- January 17, 2020

- Posted by: Amit Pabari

- Category: Economy

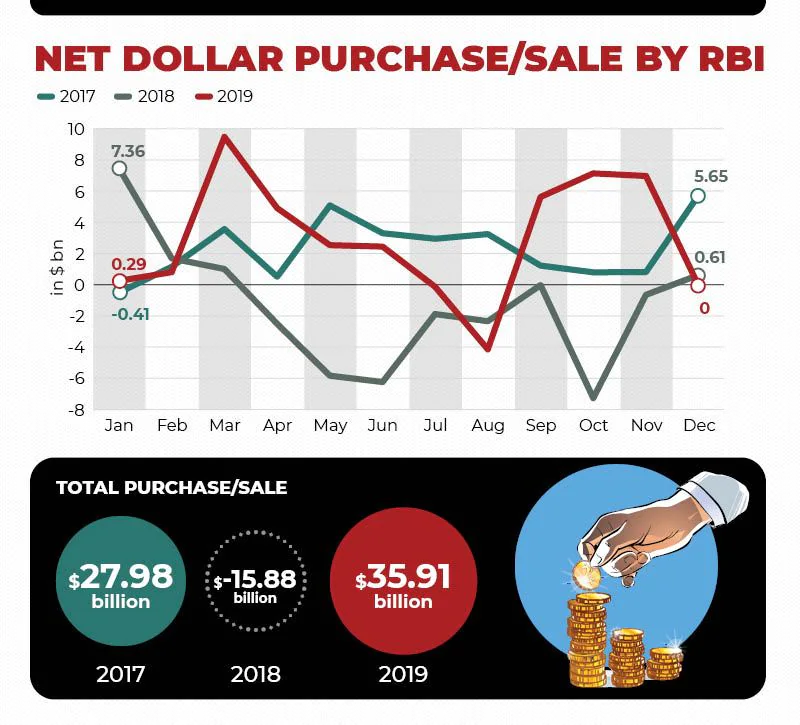

The dollar buying programme of the Reserve Bank of India has become the talk of the town of late. But was it the same case in the preceding years? Let’s have a look at how the RBI intervened in the dollar for the past three years and what were the reasons for intervention.

As seen above, the RBI was a net buyer of dollars in the year 2017 where it had bought around $28 billion. These were the days when the rupee had appreciated from 68/$ to around 63.50/$ supported by robust inflows in the Indian capital market. Hence, the RBI didn’t miss the opportunity and tried to absorb money flowing in the country to build its reserves.

In the succeeding year, i.e. 2018, a lot was happening globally and domestically. The markets across the globe were feeling the heat of US-China tariff attacks; domestically, default by NBFC giant IL&FS triggered panic in the markets and cause a major knee-jerk reaction on the domestic unit. Rupee skyrocketed from 68.5/$ to print its all-time high mark of 74.50/$. Here, the RBI used its dollar reserves as “Brahmastra” to curb the depreciation and volatility in the pair. Therefore, the RBI remained a net seller of the dollar in 2018 by offloading $15.88 billion from its kitty.

Of late, everywhere the buzz is about the RBI taking its reserves to an all-time high, let’s see how much have dollars contributed to the same. If we see the reserves data as from December 2018 to November 2019, there is a sharp surge in India’s FX reserves which have risen from $394 to $449 billion. In absolute terms, the rise is of approximately $55 billion. Out of this, dollar contributed to around $36.51 billion which counts to nearly 66 percent of the total rise in the reserves. This shows how aggressive was the RBI in protecting the rupee from appreciating sharply.

The irony is that the dollar rise is being witnessed since the time Shaktikanta Das has taken charge as the RBI governor in December 2018. It seems that he has managed to convince the government to remain export centric with a stable to weaker currency than being focussing on import bills with a stronger rupee.

Secondly, the domestic economy is posing concerns in terms of growth, employment, IIP, inflation, infrastructure growth, and various other data being released from time to time. Fiscal slippage and higher budget deficit being evidenced now are some of the factors that can build some pressure in the exchange rate at some point in time in the forthcoming days.

Finally, there is a concern about the upcoming inflows from SBI Card IPO and Reliance Industries fundraising through foreign banks might drive rupee stronger. Well, if the RBI stays abided to its buying pattern, the downside seems to be protected near 70.35-70.50 levels. Therefore, it looks like, the central bank is very comfortable keeping rupee in a broad range of 70.50-72.40 as it is getting an opportunity to settle import bills on dips close to 70.50 levels and boost country exports by driving pair close to 72.40 levels.

Technical aspect

Over a period of 6 months, there is congestion in the rupee range as the pair is forming lower highs and higher bottoms. The previous highs were 72.41, 72.24 and recently 72.11; whereas the lows were formed at 70.36, 70.52 and this time possibly opening up a room near 70.60 which acts as a baseline. This suggests the intensity of the pressure in which the pair is compressed thereby getting the range narrower with time. However, 70.50-70.60 remains a crucial support for the pair and 72.10-20 shall act as important resistance. Given the RBI intervention, there is 60-70 percent probability that the pair might not break the baseline.

In a nutshell, one can say that the pair shall remain in its range of 70.50-72.40 levels till H1 2020 with limited appreciation and bias towards depreciation. A breakout in the range will be alarming and shall trigger a velocity of 1-1.5 rupee in the pair. But the possibility of breakout is more on the upside than on the downside as the sword of uncertainty still hangs with US-China phase 2-3 deal, US elections, US-Iran tension still far from being over and domestic slowdown.

Amit Pabari is managing director of CR Forex Advisors.

Leave a Reply

You must be logged in to post a comment.