- April 8, 2020

- Posted by: Amit Pabari

- Category: Currency

Globally, Emerging market currencies have been on a roller-coaster ride driven by COVID-19-led panic and global lockdown. In the last few trading sessions, we saw some positive changes on the Indo-global front:

– A decent rally in the US, Asian and Indian stocks as the number of cases that were reported in New York, Spain, Italy, and Germany showed the sign of decline.

– Oil prices began to rise on the back of the Saudi-Russia pact.

– Chinese market began to fully operate and their currency recovered from 7.12 to 7.05 levels.

Also, Indian rupee yesterday appreciated till 75.60 levels. Do all of these mean the worst is over and things will start normalizing?

Let’s classify the same into positive and negative factors for rupee:

Negatives for rupee:

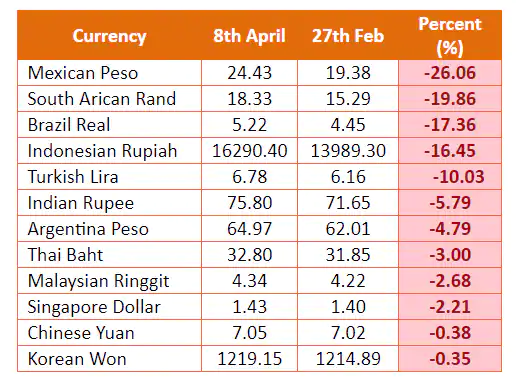

As we glance through, all the Asian currencies have depreciated against the dollar since the coronavirus outbreak got alarming. Amongst the highest is South African Rand; followed by the sequence given below and the least depreciated is Chinese Yuan.

The above table indicates that as compared to other peers that weakened heavily, the rupee has remained relatively stable and depreciated merely by 7 percent on the back of aggressive RBI intervention. If the same is halted and outflows continue due to a rising number of cases, we will see rupee making news highs as there is ample room for depreciation.

Historically, May is a depreciating month for the rupee and in the last one decade; the pair has depreciated 9 out of 10 times in the month of May. Hence seasonality effect can play its role to trigger more depreciation.

![]()

Indian firms have to pay record offshore dues in the June quarter. Indian borrowers had been loading up on foreign currency-denominated debt amid a squeeze in rupee credit markets, and have to repay $7.5 billion of overseas bonds and loans in the April-June period. A weakening rupee means that the burden of such redemptions will increase at a time when a drop in global demand is hurting corporate cash flows.

Positives for rupee:

Along with ample measures which includes Swaps, LTRO, OMO’s and Cutting benchmark interest rates, RBI has so far offloaded $17 billion from its forex kitty to prevent rapid depreciation in the rupee. If RBI continues to intervene with the same aggression, then the losses in the rupee shall be limited and the pace of depreciation will be slow.

FPI holding limits for all listed stocks raised from 24 percent to the respective sectoral foreign investment limits. The raising of FPI limits by NSDL/CDSL is a good sign so as to attract flows as the current sentiments of FPI towards emerging market equities is not very conducive.

MSCI is expected to rebalance MSCI India weight in the emerging market (EM) index. It is estimated that MSCI India’s weight in EM to rise by 55 basis points. The change in India’s weightage on the MSCI index, will result in passive inflows of over $1.4 billion and active inflows of $5.7 billion. The likely inflow of billions of dollars could prove fruitful in reviving the market sentiment.

The US Fed is broadening the swap lines it has set up to boost US dollar funding markets to additional countries to help lessen strains in global US dollar funding markets; thereby mitigating the effects of strains on the supply of credit to households and businesses, both domestically and abroad.

Technical Aspect:

The near term support for the pair is at 75.50 levels, but on a broader perspective, the crucial support remains at 74.50 levels which if broken shall indicate a trend reversal. Till the time the pair doesn’t break 75.10 and 74.50, view shall be to buy on dips and hold for selling for fresh highs.

Considering the above-mentioned fundamentals and technicals, it looks more like that the biasness for the rupee is towards depreciation and the pair might touch 76.50-77 levels in the upcoming sessions. Hence any dip shall be short-lived and merely a buying opportunity.

(Amit Pabari is Managing Director – CR at Forex Advisors. The views expressed are personal.)

Leave a Reply

You must be logged in to post a comment.