Amit Pabari

-

Stronger dollar taking a toll on its rivals

- January 28, 2020

- Posted by: Amit Pabari

- Category: Market

No Comments

The USD is scraping the skies to pop up fresh highs as the rise for safe heaven increases after a viral breakout. Going forward, the US Fed prepares to hold their first policy meeting of the year on January 28 and 29, central bankers are sending clear signals that the monetary policy is in an ideal spot. Meanwhile, employers are still hiring, workers are still spending, unemployment is still low and inflation is still tame.

-

Indian rupee is trying to swim before taking a dive

- January 23, 2020

- Posted by: Amit Pabari

- Category: Economy

The current situation suggests that the impact on the currency shall remain biased towards depreciation with a cap near 72.40 levels until March 2020.

-

Budget, RBI policy to drive the theme for rupee; dollar to stay strong

- January 21, 2020

- Posted by: Amit Pabari

- Category: Economy

Due to an unexpected shortfall in revenue and higher spending, the fiscal deficit for the current financial year is likely to edge higher at 3.7-4 percent. However, the same is likely to slow down the capital flows into the country which could lead to the currency’s weakness towards 71.50 levels.

-

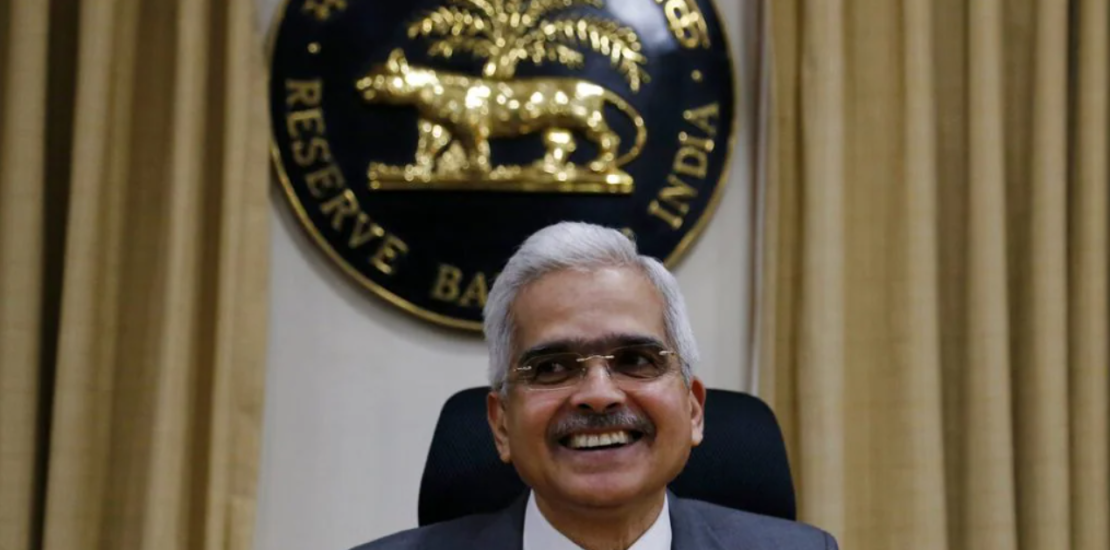

Switching gears: How RBI’s dollar-buying programme affects Indian rupee

- January 17, 2020

- Posted by: Amit Pabari

- Category: Economy

The dollar buying programme by the Reserve Bank of India has become a talk of the town of late. But was it the same case in the preceding years? Let’s have a look at how the RBI intervened in the dollar for the past three years.

-

Gold prices in 2020: What will drive the yellow metal this year

- January 3, 2020

- Posted by: Amit Pabari

- Category: Market

After a bull grip in 2019, gold prices in the first two days of the new year has been steady. In last year, the yellow metal had given more than 18 percent return.

-

Where is the Indian rupee headed? Find out here

- December 31, 2019

- Posted by: Amit Pabari

- Category: Economy

Globally, emerging market currencies have been on a rollercoaster rise driven by the US-Sino drama. As we glance through 2019, most of the Asian currencies had depreciated against the dollar.

-

RBI’s Operation Twist: What will be its impact on rupee and retail loans?

- December 27, 2019

- Posted by: Amit Pabari

- Category: Finance

From forex swaps instead of its traditional bond purchases to embracing an ‘Operation Twist’, the RBI is pushing the boundaries of conventional central bank policy to improve rate transmission, spur credit to the economy and keeping rupee stable.

-

US-China deal and Brexit are over, so what’s next for currencies?

- December 23, 2019

- Posted by: Amit Pabari

- Category: Market

The markets are now in a relaxed mode, done and dusted by the most awaited completion of ‘phase one’ of US-China trade deal and completion of dollar inflows from Arcelor Mittal takeover deal. For 15 days, the rupee has been trading in a thin range of 70.50-71.30 levels.

-

Will bears take over bulls for the rupee or is it going to be a tug of war?

- December 19, 2019

- Posted by: Amit Pabari

- Category: Economics

Globally, the rise in uncertainty around the world in the past two years has been increasing demand for safe havens such as the US dollar, US Treasury bonds, and Gold.

-

Indian rupee will see selling pressures between 71.10 and 71.30 per dollar

- December 16, 2019

- Posted by: Amit Pabari

- Category: Market

After a cheerful weekend following the Asian peers, the Indian rupee retreated back in its comfort zone near 70.80 levels from the recent highs. As the markets are nearing much awaited Christmas holidays, volatility shall dry up as traders shall be closing their trading books and heading to party.