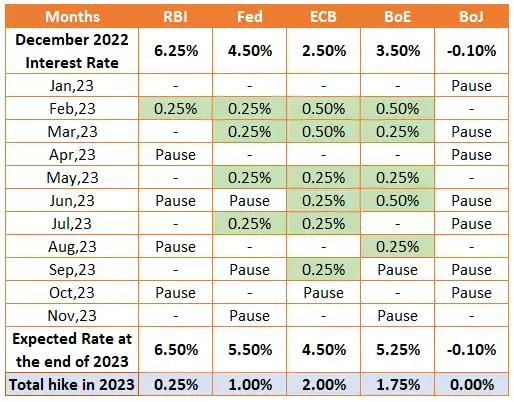

In 2023, central banks slowed their rate hike momentum due to declining inflationary pressures. Despite a gradual easing in core inflation, five major central banks collectively implemented eight 25-basis-point rate hikes and four 50-basis-point rate hikes in the first half of the year.

However, the pace slowed in the second half, with only four 25-basis-point rate hikes executed by these banks.

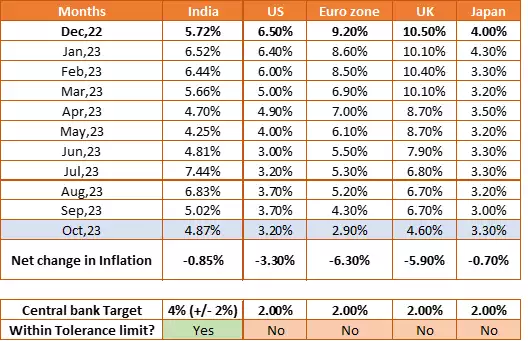

In a span of merely 10 months, a noticeable decline in inflation rates was witnessed across several countries. The most significant drop was witnessed in the Eurozone, where inflation plummeted from 9.2% to 2.9%, marking a substantial 6.30% decrease.

Following closely, the UK experienced a substantial decrease of 5.90% in its inflation rate. Meanwhile, the United States saw its inflation rate halve from 6.50% to 3.30%.

Japan exhibited a ‘stickiness’ in its inflation rates, while India demonstrated stability by maintaining inflation within the target range set by its central bank.

What’s done is done. What’s next?

Regarding the roadmap ahead, the upcoming December central bank meeting holds significant importance. It won’t solely revolve around the decision of a rate hike, pause, or cut, but rather the focal point will be the guidance and narrative provided regarding economic activity.

RBI Policy: 8th December

Expectations:

Not inflation, growth or interest rate, but liquidity & credit weight would be the key areas where RBI’s meeting will majorly grab attention.

The recent report from the RBI highlights a concerning liquidity deficit in India’s banking system, reaching a five-year high at Rs 1.74 lakh crore ($20.90 billion).

Several factors contribute to this imbalance, including a surge in bank credit, significant advance tax payments by corporates, and sluggish growth in deposit accumulation.

Continuous RBI interventions aimed at stabilizing the rupee against the US dollar have further impacted liquidity. Increased outflows due to higher GST payments and heightened cash withdrawals during the holiday season have compounded this deficit.

However, anticipation of government spending injecting liquidity offers hope for a potential boost in banking sector liquidity amidst these challenging circumstances.

Following the liquidity deficit, the RBI might delay its planned open market bond sale.

Secondly, following the RBI circular on risk weightage, a sudden surge in primary bond issuance has been observed. Recent days witnessed major government entities like Canara Bank, REC, SIDBI, IRFC, and PFC preparing to access the bond market, reflecting this trend.

So, comments or Q&A on the same in a press conference will be in focus. Regarding interest rates, the weighted average call rate (WACR), indicative of banks’ borrowing expenses, has surged beyond has surged beyond the upper limit of the RBI’s interest rate corridor.

But again, as inflation is within RBI’s band, the central bank is likely to remain hawkish with the withdrawal of accommodation.

Likely Impact on the Rupee: The upcoming December policy is expected to have minimal impact because the RBI consistently aims for a balanced approach.

While fundamental factors and EM FX performance suggest possible appreciation against the USD, the Daily Dollar Demand (DDD) indicates limited gains, likely around 83-83.10 levels.

But if any big flows hit in the market or dollar weakness persist then USDINR can breach 83 mark and move towards 82.75-82.50 levels. On the flip side, the RBI seems to be gradually changing its stance from 83.30 to 83.35 and possibly targeting 83.40.

This deliberate approach in managing rupee depreciation shows a reluctance to let the Rupee reach record-low values against the dollar.

Federal Reserve: 13th December

The likelihood of a December rate hike at a mere 3% probability isn’t compelling market participants to favor holding onto the dollar.

With headline inflation at 3.2% and core inflation dipping to a 4% low in October 2023, the rationale for betting on a rate hike diminishes. Market attention is shifting toward the upcoming economic projections and the dot plot for insight into future interest rates.

The recent 31st Oct-1st Nov meeting painted a bearish picture for the USD, with the Fed indicating a reluctance toward a rate hike, leading to a decline in the US DXY from above 107 to 103.10 and the US 10-year bond yield from 4.93% to 4.40%.

Looking ahead to 2024, the CME FedWatch tool suggests a 25% chance of the first rate cut in March, escalating to nearly 50% by May.

Throughout 2023, quantitative tightening progressed silently and is anticipated to exert a significant impact in 2024.

This scenario paints a picture of a period where the central bank might ease policy through rate reductions while concurrently conducting quantitative tightening.

This dual approach indicates a policy direction toward a potential tapering of tightening around the end of 2024.

Likely Impact on US DXY:

Over the short to medium term, with the Fed expected to implement a rate cut well ahead of the ECB and BoE, the resulting divergence is likely to benefit other major developed market (DM) and emerging market (EM) currencies.

Consequently, we anticipate the US DXY to decline further towards levels around 100 within the next 1 to 1.5 months and 98.50 over next 2 to 3 months.

ECB and BoE meeting: 14th December

Both neighbours, the ECB and BoE, are expected to deliver their final monetary policy decisions of the year on the same day in December. Regarding the ECB, the inflation rate stood at 2.9% year-on-year in October 2023, marking the lowest figure since July 2021 but still exceeding the ECB’s 2% target.

This rise primarily resulted from a decline in energy prices and a slowdown in food inflation. However, core inflation remains double the target at 4.2%, though it’s the lowest since July 2022.

In the final monetary policy meeting, the ECB’s comments will be closely watched, especially after Lagarde’s recent warning about potential slight increases in headline inflation in the coming months, alongside expectations of persistently weak growth.

An additional challenge for the ECB is the significant disparity in inflationary pressures among EU member states.

With the maturity of a major part of the TLRO and the phasing out of reinvestment in the APP program, focus will shift to the PEPP. The ECB faces fragmentation issues when considering rate hikes or cuts, complicating swift changes in its stance.

As for the BoE, Governor Bailey expressed it was premature to contemplate in

was premature to contemplate interest rate cuts while tackling the task of reducing inflation to its 2% target from the current 4.6%.

Other MPC members, including Jonathan Haskel and Deputy Governor Dave Ramsden, also advocate for an extended pause in interest rates. On the economic data front, improved PMI figures have emerged, and the Office for Budget Responsibility (OBR) recently offered a more positive outlook, projecting growth rates of 0.7% and 1.4% in the upcoming years.

Moreover, Chancellor Hunt’s Autumn statement proposes an £18 billion fiscal package aimed at tax relief, potentially boosting the UK’s economic growth forecasts for 2024. Overall, the BoE may be the last central bank to consider a rate cut.

Likely Impact on Euro and Pound:

The more than 550-pip surge in EURUSD and nearly 700-pip movement in GBPUSD stemmed from a dovish statement by a Fed member, leading to a decline in the US DXY and US 10-year bond yield.

With the interest rate expectation differential favoring the Euro and Pound, we anticipate EURUSD to further advance towards the levels of 1.1250 to 1.1350 and GBPUSD to move towards 1.2900 to 1.3000 over next 2 to 3 months.

Bank of Japan: 19th December

The BOJ allowed 10-year yields to breach prior limits, reaching around 0.5% in December 2022 and roughly 1.00% in July 2023.

Despite these measures, the yen initially strengthened against the USD due to US yield fluctuations, yet later hit record lows in October and November 2023 as Japan faces escalating prices, with inflation surpassing the central bank’s target for 19 consecutive months, amid market expectations for a rate hike.

The upcoming BOJ meeting on December 19, 2023, might bring adjustments to Yield Curve Control (YCC), potentially enhancing flexibility or eliminating it entirely.

This move could bolster the Japanese yen,

yen, particularly if it influences yield differentials favorably against the US dollar.

However, BoJ’s Ueda affirmed the central bank’s commitment to stabilizing foreign exchange market volatility amidst Japan’s prolonged inflation above the target level.

Likely Impact on the Yen:

As US yields undergo correction due to anticipated lower Fed interest rates in 2024, the differential appears to favor the Yen.

Moreover, the BoJ’s expected shift towards a more hawkish stance in the coming months, driven by persistently higher inflation compared to their peer countries, might result in a partial unwind of the carry trade in favor of the Yen.

Overall, the USDJPY pair is projected to decline further towards levels around 143.50 over the next couple of months. Conversely, resistance is anticipated near 149.50, followed by a final barrier at 150.50 levels.

Amit Pabari is Managing Director at CR Forex Advisors. The views expressed in this article are his personal views.

Source:https://shorturl.at/acrAS