- January 27, 2021

- Posted by: Amit Pabari

- Category: Currency

Over the past one month, the dollar-rupee pair has stuck range bound and looking at the pair’s price action momentum, there is a lot of buzz in the market about rupee moving stronger breaking 72.50 levels. Let’s understand the crisp causes that can cause strength in the pair or lead it to weakness hear-on.

Favourable Factors:

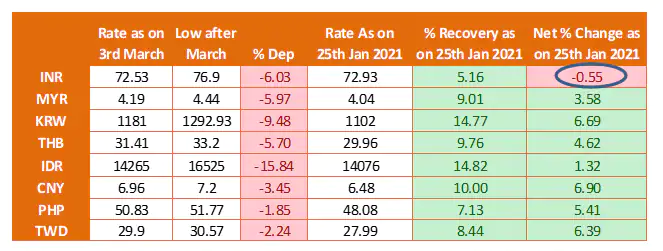

Dollar-rupee undervalued against Emerging Market (EM) peers: After a record outflow of almost $90 billion in March which had drastically eroded the value of EM currencies versus dollar, investors returned to EM stock and bond to bring total inflows in the final nine months of 2020 to more than $360 billion. In the first three weeks of January-21, 30 major emerging market economies have attracted nearly $ 17 billion inflows out of which India stands with $2 billion of FII inflows showing how the flooding stimulus continues to drive investors towards EMs. This has led to the strengthening of the EM currencies making them significantly stronger than pre corona levels. Well, the dollar-rupee remains odd amongst the basket being yet weaker by nearly half a per cent due to central bank intervention. The current undervaluation of the pair opens up ample room to appreciate in line with the peers.

Dampened Dollar: Rising optimism over emerging economies is in tune with increasing pessimism over US markets especially dollar. While economic and business conditions are supportive for many EMs, fiscal and monetary assistance by the developed economies has left vast pools of investment capital in search of greater returns outside developed markets. Liquidity injections of trillions of dollars from the Fed combined with swap lines from the Fed have led to rising debts. The most fundamental problem is the sheer size of a debt load that was already huge and has to swell the debt mountain to as much as $26 trillion, a jump of over 50 percent from 2019, eventually hampering the value to the dollar.

Unfavourable Factors:

King playing the game himself (RBI Intervention): When markets were hoping for the rupee that the RBI may slow its foreign-currency accumulation after the reserves rose to a record, the RBI signalled that it won’t give away on dollar purchases. This pushed the currency to the bottom of Asia’s currency rankings in 2020. So far the large FX intervention that the central bank undertook in 2020 is totalling nearly $120 billion. Building reserves shall continue in 2021 even at the risk of being added to the US watch list for currency manipulation as these buffers help against external shocks. Hence, persistent FX intervention will see dollar-rupee underperforming EM currencies, thereby placing the lid on the unprecedented strength.

Ballooning Deficits: Government had projected a fiscal deficit target of 3.5 percent of GDP for the current year FY and estimated government borrowing of 7.8 trillion rupees. This was later revised to 12 trillion rupees in order to provide relief to millions of people and businesses hurt by the pandemic and is estimated to take the fiscal deficits above 7 percent. Well due to rising debts, nearly $14 billion of outflows from the debt segment was already witnessed in the last Calendar year and with an expected expansionary federal budget for the upcoming year, these deficits are likely to come under strain, thereby further weighing on the debt segment leading to erosion in the value of dollar-rupee.

Conclusion:

Well, when mixed bag of updates carries uncertainty and uncertainty is the only certainty, trading in rupee gets tricky. With a narrow intraday range when trading/hedging becomes indecisive, it is advisable to follow the policy and adopt a risk reversal strategy that could warrant against the irrational market moves. Overall, in our opinion, the strength in the pair seems limited to 72.50 levels and the weakness too remains capped around 74.00 levels on an immediate basis. Hence, below mentioned strategy would help in insulating the exporters and importers against the market moves.

Strategy:

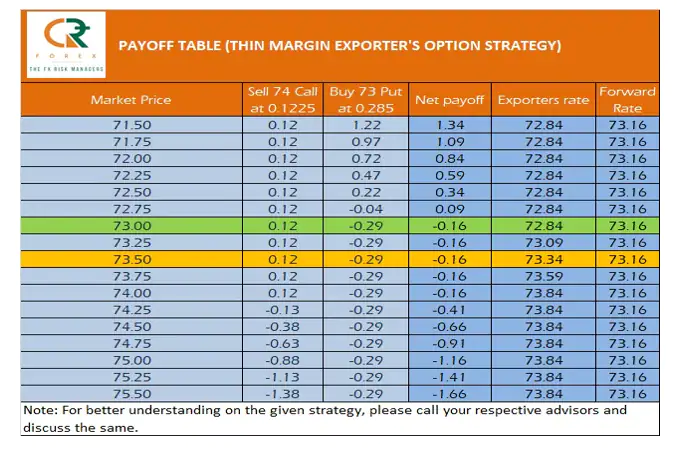

Strategy for Exporters: For thin margin exporters like chemical exporters and agri exporters

Spot rate: 72.93, Forward Rate: 73.16

Option strategy for Date: 24th Feb, 2021

Strategy: Sell 74.00 Call at 0.1225; Buy 73.00 Put at 0.2850

CR Forex view: We are expecting that there is a limited downside for the dollar-rupee pair and we could see upside reversal in making. Further, RBI could not allow the pair to fall below 72.80-72.50 levels and will definitely intervene in the market. And hence, this strategy is useful for those exporters who want participation on the upside and at the same time want to remain hedge their thin margins exports.

CR Forex view: We are expecting that there is a limited downside for the dollar-rupee pair and we could see upside reversal in making. Further, RBI could not allow the pair to fall below 72.80-72.50 levels and will definitely intervene in the market. And hence, this strategy is useful for those exporters who want participation on the upside and at the same time want to remain hedge their thin margins exports.

Scenario:

1. If dollar-rupee expires above 73.50 levels (marked in Orange), then exporter’s payoff will be better than forward rate. Above 74.00 their remittances will be locked at 73.84.

2. In adverse case, if dollar-rupee expires below 73.00(Marked in Green) then exports will be locked at 72.84 levels. Here, the downside will be protected and risk will be locked.

Strategy for Importers: Importers can maintain a one-month hedge policy and cover their exposure till Feb-end around 72.90 levels. They can also buy at the money call option to keep the downside open.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.