- March 23, 2021

- Posted by: Amit Pabari

- Category: Market

Just like any other television programme, Fed’s QE and taper program is running the show in the financial market since the global financial crisis- 2008. With rising inflationary pressure, speculations on early tapering have grabbed the markets.

The rising inflation is good for the developed market, but it is a concern for emerging markets. And hence, inflationary pressure will force emerging market central banks to raise their interest rates and hence, liquidity crunch could be seen especially in Fragile Five countries. Not just the expectation of early tapering but overall, it’s a win-win situation for USD as either higher US growth prospect or liquidity crunch will lead to demand for US dollar.

The explanations for each factor that could drive the US dollar higher are mentioned below:

How Fragile Five economies are doing compared to 2013 and their preparation ahead of taper tantrum-2

During the 2013 taper tantrum, “Fragile five countries”- Brazil, India, Indonesia, South Africa, and Turkey experienced significant weakness and made it difficult to finance their own account deficits. The central banks failed to keep much reserve to mitigate their debts. And then their currencies depreciated as much as 8-10 percent against the US dollar on receding risk-on sentiment and capital flight back to safe investment- US treasuries.

Currently, all central banks have geared up their Forex reserves in 2020 at the highest pace since 2013 to combat the issue of dollar glut during outflow. But looking at the current US debt-pile, it seems bond tapering (taper tantrum 2) and further Fed’s action of balance sheet reduction will lead to unwanted pressure on the bond market and cause interest rates to increase rapidly.

Developed market and Emerging market Central banks are diverging their path?

Despite better-than-expected economic data and recovery, developed country’s central banks such as Fed and BoE retrained themselves to turn hawkish. Although, long-term rates are pricing-in future fed hikes and hence the demand for dollar is gaining momentum. However, on another side; emerging market central banks have to consider rising commodity-linked inflation rates and liquidity conditions.

Russia hikes the interest rate by 25 bps to 4.50 percent, for the first time since 2018. Turkey hike by 200 bps to 19 percent last week. Overall, hawkish emerging market central bank action will be on rising inflation fear and US bond yield could lead to outflow from country like India, Indonesia, Russia, Turkey, China.

Doubts over fed’s SLR exemption extension

While everyone was busy listening about the “rate hike”, “tightening”, “hawkish” words, market participants failed to think about the SLR exemption extension. March 31 is not just an end of the Indian financial year but it’s an end for US SLR exemption too.

The SLR (Supplementary Leverage Ratio) is the U.S. version of BASEL-III capital adequacy norm and a Tier-1 leverage ratio; usually it is from 3-5 percent common equity capital which U.S. banks must maintain relative to their total leverage exposure. If fed fails to extend then big banks with holdings of US treasuries worth $2 trillion may be forced to liquidate at least $350-550 billion in the secondary market and tangible effect of correction in US bond prices and jump in yield can be seen across asset classes.

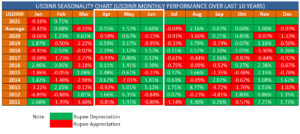

Rupee follows summer seasonality strongly

The appreciating March is on the verge of an end and the rupee seems closing on a stronger foot against the US dollar. But let’s move forward and analyze the seasonality pattern, it suggests that the rupee on an average depreciates by 2.5 percent in April, May and June month. The May leads out of this three month as widely we hear “Sell in May and Go away” for stocks and this brings downside momentum in the local currency.

Conclusion

In nutshell, the US dollar could take near-term cues from the Fed’s call over the SLR exemption deadline. Over the steady period of time, tapering tone and Biden’s upcoming higher US tax legislative could cap further upside in overvalued equities and all riskier flow could go back into safe treasuries.

On the domestic front, rising Corona cases and inflation fear could create pressure on the local stock and so on Rupee too. And hence, we expect limited downside in the pair and reversal from 72.30 could take the pair towards 73.50-74.00 in upcoming months. However, it is advisable to follow a defined risk management policy and stick to it.

Strategy

Strategy for Exporters

Thin margin exporters: The thin margin exporters are advised to cover back to back near 72.50-72.70 levels as rupee has not shown reversal yet.

Thick margin exporters: Thick margin exporters are advised to pre-utilize their long-term forwards ahead of March closing to avoid less conversion rate. Further, for bookings, they are advised to hold for 73.00 above levels and maintain a minimum hedge ratio of 40-45 percent.

Strategy for Importers: Importers are advised to cover for at least for next 30-45 days as USD INR seems close to the bottom.

-Amit Pabari is managing director of CR Forex Advisors. The views expressed are personal.

Leave a Reply

You must be logged in to post a comment.